Resumen

¿Cuál es la volatilidad y el equilibrio del riesgo para los precios del petróleo crudo y los productos refinados? Se necesitan conocimientos basados en datos y el contexto del mercado para abordar esta pregunta aparentemente sencilla. Si puede responder con confianza, tendrá una ventaja a la hora de tomar mejores decisiones de negociación, cobertura y manejo de riesgos.

Argus Possibility Curves es un servicio de datos de pronósticos probabilísticos. Cada día publicamos una previsión de precios para todas las principales grados de petróleo crudo y los principales productos de petróleo refinado, junto con la probabilidad de observar ese precio asociado a cada cuantilo. Producidas combinando las últimas técnicas de ciencia de datos y aprendizaje automático con la base de datos de precios patentada de Argus, Argus Possibility Curves es la única forma de estimar con confianza la volatilidad y el equilibrio de riesgos asociados a los precios del petróleo.

¿Por qué usar Argus Possibility Curves?

En esencia, Argus Possibility Curves se pueden utilizar para desarrollar herramientas de negociación y manejo de riesgos, como tarjetas de puntuación de negociación basadas en las últimas dinámicas de mercado que pueden medir:

- Volatilidad de precios: mercados en rápido movimiento pueden dar lugar a interesantes oportunidades de negociación.

- Equilibrio del riesgo (riesgo al alza vs. riesgo a la baja): estos cambios poco frecuentes y grandes en el mercado pueden cambiar la P&L

- Dado que nuestros pronósticos probabilísticos prospectivos cubren hasta tres meses por adelantado, se pueden desarrollar cuadros de calificación para los grados de crudo, los principales productos de petróleo refinado, los diferenciales temporales y los diferenciales de grado.

Características claves

Datos de transacciones físicas alternativas

Combinamos los impulsores financieros y macroeconómicos convencionales con datos propios obtenidos de nuestra función como agencia líder de informes de precios internacional.

Cobertura de crudo y productos refinados

Datos de Pronóstico probabilísticas para los principales grados internacionales de petróleo crudo y productos refinados claves.

Argus universe of drivers

Utilizamos más de 200 factores macroeconómicos y financieros que se han calibrado específicamente para los mercados de energía y commodities.

Aprendizaje automático

Nuestro marco de aprendizaje automático incluye el uso de relaciones lineales y no lineales, interacciones entre los impulsores del mercado y la energía para manejar conjuntos de datos relativamente pequeños.

Datos de transacciones físicas alternativas

Somos una agencia líder en la elaboración de informes de precios para los mercados internacionales de energía y commodities, esta experiencia nos permite dar un contexto de mercado real a los datos.

Los datos y la determinación de los factores claves

Utilización de datos de precios y contratos propios, complementados con datos fundamentales, financieros y macroeconómicos.

Especificaciones de los productos

Los pronósticos probabilísticos representan el futuro de la previsión de precios de las materias primascommodiies con su enfoque innovador, que ofrece una perspectiva dinámica y matizada que los pronósticos tradicionales simplemente no pueden igualar.

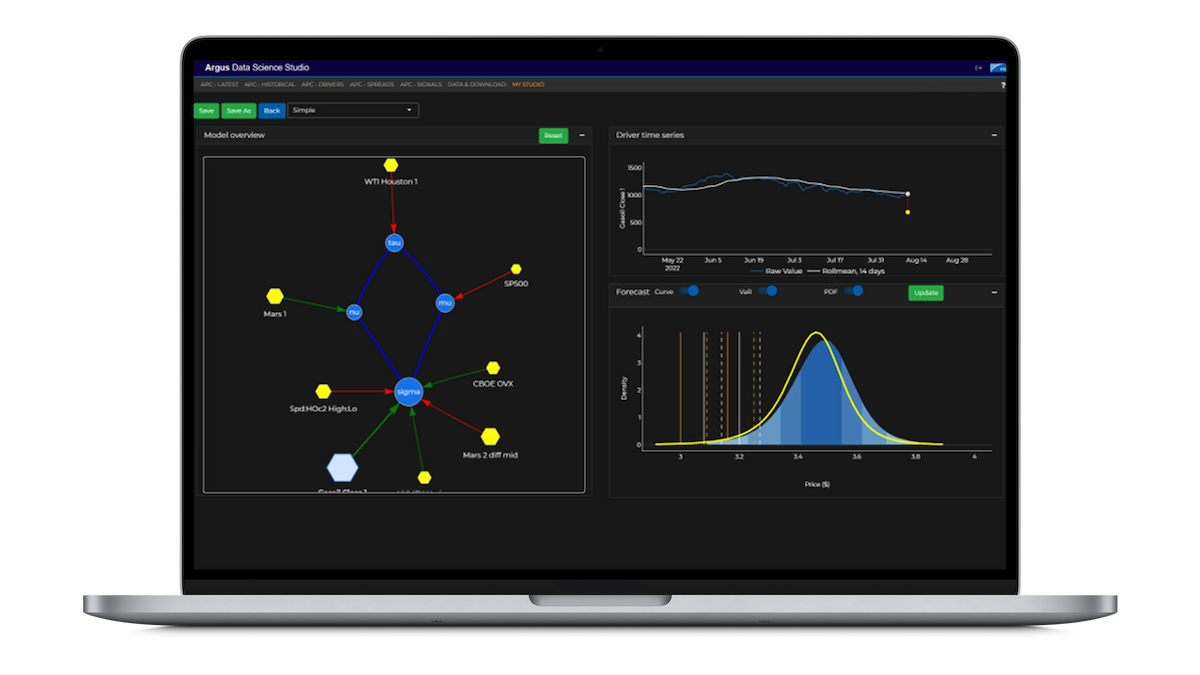

Curva de posibilidades a través de Argus Data Science Studio

Argus Data Science Studio es una poderosa herramienta diseñada para respaldar sus decisiones de análisis, negociación, cobertura y manejo de riesgos. Accede a los datos de Argus Possibility Curves a través del Estudio, donde puede visualizar pronósticos probabilísticos y personalizarlos cambiando los impulsores y las relaciones para reflejar su conocimiento individual del dominio.

Más información