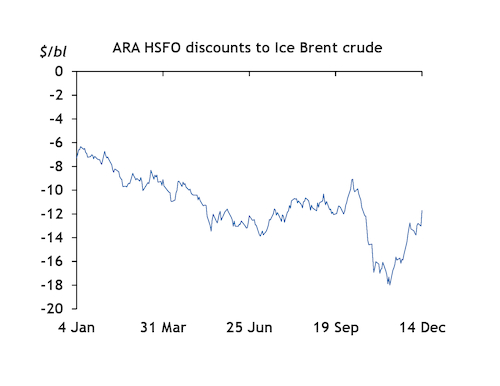

European high-sulphur fuel oil (HSFO) prices will continue to find support from US and northwest European refinery demand in 2022, as well as from shipping and power consumption, after discounts to crude remained wide enough to attract traders' buying interest in 2021.

Refiners with more complex refineries in the US Gulf coast and the Amsterdam-Rotterdam-Antwerp (ARA) trading and refining hub have continued to buy steady amounts of high-sulphur residuals from Russia for their cokers to increase diesel output, which contributed to support HSFO prices. Some refiners are likely to continue buying high-sulphur residuals from the Baltics, as heavy and sour crude output might be limited going into next year because of Opec+ supply cuts. Some US refiners typically buy Russian fuel oil to blend with shale crude in order to process in cokers, making the residual product a substitute for heavy crude.

Baltic Sea fuel oil exports to the US averaged around 800,000 t/month in 2021, down from 1mn t/month in 2020, according to Vortexa. Shipments to the US accounted for nearly 30pc of all Baltic Sea loadings in 2021, down from 40pc in 2020. Exports to northwest Europe rose by 43pc on the year to 1mn t/month, taking a 39pc share of overall Baltic Sea loadings.

But higher supply could pressure HSFO prices downward in 2022. Russian state-controlled Rosneft offered to sell up to 21.7mn t of fuel oil in its term tender for the year, higher by around 1.5mn t compared with 2021. Russia will remain the primary exporter of residual fuel oil cargoes in 2022, as it has yet to complete most of its refining upgrade projects.

Also on the supply side, market participants are awaiting the outcome of discussions to revive the Joint Comprehensive Plan of Action (JCPOA) nuclear agreement. The US and Iran remain far from a deal, but if sanctions against Tehran were lifted in 2022 the return of Iran's HSFO supply would weigh on global prices. Iran used to be one of the largest fuel oil suppliers in the Middle East.

Another key driver of HSFO prices will be demand for power generation, especially in the first quarter of 2022 when the northern hemisphere winter could draw more from markets east of Suez. Record-high gas prices have driven many industries, including refiners, to seek alternative fuels for power generation.

Asia-Pacific was one of fastest-switching regions, with cargoes mostly heading there from the Middle East and other countries east of Suez. Higher Japanese fuel oil imports suggested switching between gas and fuel oil, as the country is typically one of the largest buyers of LNG. Japan imported more than 250,000t of fuel oil in the fourth quarter of 2021, compared with just 30,000t in the same period a year earlier, Vortexa data show.

Shipping demand will also continue to support prices in the new year, especially if the HSFO discount to 0.5pc very-low sulphur fuel oil (VLSFO) — the 'Hi5 spread' — holds at current levels. Fuel oil demand for the shipping industry has remained robust as a wider Hi5 spread helped boost the number of scrubber installations in 2021. The spread averaged $130/t in the past two months, and if it stays at that level it will probably further boost HSFO demand as a marine fuel.

VLSFO will remain the dominant marine fuel. Forward curves for European VLSFO point to robust refining margins at around $5-6/bl for 2022, because regional availability is fairly balanced with refiners supplying most of their production to marine fuel suppliers in the region, leaving very little for export.