Rising costs and a depleting backlog of drilled-but-uncompleted (DUC) wells will force many shale producers to spend more next year just to maintain output.

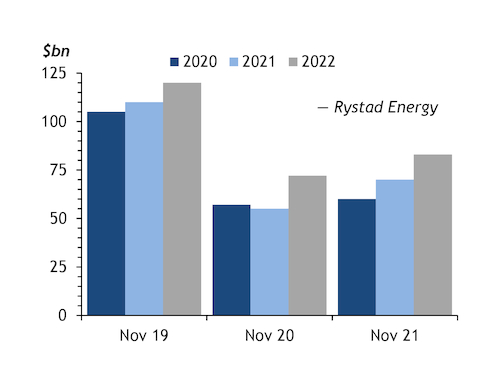

US tight oil production has bounced back strongly this year, without most firms boosting budgets. Output will be nearly 700,000 b/d higher this month than a year ago, the EIA projects. Upstream shale oil and gas-related spending plans were cut sharply last year after Covid-19 hit demand and undermined prices, and they have only recently started to recover, consultancy Rystad Energy says. Before the pandemic, Rystad expected public and private shale firms to spend $105bn in 2020, but this was cut to just $60bn (see graph).

Publicly traded firms have kept a tight grip on upstream spending this year. They have used rising cash flow from higher prices to pay off debt and reward disgruntled shareholders instead of reinvesting for output growth as they used to. A peer group of 21 public shale oil producers — excluding major oil firms — reinvested only 46pc last quarter, despite strong cash flow from operations, compared with a historical average of over 130pc, Rystad says.

But spending by private operators has picked up strongly this year as oil prices have risen. This has contributed to rising costs for rig hire, drilling and completion. Private-sector firms account for two-thirds of the drilling activity and a third of completions this year, Rystad says. US horizontal rig counts are up by two-thirds since the end of 2020 — mainly owing to increased drilling by private operators — and Rystad envisages a 16pc rise in US shale sector spending this year.

Further increases in spending are likely next year as activity and oil service cost inflation picks up, despite offsetting savings from efficiency gains. Rystad expects shale budgets to rise by 19pc in 2022. Liberty Oilfield Services chief executive Chris Wright agrees. "Going into next year, the publics are still very disciplined," but even maintaining production levels for public firms still means higher spending, he says. "Around a 20-plus percent total increase in capex [capital expenditure] next year, that is probably a reasonable guess."

Tubular bills

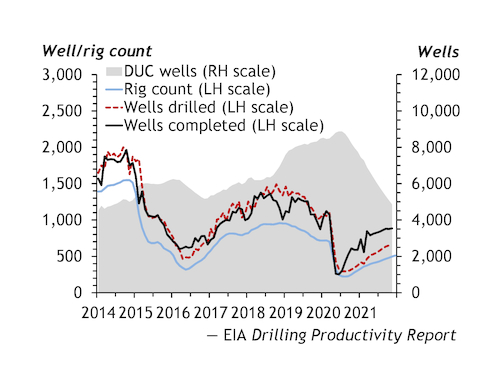

Growing demand for drilling rigs is fuelling cost inflation now that firms are depleting their backlog of DUC wells (see graph). Half as many more wells were completed than drilled this year, as firms took advantage of much lower costs for bringing new production from DUC wells on stream. But the number of available DUCs has almost halved to 4,885 from a peak of 8,874 in June 2020 for the seven shale formations covered in the EIA's monthly Drilling Productivity Report (DPR).

Firms will have to drill many more wells next year just to maintain output as the supply of DUC wells dries up. This alone will boost spending as completion is around 60pc of the full cost of drilling and completing a new well. "In 2022, we won't have as many DUCs to complete as we did in 2021," Occidental chief executive Vicki Hollub says. "We completed about 100 DUCs this year." The industry also faces rising costs for steel, labour and fuel. "Availability of tubulars is something most companies are struggling with," EOG Resources chief operating officer Billy Helms says. "And getting enough people to manage the activity levels."

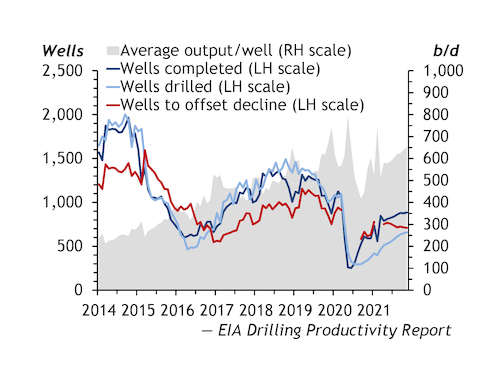

Oil production rises by 90,000 b/d in the DPR-7 regions next month as new-well output outpaces legacy decline rates of 470,000 b/d. In all, 885 wells were completed last month — with an average output of 650 b/d in that first month — 176 wells more than needed to offset legacy declines. But the share of DUC wells in DPR-7 completions slipped to 26pc from over 40pc at the start of 2021 as the gap between completions and drilling narrowed. Without DUC wells, 709 new wells would be needed to offset legacy declines — an 8pc increase in drilling activity.