Japan's coal imports declined in June, pressured by deteriorating coal-gas switching economics and recovering nuclear availability.

Japanese coal imports fell by 750,000t, or 8.6pc on the year, to 7.5mn t last month, provisional finance ministry data show.

Russia was the main driver of the decline, with receipts falling by 321,000t to 1.3mn t.

Indonesian imports declined by 229,000t to 704,000t, while Australian shipments dropped by 194,000t to a 13-month low of 5.1mn t. This total may include small amounts of South African and Colombian coal, which are not differentiated in the provisional data.

Cumulative imports in January-June were 52.3mn t, down by 913,000t on the year.

By contrast, Japan's LNG imports were up by 8.5pc on the year to 5.7mn t in June, with cumulative January-June LNG receipts 7.2pc higher at 38.9mn t.

LNG restocking requirements following a cold winter that eroded inventories are one reason behind the larger LNG inflows. But there is also a dwindling incentive for Japanese utilities to burn coal relative to gas, based on current generation cost economics.

Fuel-switching incentive grows

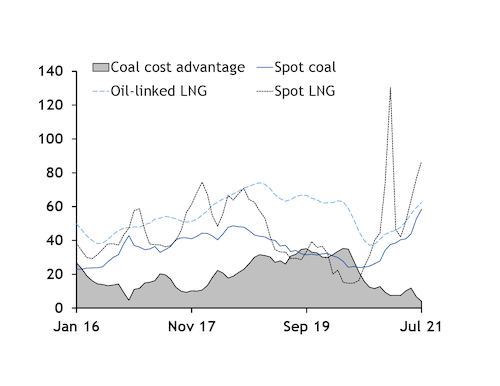

The cost of generating power from spot coal has risen close to the cost of generation from imported oil-linked LNG in recent months — the pricing mechanism that covers the bulk of Japan's LNG imports (see chart).

The generation cost for spot coal burnt in a 38pc-efficient plant was $58.40/MWh in July, a discount of $4.03/MWh to the equivalent cost for oil-linked LNG burnt in a 55pc-efficient plant, according to Argus calculations. By contrast, the discount was $6.69/MWh in June and $21.37/MWh in July 2020.

Spot coal benchmarks globally have increased in recent months, propelled by numerous supply constraints and robust Asian demand. Argus' fob Newcastle NAR 6,000 kcal/kg prompt assessment was at a 13-year high of $151.14/t on 23 July, up by around $66/t since January.

Global gas prices have also risen — particularly spot LNG prices — but the price increase in oil markets has been less pronounced, capping gains in term LNG contracts.

Power demand at a high level

The short-term outlook for Japan's thermal power demand is mixed. Above-average temperatures should support overall electricity consumption during the peak cooling period.

There is a 70pc chance of above-average temperatures in northern Japan over the next month and a 50-60pc chance in the rest of the country, according to the Japan Meteorological Agency. This falls to a 40pc chance of above-average temperatures heading into the shoulder season in September and October.

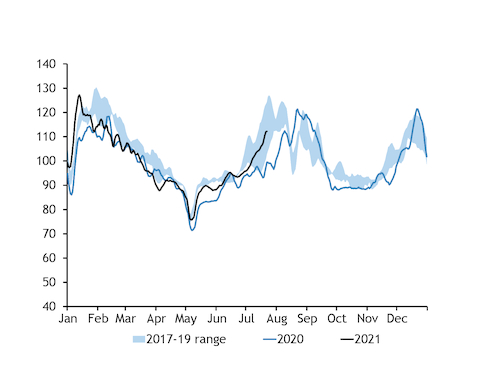

Japan's power demand averaged 2.5 TWh/day on 1-22 July, according to government figures. This is up from 2.3 TWh/d over the same period last year and 2.4 TWh/d on 1-22 July 2019.

But Tokyo is still under a state of emergency because of Covid-19, which could cap overall power demand, while much higher nuclear availability compared with a year earlier should weigh on thermal import requirements in the second half of this year.

Japan's nuclear availability is expected to average 8.8 GW/month in July-December, up from 3.4GW/month a year earlier.

Longer term, returning nuclear units to full working order is a key pillar of Japan's energy strategy. The government last week released ambitious new targets to reduce the share of thermal power generation in the national mix to 41pc by 2030-31.

In addition to brining a swathe of nuclear units back on line, this draft plan is predicated on making strides in overall energy efficiency and ramping up renewable output, particularly solar and wind generation.