The constrained logistics in Ukraine are expected to continue to provide support to prompt corn prices over the next two months, while delaying shipments to ports, which could result in some oversupply on the market in March-April 2022, given the arrival of Argentinian new-crop corn.

Ukrainian spot corn prices have remained supported from the start of the season in October, despite a record production this year, with the average Argus-assessed fob and cpt corn prices standing at $277/t and $268/t, respectively, in October-November. These levels were about $50/t higher compared with the respective values a year earlier, when Ukraine's corn production was reduced by dry weather conditions.

One of the reasons for strong corn prices at the start of the season was the disrupted logistics in the country, which hampered corn deliveries to port terminals and slowed loading operations, with some exporters paying high demurrage costs. And this situation could continue in the upcoming months, given record grain crop in Ukraine this season.

Ukrainian corn and wheat production is estimated to hit record highs in the 2021-22 marketing season — at 38mn t and 33mn t, respectively — with exports projected at the respective 31.5mn t and 24mn t, according to the US Department of Agriculture (USDA). This has created an additional burden on the country's outmoded logistics system, which usually faces disruptions in December-January, when grain exports from Ukraine reach their peak volumes.

Record grain exports versus limited logistics capacities

This year, Ukrainian exporters have faced railway logistics issues earlier than usual, when demand for railway cars rose sharply in November and a limited number of locomotives was not able to meet needs of grain shippers amid the arrival of the delayed corn crop and the ongoing strong wheat shipments.

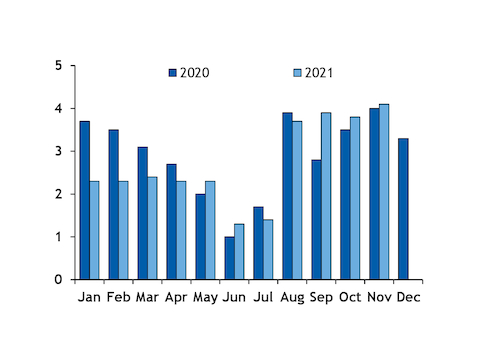

Railway secures about 70-75pc of Ukraine's overall grain transportations to the ports, with the maximum monthly capacity of 3.5-4mn t of grains. Despite this, Ukraine's November railway grain transportations hit an all-time high of 4.1mn t, which is close to the upper bounds of railway logistics capacity and up by 1.2mn t compared with the previous year, the state-owned Ukrainian Railways' data show.

Overall corn exports from Ukraine totalled about 4.7mn t in October-November, with 27.4mn t expected to be shipped by the end of the season in September 2022. Meanwhile, wheat exports since the start of the marketing year in July amounted to nearly 14.8mn t, and another 9.2mn t could be shipped by the end of June 2022, according to the USDA's data.

Ukraine's wheat exports in December and January are expected to reach 2mn t and 1.8mn t, respectively, while corn exports could hit 5mn t in each of the months, market participants said. This means that Ukrainian exporters are expected to ship a total of 7mn t and 6.8mn t of grains in December and January, respectively, which could be difficult to achieve in the light of limited logistics capacities, estimated at about 6mn t per month.

Inland truck transportation, which accounts for about 20-25pc of Ukraine's overall grain deliveries to ports, is likely to do little to help to secure record grain exports in the upcoming months, as it is limited by distance to the ports, which makes its usage unprofitable for deliveries from the remote regions.

Downward pressure from rising competition

Given the constrained logistics capacities and strong competition for railway transport between grains and other goods, especially imported coal, further disruptions to grain deliveries to Ukrainian ports are possible. This could result in delayed ship loadings in the next two months and leave Ukraine with large corn supplies, with risks of washouts, when Argentina starts to supply its new-corn crop in March-April 2022.

Argentina is expected to harvest a record corn crop this marketing season, with exports projecting at 39mn t, the USDA's data show. This could encourage some global importers — such as Egypt — to ramp up purchases of Argentinian product in the case of delayed deliveries from Ukraine.

Moreover, Ukrainian product continues to remain the most expensive on the global market. This increases the chances of lower Ukrainian corn prices once the cheaper-priced Argentinian crop arrives to the market and the country's logistics issues ease following decreasing wheat shipments from February. And this could result in some oversupply in the local market, with large stocks at the end of the marketing year.