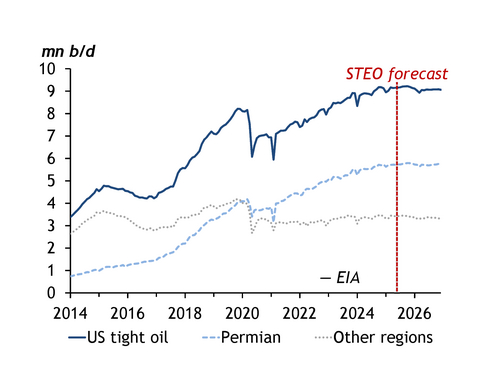

US shale oil output is poised to decline in 2026 for the first time in five years on lower crude prices — notwithstanding the spike that followed this week's Israeli attacks on Iran — and a slowdown in rig activity, throwing a wrench in President Donald Trump's plans to open the production floodgates during his second term.

US crude output next year is due to average 13.37mn b/d, down from an expected 13.42mn b/d in 2025, according to a monthly report from government agency the EIA last week. That would be the first annual decline since 2021, when the pandemic throttled oil demand.

The latest projection from the statistics arm of the US Department of Energy is a far cry from the 150,000 b/d gain expected for 2026 just a few months ago, but tallies with a growing chorus of warnings from shale producers that activity is at risk of tapering off in a lower oil price environment caused by a combination of Trump's trade wars and the accelerated unwinding of Opec+ cuts.

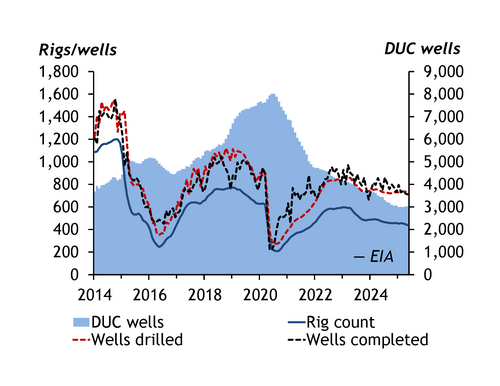

The agency cited a larger-than-expected drop in the number of active rigs last month than what it had anticipated in its Short-Term Energy Outlook (STEO) for May. "With fewer active drilling rigs, we forecast US operators will drill and complete fewer wells through 2026," the EIA said.

Increased caution on the part of producers has seen the US rig count slide to its lowest since late 2021, while the inventory of drilled but uncompleted (DUC) wells has been accumulating as companies hold off for the time being.

While leading shale producers such as Diamondback Energy have already raised the alarm over peak output, the administration has countered that with efforts to slash red tape and free up permitting that it hopes will underpin the sector's growth potential over the long term.

Next year's anticipated decline will be partially offset by an uptick in offshore output from the Gulf of Mexico as several projects start up. Production from the region is forecast to edge up to 1.85mn b/d next year from an expected 1.81mn b/d in 2025. The EIA expects 13 fields in the Gulf of Mexico to start oil and natural gas production this year and next — more than half of which will be developed using sub-sea tiebacks or extensions to floating production units — as an area that was overshadowed during the shale boom enjoys a revival.

No big deal

But the shale patch slowdown is already filtering through to deal-making. While fewer mergers and acquisitions have been announced in recent months compared with the dizzying pace seen in the past few years, there have been some notable exceptions of late. US independent EOG Resources last month swooped in for privately held Encino Acquisition Partners in a $5.6bn deal to expand its footprint in the Utica shale of Ohio. By doubling down on an up-and-coming basin in its first major acquisition in almost a decade, EOG avoided the lofty valuations seen in the increasingly crowded Permian basin of west Texas and southeastern New Mexico.

And earlier this month, Viper Energy — a unit of Diamondback Energy that owns and acquires mineral and royalty interests — agreed to buy Sitio Royalties for $4.1bn to expand its Permian position. "Mineral interests offer the highest form of security and upside in the oil field, and any and all benefits an operator manages to unlock accrue directly to the mineral holder without any capital risk, forever," Diamondback chief executive Kaes Van't Hof says.

And despite the recent headwinds spurred by Trump's on-and-off again tariffs and a deteriorating economic outlook, long-term oil price projections in a recent survey of banks by law firm Haynes Boone were little changed from autumn. That suggests lenders that took part view the current volatility as temporary.