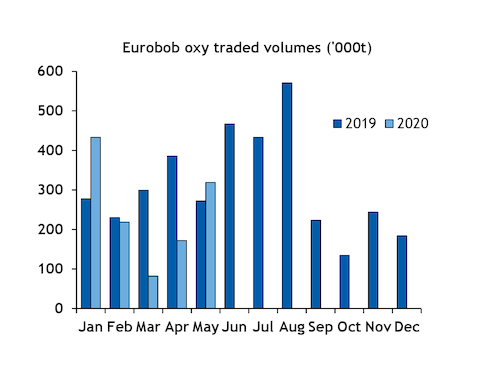

Traded volumes of Argus Eurobob gasoline rebounded further in May to reach a combined 385,000t, up from 186,000t in April and 298,000t a year earlier. Both oxy and non-oxy grades saw a sharp recovery in liquidity, as travel restrictions were eased in several European countries.

Oxy barge trading liquidity totalled 319,000t in May, from 172,000t in April and 272,000t a year earlier. It was the highest monthly volume since January, and the largest May total since 2016.

Volumes have rebounded further since falling to a record low in March, when widespread travel restrictions imposed to limit the spread of Covid-19 reduced end-user demand for gasoline by as much as 70-80pc in some European countries.

Most European countries began easing restrictions last month.

Oxy barge volumes are still lower for the year as a whole, at 1.23mn t in January-May, compared with 1.38mn t in the same period of 2019.

Gunvor was the largest buyer, securing 228,000t of Eurobob oxy barges in May, after buying none in April. ExxonMobil and Petroineos bought 26,000t and 27,000t, respectively, from nothing and 14,000t in April.

The remaining volumes were purchased by Equinor, Finco, Neste, Trafigura and Macquarie.

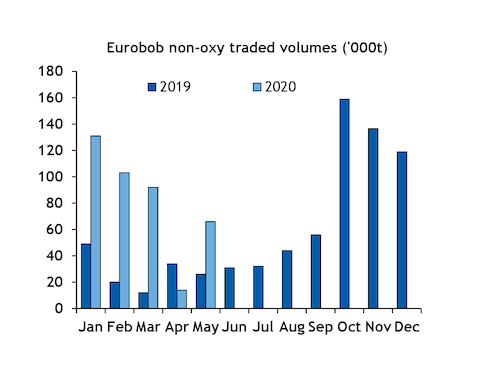

Non-oxy Eurobob volumes also rebounded in May, reaching 66,000t from just 14,000t in April, and 26,000t a year earlier.

Non-oxy barge volumes are still sharply higher for the year to date at 407,000t for January-May, compared with 141,000t in the same period last year.

Gunvor secured 34,000t of non-oxy gasoline in May, after buying none in April. And Varo bought 22,000t, up from 8,000t a month earlier.

BP, Litasco, Van Raak, Mabanaft and Hartree all purchased 2,000t each. Total sold 40,000t and ExxonMobil 10,000t in May, from nothing in April. BP, Litasco, Shell, Varo and Finco sold the remaining non-oxy volumes.