Recovering oil prices, global optimism in the wake of recent Covid-19 vaccine news and short-term supply tightness in the seaborne coal market have created increasingly bullish sentiment in the API 2 swaps market this month.

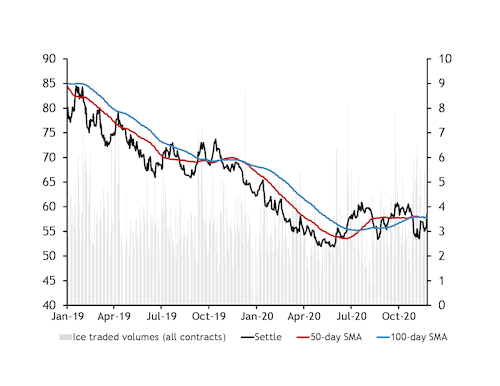

After shedding $5.35/t in the two weeks to 6 November ahead of new lockdown measures in Europe, the API 2 year-ahead has since gained $4.35/t to settle at $58.50/t on 24 November and was trading higher again as of 13:00 GMT on 25 November.

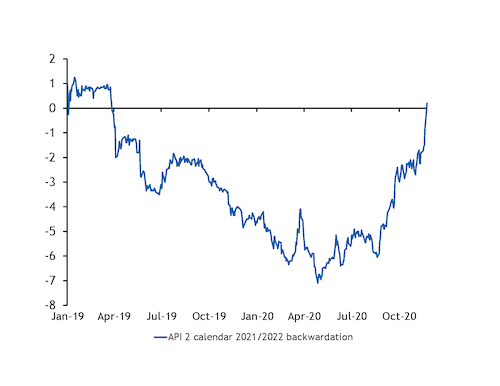

The latest rally includes a single-day gain of $2.40/t on 24 November, the biggest day-on-day increase for a year-ahead swap since July 2019, and pushed the calendar 2021/calendar 2022 pair — which have traded in contango since March 2019 — into a $0.20/t backwardation.

Annualised volatility on the API 2 year-ahead is at its highest since March 2018 at 32.3pc, according to Argus analysis, spurring a spike in paper liquidity during the latest rally.

Some 8.4mn t of API 2 coal swaps traded on the Ice exchange on 24 November, according to Ice data — an 11-month high — and monthly Ice volumes look set to surpass 100mn t for the first time in two years. Ice typically accounts for around 75pc of API 2 paper liquidity, with the remainder traded through CME.

The latest rally and spike in liquidity have been accompanied by rising open interest on forward API 2 swaps, which suggests that counterparties taking long positions have lent support to the market, rather than a squeeze among those with short positions.

Open positions on swaps delivering next year totalled 25.8mn t on 24 November, up from 22.3mn t at the start of the month, according to Ice data. This was close to the 26.1mn t peak on 23 October, but still around 9mn t short of open interest on year-ahead swaps this time last year.

But open positions on swaps delivering in the second forward year — currently 2022 — is now up versus both last year and 2018, following a 4mn t increase in open interest this month to 16.7mn t as of 24 November.

In the options market, bearish positions on right-to-sell year-ahead put options have also been cut this month, pointing towards an increasingly firm outlook among market participants.

The greatest open interest on API 2 year-ahead options was on puts at a $50/t strike at 340 lots at the end of October, but this has been cut back to 240 lots this month. Such puts are out-of-the-money so long as the API 2 year-ahead trades above $50/t and the drop in open interest this month suggests that the holders think it unlikely that $50/t puts will become profitable before expiry in early December.

Vaccine optimism and coal supply tightness lend support

The rally in European coal prices this month comes as a succession of news about positive Covid-19 vaccine trials boosts the global economic outlook for 2021 and beyond, although short-term supply tightness in the global coal market has also factored.

The first vaccine announcement from US pharmaceutical giant Pfizer came on 9 November and Brent crude prices have since gained more than a fifth in value to settle at an eight-month high of $47/bl on 24 November.

Optimism about an eventual global economic recovery in 2021 has fuelled expectations of a partial rebound in seaborne coal demand next year as well, with Noble Resources this week saying it expects demand to increase by 3.8pc or 35mn t in 2021.

Most of this potential growth is likely to centre on Indian demand, bolstered by a more modest recovery in northeast Asian imports — excluding China — and strength in Vietnam and other markets in south and southeast Asia.

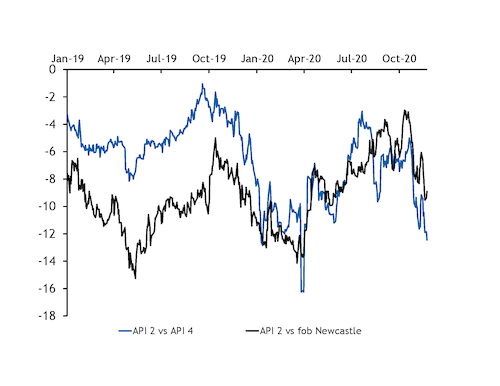

The increase in API 2 year-ahead prices has therefore been far outpaced by the equivalent API 4 and fob Newcastle contracts, which held premiums of $12.45/t and $8.91/t, respectively, to the API 2 calendar 2021 yesterday, from $9.75/t and $7.61/t on 30 October.

Short-term supply tightness driven by a damaged shiploader at Newcastle, the potential for extended mining closures over the festive period in Australia and falling coal stocks at Richards Bay in South Africa have also given an additional boost to Asia-Pacific prices.

Excessive rains and suspensions at key miners Prodeco and Cerrejon in Colombia and the potential for only a modest recovery in US exports next year continues to pose a supply-side risk to the Atlantic coal market as well, which may continue to draw down European stocks and tighten the fundamental balance throughout the winter.

But the outlook for coal burn in Europe remains weak, with natural gas once again competing strongly in the year-ahead baseload as recovering US LNG exports, mild fourth-quarter weather and the potential for further short-term economic impacts from the pandemic ease the winter risk premium in the gas market.

German high-efficiency 46pc clean dark spreads have fallen below 55pc efficiency clean spark spreads for year-ahead base-load generation since 18 November, as coal has fallen down the merit order following a brief resurgence in October-November.

The outright year-ahead clean dark spread has fallen by €0.82/MWh this month to €4.11/MWh on 24 November.