Finnish Neste Oil's progress towards a greater reliance on renewable feedstock is a concern for sellers of Russian crude Urals in the northwest European market.

Urals deliveries to Finland have declined this year as plans to co-process crude and renewable feedstocks at Neste's 197,000 b/d Porvoo refinery have progressed. Deliveries are also down following the permanent closure of the firm's 55,000 b/d Naantali plant for economic reasons. Urals supplies to Finland dropped by 22pc on the year to 187,000 b/d in January-March, vessel tracking data show. Porvoo has not received Urals since 5 April because of scheduled maintenance. And Urals shipments to Finland could still ease further once Porvoo resumes operations, pressured by Finland's aim of having renewables account for at least 51pc of its energy consumption by 2030.

Urals demand has fallen elsewhere in Europe too. Operations at Total's 93,000 b/d Grandpuits plant near Paris halted at the end of March before its conversion into a biorefinery. Grandpuits is connected by pipeline to the port of Le Havre, which last received Urals on 27 March — this year's sole delivery. Around 35,000 b/d of Urals, in five shipments, went to Le Havre in the first quarter of 2020.

And strong competition from North Sea crudes is pressuring Urals' market share in northwest Europe. Swedish refiner Preem — historically a regular Urals buyer — has increasingly opted for North Sea grades for its 220,000 b/d Lysekil plant at Brofjorden in recent years. The company is also converting the Lysekil refinery to co-process crude and renewable feedstocks.

Urals deliveries to Brofjorden were nearly 50pc lower on the year at 16,000 b/d in the first quarter and down by more than 86pc against the first quarter of 2019. But imports of Norwegian light sweet Gullfaks and medium sour Johan Sverdrup are rising — 31pc higher on the year at a combined 92,000 b/d in January-March and up from zero in the first quarter of 2019.

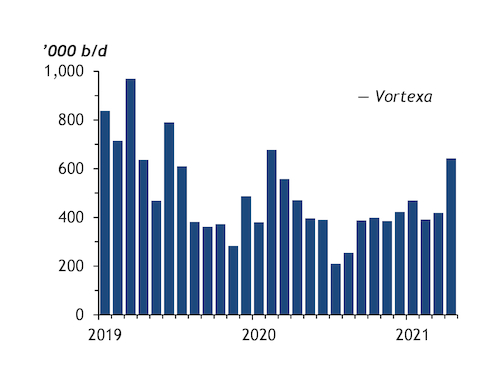

Rising transatlantic shipments of US crude could also pose problems for Urals sellers. At least six cargoes of light sweet WTI have headed to countries on the Baltic Sea since the start of April, including Lithuania and Denmark, compared with just two shipments in the first quarter, data from oil analytics firm Vortexa show. Light sweet US crude can be blended with cheaper medium and heavy sour Mideast Gulf grades, such as Arab Heavy or Iraqi Kirkuk, to create a distillate and residue-rich blend similar to Urals.

Asian interest

And the outlook for long-haul Urals exports looks uncertain as the Opec+ group further unwinds its production restraint agreement in May-July. Urals cargoes found their way to rare outlets in northeast Asia after the group's production cuts were introduced last year, as regional buyers such as Japan and South Korea were left with reduced availability of their usual Mideast Gulf medium sour base-load grades. A rise in the supply of Mideast Gulf crude in the Asia-Pacific market could eat into any market share Urals was able to gain when availability was curtailed. But a return to pre-pandemic demand from China could still help offset any easing in Asian interest. Urals exports to China in May have already matched total shipments in January-April and could rise further.

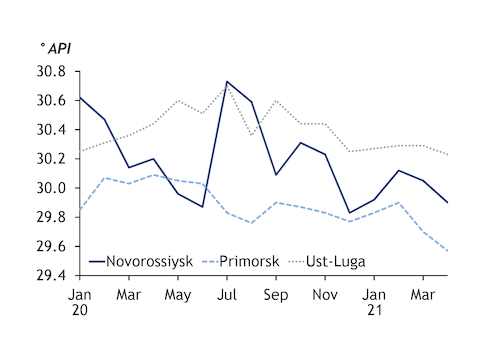

There are also growing concerns about seaborne Urals' quality — particularly increasing density. Data from pipeline operator Transneft indicate that April-loading Urals was heavier than a year earlier at the Baltic ports of Primorsk and Ust-Luga, and at Novorossiysk on the Black Sea — sliding by 1.7pc to 29.57°API, by 0.7pc to 30.23°API and by nearly 1pc to 29.90°API, respectively. The decline comes at a time of growing demand for low-sulphur supplies, participants say.