Spain's major utilities are debating a proposal for the government to reinstate the €2.34/MWh ‘green cent' tax on gas for power generation on combined-cycle gas turbines (CCGTs), which could help to soften an expected return of a tariff deficit in the electricity system owing to the Covid-19 pandemic.

Reintroducing the ‘green cent' tax on CCGTs would lead to higher revenues to the system not only because of the tax charges on gas-fired generation, but also indirectly owing to increases in wholesale power prices arising from the measure. CCGTs are the main marginal power price setters in Spain and would be likely to pass on the tax cost in their offer prices in the day-ahead market. This would generate more gains through the country's 7pc tax on power generation, which is levied on revenues from all plants regardless of size or technology.

The sharp drops in Spain's electricity demand and wholesale prices to multi-year lows in recent months have increased the possibility of a re-emergence of the so-called power tariff deficit — the shortfall between regulated power system costs and revenues. This has prompted the government to start looking at possible tax changes, environment and energy minister Teresa Ribera said last month.

Italian utility Enel's head of global power generation, Antonio Cammisecra, told Argus last week that Spain's association of large power utilities Aelec — of which Enel's Spanish subsidiary Endesa is a member — had asked for a "transitional" reimposition of the tax to help alleviate the situation.

While Aelec declined to comment on the matter, Spanish utility Naturgy acknowledged that an "internal debate" about the proposal has been taking place among members. But no "fixed position" has been agreed, and an "official" request to the government is yet to be made, Naturgy said.

Portuguese utility and Aelec member EDP noted that reinstating the green cent tax is one of a series of proposals from local utilities aimed at mitigating a potential tariff deficit arising from the coronavirus impact on the Spanish power system. EDP did not know whether the package of proposals had already been sent to the government.

Spanish utility Iberdrola, another Aelec member, did not reply to queries for comment on the issue. The Spanish environment and energy minister has not commented either.

Naturgy has the highest installed CCGT capacity in Spain, at around 7.4GW, from a total of 26.3GW in the country. It is followed by Iberdrola, with 5.7GW, and Endesa with 5.44GW. EDP has 1.7GW of capacity in Spain and 3.7GW overall in Iberia, though it is selling 843MW to Total.

No expected change in merit order

The green cent is a tax on hydrocarbons levied on coal-fired power plants, CCGTs and combined heat and power (CHP) units. CCGTs and CHPs have been exempt since October 2018, while coal-fired plants have continued paying the tax.

The exemption initially helped CCGTs to raise their competitiveness against coal-fired units. But over the past year, high EU emissions allowance costs and low gas prices have been the main reasons pushing coal-fired plants out of the merit order, effectively turning CCGTs into the main marginal price setters in the Iberian market.

"The situation of the CCGTs would not be aggravated by a temporary incorporation of the ‘green cent', as they are currently a marginal technology in Spain and without competition, since coal has virtually stopped being used," EDP told Argus.

There would be no risk of CCGTs falling out of the merit order in the event of a return in the tax, the utility said.

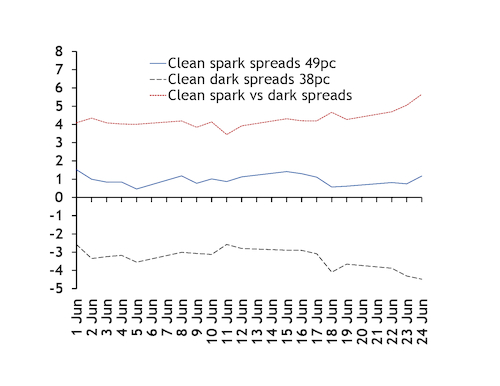

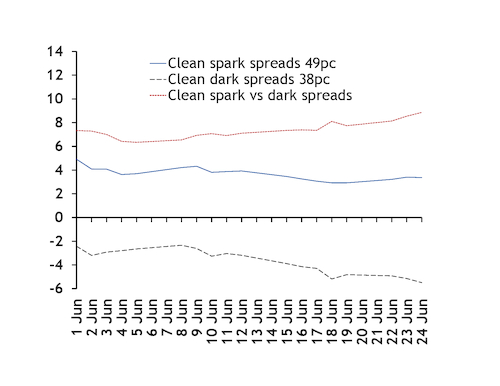

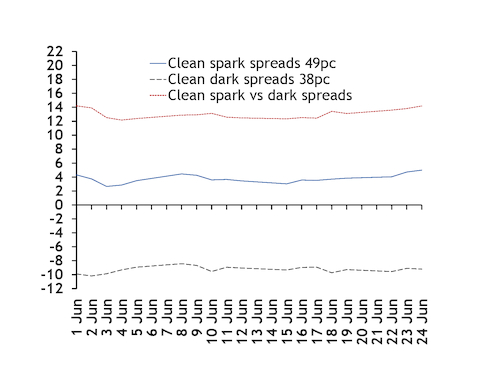

Argus calculations show that CCGTs with an average generating efficiency of 49pc would be ahead of 38pc-efficient coal-fired plants for the rest of this year and in 2021 even if the tax is reinstated. The clean spark spreads' premium to clean dark spreads was at €14.20/MWh for the third quarter, €8.85/MWh for the fourth quarter and €5.65/MWh for 2021 yesterday (see charts).

Higher power prices

But implied gas-fired margins for next year would be particularly tight, at an average of below €1/MWh so far in June, which suggests power prices would need to be higher for CCGTs to enter the day-ahead market. Argus' clean spark and dark spreads are based on assessments of over-the-counter power prices, PVB gas contracts, API 2 coal swaps and EU emissions trading system allowances, and do not include variables such as third-party access and operation and maintenance costs.

Such costs can vary widely among individual CCGTs. EDP said in a presentation late last year that cost assumptions for its Iberian CCGT fleet were based on a 48pc generating efficiency and included €2.50/MWh of operation and maintenance costs and €0.50/MWh of third-party access costs on average, which would take implied forward margins for 2021 to negative territory. "The ‘green cent' can ultimately be added to the marginal cost of CCGTs," the company told Argus.

The main reason the Spanish government exempted the ‘green cent' on CCGTs and CHPs in October 2018 was to help bring electricity prices down at that time. That "urgent measure" was followed by a six-month suspension of the 7pc tax on power generation, causing sharp price drops in forward contracts both when it was first announced in September and when it was officially approved in October that year.

The ‘green cent' exemption on CCGTs and CHPs reduced wholesale power prices by around €3.40/MWh in October-December 2018, according to an estimate by Natalia Fabra, a professor of economics at Universidad Carlos III de Madrid and the principal investigator of the European Research Council (ERC) consolidator project "Current Tools and Policy Challenges in Electricity Markets".

The fact that wholesale power prices would be likely to increase if the tax was brought back could make it an unpopular decision for the Spanish government to take at this time, even if major utilities are lobbying for it, market participants said.

Wholesale power prices have been much lower than previous years owing to the pandemic, but Spanish energy-intensive industries have still been lobbying for support in recent months as they continue waiting for a long-promised statute for electro-intensive consumers, a market participant said.

But if implemented, the ‘green cent' could potentially be beneficial for some utilities, as they would be able to sell power from infra-marginal generation technologies — those that, because of their lower generation costs, do not set wholesale power prices in the Iberian market — such as hydro and nuclear at higher prices, the market participant said.