France's nuclear fleet could reach output unseen since 2017-18 this winter, driving strong exports.

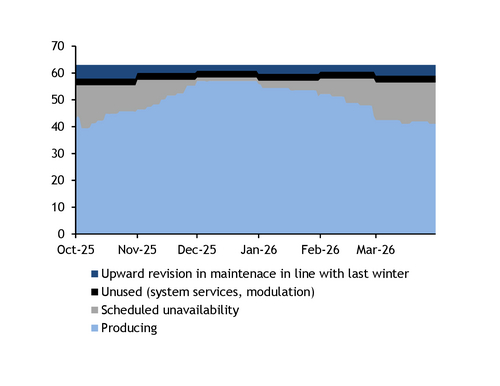

Unavailability across EdF's French fleet is scheduled at 7.7GW in the fourth quarter of 2025 and first quarter of 2026. This is far lower than unavailability since at least 2018, although the final figure is unlikely to be this low as EdF systematically adds maintenance closer to delivery.

But if upward revisions are in line with last year's, France will still have more availability this winter.

Nuclear unavailability last winter was revised up by an average of 3.4GW between 19 September and delivery. Upward revisions were largest in the shoulder seasons — averaging 5.3GW and 4.8GW in the first and last 15 days of the season, respectively. And there was probably some adjustment of maintenance to account for demand and price, with a period of downward revisions on 9-15 December corresponding with a cold snap and demand spike.

Adjustments between the schedule as of mid-September and at delivery were far larger in previous years, averaging 7GW in 2023-24, 11.7GW in 2022-23, and 7.2GW in 2021-22. But these years were affected by the stress corrosion crisis that took plants off line, while the two previous winters were affected by the pandemic and its impact on demand and maintenance.

In the last 'normal' winters before these crises — 2017-18 and 2018-19 — upward revisions between mid-September and delivery were still larger than last winter, at 7.4GW and 5.2GW, respectively.

Taking last year's difference between schedule and delivery as the most likely indicator for this year, EdF could have unavailability of 11.1GW across the season (see status of nuclear fleet graph).

Nuclear availability is one factor determining output, but another is the amount of capacity theoretically available but not used. Some of this is kept back for balancing, while in recent years an increasingly amount has been capacity that went unused for the lack of an economic outlet during periods of low prices — normally associated with high renewable generation.

The difference between availability and output averaged 2GW across 2018 and 2019 — the last pre-crises, pre-solar boom years. This spread expanded to 2.3GW in 2020 as low demand reduced the incentive to maximise production, but narrowed to 1.8GW in 2022-23 as the dual price and stress corrosion crises pushed EdF to exploit its nuclear fleet to the full.

Since 2024, the spread has been expanding again, especially in summer, when solar output pushes down daytime prices. It averaged 3GW last year, and has held roughly 20pc higher in 2025. Assuming it is 20pc higher this winter, it could average 2.5GW.

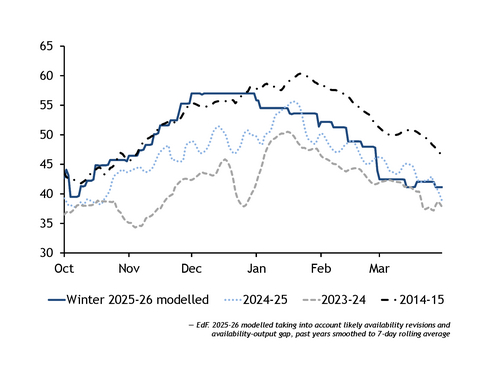

This suggests EdF's nuclear output could average 49.4GW, well up on 46.2GW last winter (see modelled output graph). This would place output in line with winters 2016-18, but not as high as in 2014-15, when it averaged 52.4GW.

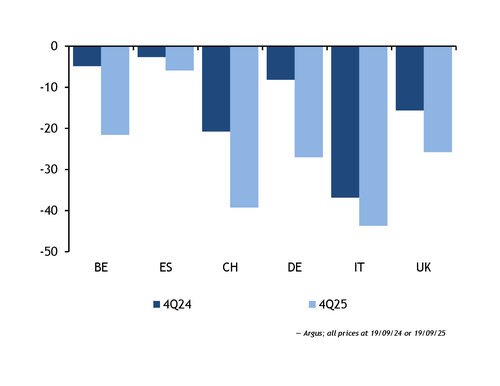

Forward price spreads to neighbours suggest expectations that France will be a stronger exporter than last winter. France's discount for the front quarter averages €27.19/MWh across its six directly interconnected neighbours, out from a €15.18/MWh discount for the fourth-quarter 2024 contract in mid-September last year (see price graph). Meanwhile, first quarter 2026 is at an average discount of €18.35/MWh across the neighbours for which Argus assesses contracts, out from €8.69/MWh at this point last year.

France's exports last winter averaged 9.3GW. This year, with the closure of three nuclear plants in Belgium, there could be more consistent demand for exports there and to surrounding countries. Wind output in neighbouring countries will also be crucial in determining demand for French exports. Wind additions have been far slower than solar additions. But market participants are alert for the possibility of calm spells, as happened last winter. A reversion to the mean after a low-wind winter 2024-25 could mean output is likely to increase, but then low wind generation might reflect a wider trend towards lower load factors, driven by climate change and increased wake effects.

Solar additions in neighbouring markets will be likely to weigh on the scope for France to export at a profit, especially in shoulder seasons. French net exports last winter were at their lowest at midday, at 76pc of the average across all hours. Europe's solar additions have continued apace, with industry association SolarPower Europe estimating that there will be 64.2GW of additions this year, not far off last year's 65.1GW.