US upstream mergers and acquisitions (M&A) are expected to slow further in 2019 amid a volatile crude market, but large corporate consolidation may still continue as companies seek to build scale and lower costs.

Deal activity already slowed last year compared with 2017, setting the stage for possible further deceleration. The number of US upstream deals in 2018 fell to 93 compared with 125 a year earlier, accountancy firm PwC says. More importantly, US shale deals fell to about 85 last year from a record 106 in 2017. But the value of these deals rose to $90bn in 2018 against $67bn the year before.

A number of large multi-billion dollar mergers took place last year, particularly in the top producing Permian basin, including Concho Resources' purchase of RSP Permian in a $9.5bn deal and Diamondback buying Energen for $9.23bn. That and other deals may make it difficult for small to medium-sized producers lacking similar scale to compete for oil services, secure pipeline offtake capacity and keep costs low. "The rationale for consolidation has never been higher," Wells Fargo Securities managing director David Humphreys says. "Scale is the key."

A potential takeover target this year is privately held Endeavor Energy Resources, which holds more than 300,000 net acres (1,214km²) in the Permian's Midland sector. The firm could be of interest to deep-pocketed majors such as ExxonMobil and Shell. "A deal in 2019 is not a foregone conclusion, but if Endeavor's backers want a near-term exit, the IPO route looks a non-starter under current market conditions," consultancy Wood Mackenzie director Greig Aitken says.

But while large-scale consolidation opportunities are becoming rarer, shale is likely to remain a major driver of deals in 2019, especially in the Permian. "We expect to continue to see good volumes of smaller deals in the basin," PwC says. A total of 33 deals worth $36bn were done in the Permian last year compared with 39 worth $30bn in 2017. And activity may pick in other basins such as the Haynesville.

Large mergers in the sector have not always been well received by shareholders, and share prices of companies have often fallen after they have announced large deals. But many producers see the need to add size and scale, because as a public company "it is just harder to get any attention", Humphreys says.

Institutional investors have become more circumspect in taking bets on the US shale industry because of lower returns compared with other sectors. They have pressed producers to focus on improving margins and maintain their operations within cash flow. Availability of capital has dwindled as a result. "There has been a reset, where rules kind of changed," US bank Jefferies managing director Bill Marko says. "Modest growth that is profitable is much more preferable than big growth."

Charting a course

Recent crude price volatility, which included a near-40pc slide in prices in the fourth quarter of 2018 from its mid-October high, may similarly keep buyers and sellers at bay. A key uncertainty is figuring out when to sell. "Navigating the exit is probably one of the biggest challenges for us," private-equity (PE) firm EnCap Investments partner Jimmy Crain says.

The share of PE deals last year fell in terms of value and volume from 2017, in part because PE firms closed a number of large transactions in 2017, and "are facing the challenge of identifying attractive assets on the market", PwC says. But there are still many PE firms willing to invest, Crain says. Companies such as EnCap see more opportunity in bigger deals, of about $1bn, which attract less competition from other potential investors. And activity may also be driven by large producers such as US independent ConocoPhillips, which continues to look at shedding assets it no longer considers as core even after a major restructuring in 2017.

| Biggest shale M&A deals 2018 | |||

| Buyer | Seller | Date | Value $bn |

| BP | BHP | 26 July | 10.5 |

| Concho Resources | RSP Permian | 28 March | 9.5 |

| Diamondback Energy | Energen | 14 August | 9.23 |

| Encana | Newfield Exploration | 1 November | 8.44 |

| — PwC, IHS Markit | |||

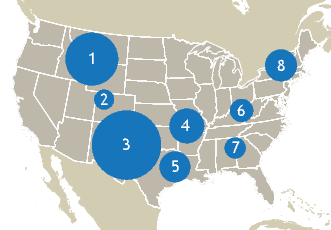

| Upstream shale deals 2018 | |||

| Key | Shale | No. of deals | Value $bn |

| 1 | Bakken | 14 | 20.8 |

| 2 | Niobrara | 9 | 3.0 |

| 3 | Permian | 33 | 36.0 |

| 4 | Anadarko | 5 | 8.9 |

| 5 | Eagle Ford | 9 | 7.0 |

| 6 | Utica | 4 | 4.0 |

| 7 | Fayetteville | 3 | 3.3 |

| 8 | Marcellus | 8 | 7.5 |

| — PwC, IHS Markit | |||