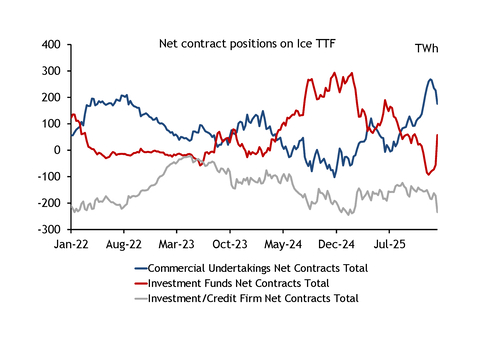

Investment funds have moved to a net long TTF position on the Intercontinental Exchange (Ice), potentially owing to stop-loss orders being triggered by soaring prices and market tightness encouraging firms to add length to their exposure.

Hedge funds cut 56TWh of short contracts by the end of last week compared with a week earlier and added another 56TWh in long contracts, according to Ice's most recent commitment of traders report (see graph).

On aggregate, hedge funds switched back to a net long position of 58TWh as of 16 January from a net short position of 55TWh a week earlier. Hedge funds had increased their short exposure dramatically between October and early January, reaching an all-time high of 560TWh in short contracts on 9 January.

The TTF price rally last week possibly prompted this pronounced repositioning. The TTF front-month price hit €37.12/MWh on 16 January, up from €28.44/MWh on 9 January, as cold weather forecasts and below-average underground inventories in Europe pointed to a tight supply-demand balance over the remainder of the winter.

An expected tight end-of-winter balance might have led funds to lengthen their position, especially considering that depleting stocks not only affect the balance-of-winter market, but also increase summer restocking requirements.

Additionally, investment funds exited their shorts in part because of the activation of stop-loss orders, according to market participants. When prices rise above a set threshold, the mechanism automatically converts the stop-loss orders into buy orders, resulting in a sudden spike in buying demand on the market and contributing to the price hike.

Unlike financial market participants, companies with retail portfolios — defined as commercial undertakings on Ice — sharply reduced their net long position to 175TWh on 16 January from 226TWh a week earlier, the largest week-on-week change since mid-August. They did so by exiting some of their long contracts, which fell to 1.47PWh on 16 January from 1.49PWh a week earlier, probably to collect profits on the back of high prices.

Commercial firms also increased their short exposure week on week to 1.29PWh from 1.27PWh, potentially signalling that they see a price ceiling around last week's level. That said, the report does not provide data on how positions vary across contracts, so it is impossible to know in which contracts they added shorts. Commercial firms have bigger margin requirements than investment funds because their position is backed by physical assets, meaning their stop-loss orders could be placed at a wider margin than those held by investment firms, and therefore they were not triggered by the price rally, market participants said.

The publication of Ice's commitment of traders report contributed to a price jump this morning, market participants said. And the TTF front-month price rose further across the session, peaking at €40/MWh about 20 minutes after the 16:30 GMT market close today. Other factors contributed to today's big price rise, including extreme cold in the US potentially curbing LNG exports and the potential for a sudden stratospheric warming event in mid to late February.