China could alleviate global distillate shortages and lower its crude import bill by allowing more product exports

Beijing has rejected oil firms' requests for further oil product export quotas this year. The decision turns what would have been an attractive arbitrage opportunity effectively into an opportunity cost for companies. It also raises the likelihood that tightening global distillate markets will return to haunt China in the form of ever-costlier crude imports.

Singapore refining margins are regularly buffeted by the ebb and flow of gasoline, diesel and jet fuel exports from China. Crack spreads for those products have tended to be lower in Asia than in other global oil trading hubs this year — partly because Chinese crude throughputs have grown by 1.6mn b/d, spilling 370,000 b/d more transport fuel into regional export markets.

Exports were tipped to shoot even higher in the fourth quarter. Oil firms asked the government for an additional 30mn-40mn bl of export quotas, and were confident of receiving assent. China is using a lot more naphtha and jet fuel this year, but supply of gasoline and diesel has grown far faster than demand. Refining margins for both products have dropped and export margins have ballooned. Chinese diesel margins fell to $18/bl this month but shortages overseas — as Opec+ producer group cuts tighten supply of the medium density crude best suited to making diesel — have pushed crack spreads globally to $35/bl.

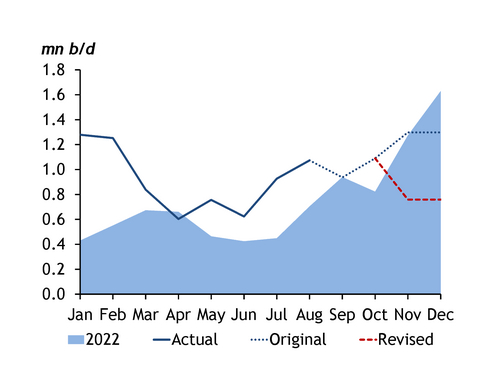

After summoning state-run refiners to discuss the state of the global market on 27 September, economic planning body the NDRC signalled that no more quotas will be forthcoming. China's exports of the three fuels will now be 500,000 b/d lower than expected (see graph). The logic for rejecting requests to boost exports is unclear. Domestic oil demand rises in the autumn, but supplies to meet that have already been allocated and demand has so far fallen short of refiners' hopes. In any case, decisions about quotas are dictated by loftier considerations, officials say, and must be approved by the state council, chaired by premier Li Qiang.

Rhyme or reason

The NDRC asserts that fuel exports should be discouraged on the grounds that they are, effectively, imports of CO2. In fact, higher exports would reduce China's oil intensity per unit of GDP, which is on course to grow by nearly 13pc this year. Justifications on the grounds of energy security are equally nebulous. China's 2021 electricity crisis spilled over into diesel markets, but China's power sector is under no constraints this year, and the country has surplus diesel.

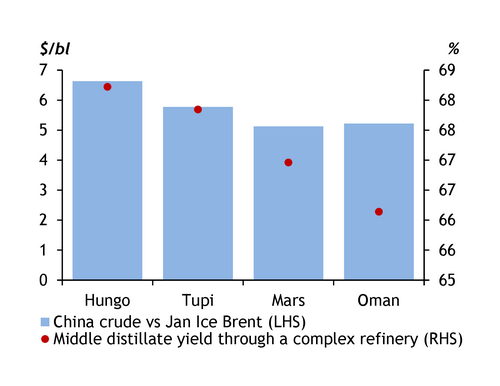

So oil firms are left to eke out what remains of their export quotas — they lost out last year too, reaching export limits as Shanghai locked down. Lower exports feed back to companies as higher notional export margins when overseas prices rise and — at a national accounts level — as low-value inventory or reduced manufacturing rather than high-value international trade. China will also ultimately pay more for crude in the form of imports, prices for which are to a large degree presently dictated by yields of scarce middle distillate (see graph). US president Joe Biden last year began authorising strategic crude stockdraws to tamp oil's price surge — his approval ratings often appear to track pump prices. China is disinclined to deploy its structural diesel surplus in a similar manner. The political cost may be far lower to Beijing but the economic cost could prove hefty.