There may be light at the end of the Covid-19 tunnel for VLCC owners, with several factors pointing to higher demand, although any increase in rates relative to bunker costs is likely to be gradual.

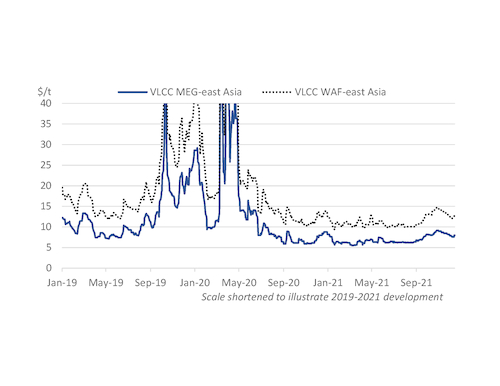

OECD oil stocks are back below the five-year average, and Argus Consulting expects global demand to return to within 1.4mn b/d of pre-Covid levels in 2022, compared with 7mn b/d below 2019 levels in 2020. This should mean more barrels moving from producer to consumer in 2022, and many tanker owners were cautiously optimistic after the third quarter, even after an extended challenging period for the industry (see chart).

VLCC demand in the Mideast Gulf, by far the vessels' largest market, rose by 1.37mn b/d from August to November, in line with Opec+ raising its production ceiling by 400,000 b/d each month. Atlantic basin loadings — which must travel further to reach east Asia, meaning more tonne miles per voyage — also increased, helped by rising west African production and favourable Mars Blend economics in Asia-Pacific in November.

Mideast Gulf crude loadings should also rise in 2022. Opec+ has so far shown determination to maintain its original schedule of incremental monthly increases, despite calls for faster growth to cool global prices, and more recent concerns about the Omicron variant hitting demand. Lower expectation for non-Opec supply in 2022 — Argus Consulting has lowered its non-Opec output growth forecast by 21pc to 3mn b/d — could also enable Opec+ to continue its programme for longer, even if most observers still expect the market to move back into surplus in 2022.

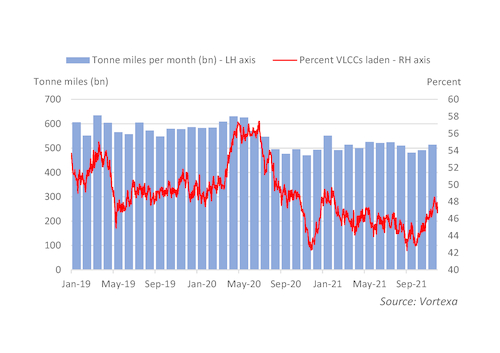

But, despite these positive signs, the VLCC market is still far from fully recovered. Mideast Gulf loadings remained 7pc below pre-pandemic levels in September-November, even after rising, with Atlantic loadings 8pc down, according to Vortexa data. The data show that global VLCC tonne miles are still well below 2019 levels — despite a larger fleet — and just 46pc of VLCCs were laden at any one time on average in 2021, including floating storage, down from 50pc in 2019 (see chart).

Slower non-Opec growth may make more room for Opec+ output increases, but also suggests a more gradual recovery for volumes on the long-haul Atlantic VLCC routes that contribute proportionally more tonne-miles. Brazilian development remains sluggish, North Sea production is recovering slower than expected from reduced investment during the pandemic, Argus Consulting says, and the US EIA expects US production to remain 3.25pc below 2019 levels in 2022.

The emergence of the Omicron variant was an unwelcome reminder that Covid-19 remains a concern for oil demand, although tighter restrictions can also lead to delays at ports and shipyards that can cause freight rates to spike.

Iranian sanctions are another known-unknown. Iran's foreign minister Hossein Amir-Abdollahian announced progress in talks with UN nuclear watchdog the IAEA on 15 December, although Iran's return to the global market is dependent on the removal of US sanctions. Sanction removal could weigh on dirty tanker rates, by allowing the fleet of tankers engaged in Iranian shipments to operate sanction-free in the wider fleet, even if some of the older vessels are scrapped rather than trading at a discount in the spot market. And higher Iranian crude production would need to be offset, barring a jump in demand, which might hinder Opec+ increases.

Finally, global VLCC supply continues to grow, with 47 newbuilds scheduled for delivery in 2022, equating to 5.6pc of the current active fleet, according to shipbroker SSY. Scrapping has picked up, but still just 16 VLCCs were demolished in 2021, according to Argus data. Prolonged low earnings may see more ships scrapped, but sanctioned trade and high second hand prices also make selling older tonnage an alternative for shipowners.

Shipowners may be correct that the market has turned a corner, with demand for crude transportation seeming likely to pick up in the coming year. But there is probably still a long road back to the pre-pandemic market, and plenty of potential obstacles along the way.