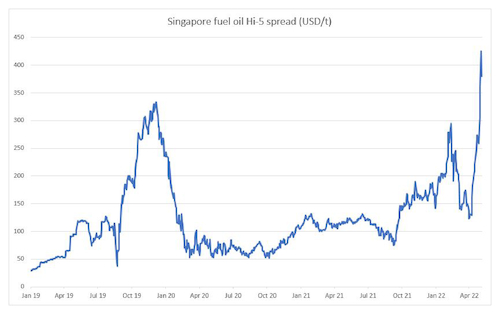

The Asian fuel oil Hi-5 spread, or the spread between Singapore 0.5pc sulphur marine fuel and 380cst high-sulphur fuel oil (HSFO) prices, has widened to record highs this week.

The spike was mainly because HSFO markets were weakening with a surge of HSFO inflows to Singapore in May, on the back of bans on Russian oil imports in Europe and the US. But low-sulphur fuel oil (LSFO) markets have been supported by limited inflows to the city-state since March, among other factors.

The Hi-5 spread widened to $425.50/t on 30 May, the highest since the $333.25/t on 2 January 2020, according to Argus assessments. It narrowed slightly but remained wide at $380.75/t on 1 June. But the European fuel oil Hi-Lo, or LSFO's premium to HSFO barges, has neared a two-year low because of the loss of Russian HSFO to Europe.

Asian LSFO margins also surged to record highs this week as refiners have been diverting low-sulphur feedstocks to gasoil and gasoline production, further tightening supplies, said traders and analysts. UK refineries' oil product output increased to 4.72mn t in April, the highest monthly volume since pre-Covid December 2019 because of record-high gasoline and diesel margins. But fuel oil production bucked the trend, falling by 25pc against a year earlier.

Singapore 0.5pc sulphur marine fuel margins, or the premium or discount of Singapore 0.5pc sulphur marine fuel swaps against Dubai crude values, also rose to $35.21/bl on 30 May. This was the highest since Argus began assessments in March 2020. Margins fell but remained supported at $26/bl on 1 June.

The 0.5pc sulphur marine fuel backwardation, with prompt prices at a premium to forward values, has widened steadily since mid-May, also hitting a record high of $74.75/t on 1 June.

The LSFO market strength is also likely a result of lean low-sulphur residual inflows to Singapore since March, with the Russian low-sulphur supply losses to Europe and the US, producing a knock-on effect of even thinner flows to Singapore. The backwardation in Singapore markets has averaged around $30/t during March-May, making arbitrage economics to Asia unviable despite wide east-west spreads.

Low-sulphur arbitrage arrivals to Singapore from west of Suez and Asia-Pacific have averaged around 2mn t/month (424,000 b/d) or less since March. They are forecast to be around just 1mn t to at most 1.4mn t in June, according to market projections.

Onshore fuel oil inventories at Singapore fell sharply to more than two-year lows of 17.456mn bl in the week to 11 May, according to Enterprise Singapore data, although they recovered to 21.106mn bl in the week to 25 May. Blending of on-specification LSFO is also likely unviable with the current steep backwardation and lack of blending components, said traders.

Looking ahead

It is yet difficult to ascertain when the tightness in LSFO markets will ease, although finished-grade LSFO supplies could increase as northeast Asian refineries return from turnarounds, said market participants.

They are unsure how the influx of Russian high-sulphur components will be absorbed, although blending finished HSFO product could be challenging because of factors like high viscosity. Some reverse arbitrage flows could happen with weak Singapore prices, although 380cst HSFO east-west spreads will need to widen first, said a trader. Spreads for July were around parity to $1.50/t at the close of online trading on 1 June.

HSFO utility demand for cooling purposes, which typically rises in south Asia, Saudi Arabia and Kuwait during their summer, could lend some support. Pakistan's state-owned marketer PSO is still seeking 195,000t of HSFO and 100,000t of LSFO each for first and second-half July delivery, higher than its usual requirements of 130,000t of HSFO and 50,000t of LSFO for each half-month. But it remains to be seen how many cargoes it will buy. Pakistan's meteorological department forecasts the monsoon to begin in the last week of June, which could also reduce HSFO consumption.