Domestic urea prices in Australia have surged on the back of rising international fob prices because of ongoing hostilities in the Middle East, and prompt supply has tightened on increased demand.

Israel's attack on Iran in the early hours of 13 June and the further escalation of tensions has caused international urea prices to surge on tightened supply as Egyptian output was halted on 13 June and Iranian urea production went off line on 18 June because Israeli gas flows have stopped. Saudi Arabian fertilizer producer Sabic sold 45,000t of granular urea at $450/t fob on 17 June, a sharp rise from $402/t fob in a deal four days earlier.

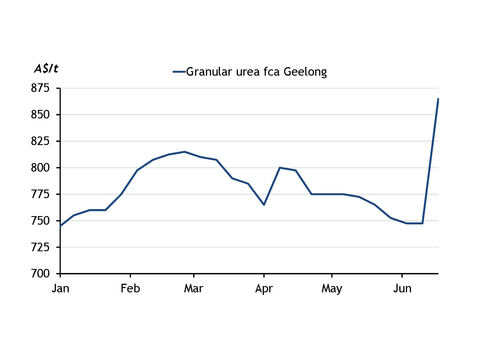

Domestic urea prices in Australia rose throughout the week to 20 June almost as fast as international prices as suppliers raised their offers on a day-by-day basis. Retailers that previously hesitated to buy from importers because of weak domestic demand rushed into the market to procure supplies on fears of further price rises. Offers started the week at around A$775/t ($503/t) fca Geelong on 16 June, increasing to A$790-800/t on 17 June. Cargoes were reportedly sold as high as A$865/t as buyers rushed into the market. Two suppliers reportedly offered urea out of Geelong at A$900/t late on 18 June, but buyers retreated at that level.

Weekly average domestic granular urea prices were assessed much higher on the week at a midpoint of A$865/t fca Geelong in the week to 20 June, up from A$745-750/t a week earlier (see graph).

Urea stocks high, prompt supply limited

Healthy stocks and underwhelming domestic consumption from growers owing to unfavourable weather conditions had limited demand for urea so far in 2025, which in turn buoyed stocks and prompted suppliers to lower prices from mid-April until hostilities broke out in the Middle East.

Australia imported 1.26mn t of urea in the first four months of the year, the latest data from the Australian Bureau of Statistics show. Urea imports reached an estimated 601,000t in May and are expected to decrease to 508,000t in June, according to vessel-tracking data from trade analytics platform Kpler. This suggests Australia's urea imports could reach 2.37mn t in January-June, down from 2.49mn t in the first half of 2024.

But Australian urea stocks are still likely to be higher at the end of June 2025 compared with the same month a year earlier, according to Argus estimates. Favourable weather conditions for urea utilisation early in 2024 reduced urea stocks in the country last year.

Urea stocks in Australia are healthy and suppliers started selling cargoes in May for delivery in 1-3 months' time because of sluggish local demand. This has led to at least one supplier running out of supply for prompt sale and delivery after buyers entered the market this week. The tight supply for prompt delivery of urea likely supported the surge in domestic urea prices over the past week.