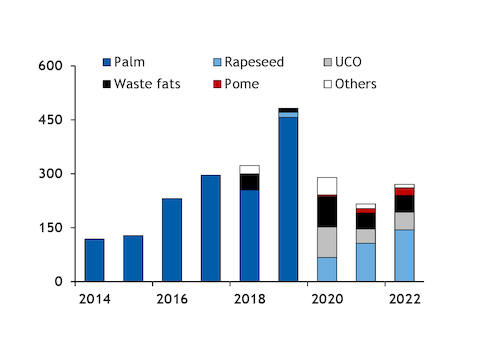

New data from the French government illustrates hydrotreated vegetable oil (HVO) demand, and helps to track the decline of palm oil imports.

According to the country's energy ministry, the highest amount of HVO blended in the French fuel mix was in 2019 at around 455,000t (585,000m³). Significant volumes were produced at TotalEnergies' 500,000 t/yr La Mede HVO unit, which started up that year.

Of the HVO blended in France in 2019, the ministry says 94.5pc was made of palm oil, with rapeseed oil, used cooking oil (UCO) and animal fats (tallow) making up the remainder (see chart).

This domestic demand will have included imports. Argus tracking shows a little over 120,000t of HVO imported into the Mediterranean port of Fos-Lavera in 2019, almost all from Rotterdam and Venice, Italy, where Italian oil firm Eni has a 350,000 t/yr HVO plant.

Following a 2019 ban by French lawmakers on the use of palm oil in domestic biofuels, the use of palm oil in HVO blending dropped to zero in 2020. TotalEnergies chief executive Patrick Pouyanne criticised the ban, saying it could threaten the existence of La Mede. In 2020 La Mede continued to import palm oil at similar levels to 2019, but all the HVO produced had to be exported, mainly to Germany and the Amsterdam-Rotterdam-Antwerp (ARA) area.

Palm oil imports have since fallen consistently, as TotalEnergies substituted palm oil for other feedstock. According to customs data, last year imports totalled 215,000t in January-November, the lowest for the period in 12 years and down by 18pc year on year. November data will be revised upwards when imports from EU countries are added. More complete data for October shows 12,500t of imports, but only 3,800t for industrial use.

Argus tracking shows the last palm oil cargo for La Mede, 25,000t, was received in May. In total the unit took 75,000t last year, delivered to Lavera. Seaborne deliveries included 85,000t of tallow, 45,000t of UCO and 30,000t of rapeseed oil.

French vegetable fatty acid distillate (Pfad) imports under the CN Code 382319 are also falling. At only 45,000t in January-November these are lower by 46pc on the year. Again some upward revision may occur.

Imports of palm oil mill effluent (Pome) under the 1522099 code fell to 55,000t in January-November, down by 27pc year on year. The energy ministry says 20,000t of HVO made from Pome was blended in France last year.