Many operators in the prolific Permian basin have raised their 2018 capital expenditure (capex) guidance to sustain production growth, albeit in some cases at lower rates.

But investors are watching closely to see how producers focused on the giant basin, spread across Texas and New Mexico, plan to cope with the twin challenges of rising costs and widening discounts for regional crude prices this year and next because of pipeline bottlenecks.

Independents increased their yearly capex guidance by $3.7bn, or 8pc, during the second quarter from their earlier plans, but their oil production is expected to gain by just 1.4pc this year, consultancy Rystad Energy says, based on an analysis of 33 onshore operators. Permian-only companies along with those that produce more than half their oil in the region accounted for $2.5bn of the rise. Permian-only operators could boost their production by 2pc this year and those with more than half their production in the basin by 4pc, Rystad says.

But investors appear unimpressed. "Almost every stock that raised capex underperformed and most with no capex increase outperformed," US-based investment bank Goldman Sachs says.

The budget revisions come as producers face increased costs but also as they seek to intensify well completions, although many of these are expected to add to output only in 2019 when pipeline bottlenecks are likely to ease, Rystad says.

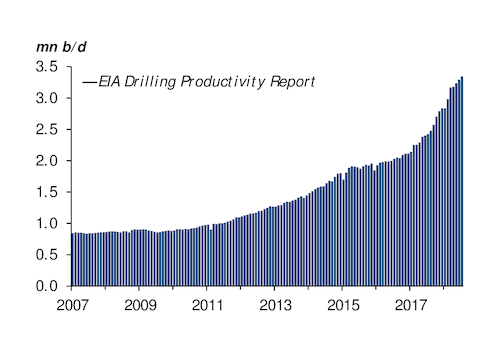

Pioneer Natural Resources, the independent with the highest output in the basin, has increased its capex target to $3.3bn-$3.4bn from $2.9bn, with the extra cash needed to secure additional rigs that it will deploy to boost production and increase well completions next year. Pioneer is working towards a 10-year output target of 1mn b/d of oil equivalent (boe/d) by 2026 and is selling assets to become a Permian-only operator, part of a growing company trend of concentrating their resources on the shale oil-rich region. As such, its production target is entirely predicated on the Permian, with growth put at 19-24pc this year.

Apache, another large independent producer focused on the Permian as a core growth area, is ramping up its spending on drilling and well completions by $400mn this year. The company says its developments in the Permian are efficient but that it needs to fund investments to allow it to conduct longer lateral drilling operations as well as expand its existing facilities.

Independent means

The midstream is also eating into independents' funds. Pioneer's costs increased to $10.50/boe in the second quarter from $10.30/boe in the first and $9.70/boe a year earlier, while its third-quarter guidance is $9.50-$11.50/boe. Part of this increase is related to labor charges, but the imposition of steel tariffs is also having an effect. Tubing and other costs have increased by 20-25pc from a year earlier purely because of tariffs, Pioneer says.

Firms are increasingly using technology to control costs and boost production. Denver-based QEP Resources, another company that is aligning its strategy to focus solely on the Permian, made one of the highest increases to its production guidance for this year, because of better-than-expected performance at its wells, underpinned by gains in its drilling and completion operations.

The company has reduced its drilling time by an average of three days, generating savings of around $400,000/well drilled in the second quarter compared with the fourth quarter of last year. "Those gains more than offset the $200,000 of inflation in materials and services" over the period, QEP chief executive Charles Stanley says.