The EIA has revised down its forecast for US ethane exports following the introduction of licensing requirements, writes Amy Strahan

US exports of ethane fell to a nearly five-year low in early June following the US Department of Commerce's restrictions on shipments to China, but market participants expect the trade dispute to be short-lived.

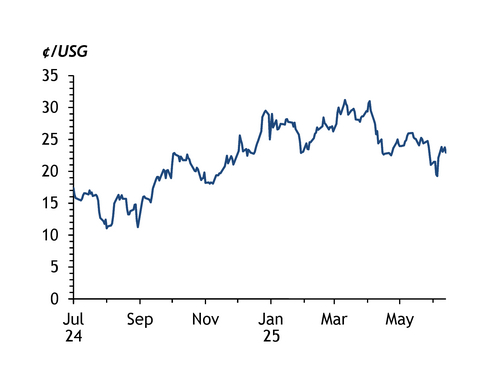

The department's Bureau of Industry and Security (BIS) sent a letter to midstream firm Enterprise Products in late May requiring it as the operator of the 240,000 b/d (5mn t/yr) Morgan's Point ethane terminal in Texas to obtain a licence for future shipments to China citing possible military uses for ethane and butane. The US' largest ethane exporter, Energy Transfer, which operates the 180,000 b/d Nederland ethane terminal, then received a similar notice on 3 June. Enterprise's request for emergency authorisation to ship three ethane cargoes totalling 2.2mn bl (177,000t) was subsequently denied, sending ethane prices at the Mont Belvieu hub in Texas to a six-month low of 19.25¢/USG ($142/t) on 5 June.

Around 198,000 b/d of US ethane loaded during the week to 26 May, after Enterprise received its letter, down from 410,000 b/d a week earlier and 547,000 b/d in the same week of 2024, Kpler data show. They are forecast to stand at 218,000 b/d over the week to 9 June. Ethane prices at Mont Belvieu had recovered to levels seen before the trade restriction by 10 June, owing in part to seasonal gains in Gulf coast natural gas prices but also because market participants expect disruptions to cargo loadings to be temporary, with the US and China holding trade talks in London this month.

Very large ethane carriers (VLEC) that deliver ethane to China were on standby by mid-June. The Pacific Ineos Grenadier, which loaded ethane from Morgan's Point while Enterprise appealed against the BIS measure, has been moored at the company's nearby Houston terminal since 9 June. Satellite's Seri Erlang remains offshore Energy Transfer's Nederland facility, while its STL Qianjiang, which loaded at Nederland in the first week of June, is now heading to India. Another Satellite vessel, STL Yangtze, discharged in India in early June, possibly owing to maintenance at Satellite's cracker in Lianyungang, China, and is now returning to Nederland, according to Kpler.

"We are all hoping the policy will be reversed soon," one market participant says, while another adds that it is likely to be resolved in days and not weeks.

Restricted view

US government agency the EIA has nevertheless attempted to forecast the impact the restriction would have on US ethane exports, revising down its forecast by 51pc to 310,000 b/d (6.4mn t/yr) for 2026. US ethane export capacity is on track to grow to as much as 900,000 b/d by the end of next year following the opening of new projects, including Enterprise's new 360,000 b/d Neches River ethane and propane terminal near Beaumont, Texas, and expansions at Morgan's Point and Energy Transfer's Marcus Hook terminals.

Chinese buyers of US ethane are also hopeful of a relatively swift resolution owing to the mercurial trade policy of the Donald Trump administration. If it is not forthcoming, they may look to switch feedslates to LPG and naphtha when possible in the shorter term, and those that have invested in new VLEC fleets could repurpose them to LPG or ethylene in the longer term. Neither would be an attractive proposition given the substantial levels of investment in new ethane-fed cracking and VLEC capacity, but would ensure that domestic downstream derivative plants are kept running. Chinese companies are unlikely to begin importing ethylene instead given the margins would still be uncompetitive compared with cracking alternative feedstocks. In any event, buyers "do not want to make a big decision they will regret", one market participant says.