Overview

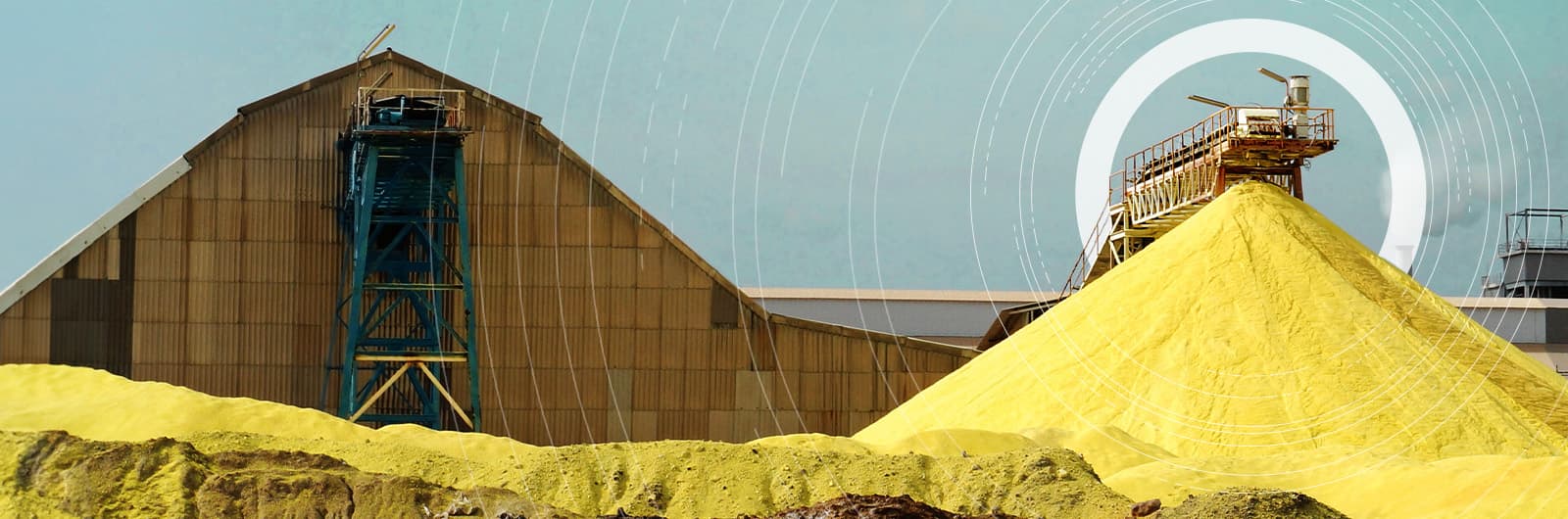

The global sulphur market has gone through fundamental changes in buying patterns, trade routes and pricing over the past few years. Fixed price contracts and formula-based indexation have become the dominant ways in which supplies are bought and sold around the world, which makes accurate price assessments and detailed analysis key to any sulphur market participants.

The global sulphuric acid industry has seen structural change in recent years and new capacities will continue to challenge the balance in the years to come. While demand will be driven by fertilizers — predominantly the increased production of phosphate and ammonium sulphates — the market will continue to be exposed to short-term supply shocks, especially from the metals sector.

Rising demand for battery materials such as nickel and cobalt (due to growing electric vehicle production) will in turn bolster demand for sulphur and sulphuric acid, increase competition for supply and impact pricing.

Our extensive market coverage includes formed sulphur (both granular and prilled), crushed lump sulphur, molten/liquid sulphur and sulphuric acid. Argus has decades of experience covering these markets, and incorporate our multi-commodity market expertise in key areas including phosphates and metals to provide the full market narrative.

Argus support market participants with:

- Price assessments (daily and weekly for sulphur, weekly for sulphuric acid), proprietary data and market commentary assessments

- Short and medium to long-term forecasting, modelling and analysis of sulphur and sulphuric acid prices, supply, demand, trade and projects

- Bespoke consulting project support

Latest sulphur and sulphuric acid news

Browse the latest market moving news on the global sulphur and sulphuric acid industry.

Argus Fertilizer Market Highlights

The complimentary Argus Fertilizer Market Highlights package includes:

• Bi-weekly Fertilizer Newsletter

• Monthly Market Update Video

• Bi-monthly Fertilizer Focus Magazine

Spotlight content

Browse the latest thought leadership produced by our global team of experts.