Thousands of US oil and gas jobs have been cut this year and more redundancies are likely to be on the way as companies seek to tighten their belts amid a downturn caused by price volatility and rising costs.

ConocoPhillips was the latest producer to announce sweeping layoffs recently, outlining plans to reduce its global workforce by up to 25pc — or as many as 3,250 positions — with the majority of the reductions taking place this year. "We are always looking at how we can be more efficient with the resources we have," a company spokesman says. Chevron said earlier this year that it was shedding up to 20pc of employees, while cuts have also been announced by others, including BP.

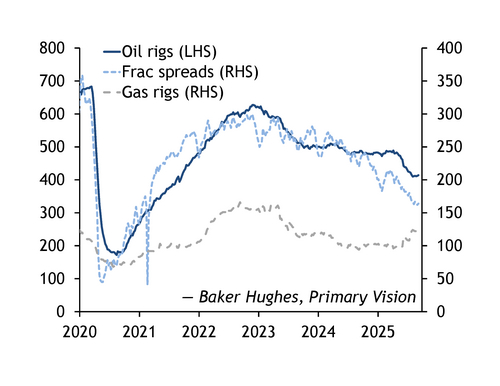

The sector is having to contend with a 12pc slide in oil prices since the start of the year, while US president Donald Trump's trade wars have buffeted the market, with tariffs on steel and aluminum imports pushing up costs. At the same time, a looming worldwide glut risks being exacerbated by Opec+'s decision to hasten the return of supplies as members of the alliance seek to regain market share. In response, US producers have sought to cut spending and slow drilling activity — the national rig count has fallen to a four-year low — as prices teeter around levels needed to profitably drill (see graph).

"Breakevens differ from operator to operator, so some will be forced to let people go while others hold steady," upstream monitor Primary Vision's chief executive officer, Matt Johnson, says. "As we approach capex depletion, layoffs are a natural part of this cycle, especially with a weaker price deck." The number of workers employed in oil and gas extraction slipped by 2pc in August to a two-year low, according to preliminary data from the Bureau of Labor Statistics.

Some companies are just coming up for air after a wave of consolidations over the past few years, and are looking to restructure their operations, with efforts to reduce headcounts a key part of that. ConocoPhillips snapped up Marathon Oil for $17.1bn last year in just one of a series of blockbuster deals that has redrawn the US shale map.

Shale productivity gains, and an efficiency drive that has taken on greater urgency — given the uncertain economic backdrop as companies seek to insulate investor payouts — have also played a part as executives seek to do more with less. Analysts expect oil prices to extend recent losses, while US crude output is forecast to decline next year for the first time since 2021.

Jam tomorrow

"In the short term, we're going to continue to see a downward trend in employment," Texas Independent Producers and Royalty Owners Association president Ed Longanecker says. Over the longer term, the outlook is more favourable, boosted by the sweeping changes to tax policy, energy regulations and federal leasing practices from Trump's recent spending and tax package that will deliver a combined multi-billion dollar windfall for the industry, he says.

And while the energy services sector saw a decline of around 6,000 jobs last month, the Energy Workforce and Technology Council says the headline numbers do not capture the full picture. "Companies remain disciplined, making targeted adjustments where needed while continuing to invest in their workforce," the trade group's president, Molly Determan, says.

But the jobs outlook for the wider oil and gas industry faces additional headwinds from the growing use of artificial intelligence, which is still at an early stage of deployment. And offshoring efforts by some of the biggest producers — moving highly skilled jobs in fields such as engineering to lower-paying countries — will also weigh on future opportunities.