Ukraine's sunflower seed (SFS) exports have increased sharply since March following the Russian invasion that resulted in disruption to the country's seed crushing and sunflower oil (SFO) exports, but a further increase is in question because of cooling demand and falling prices.

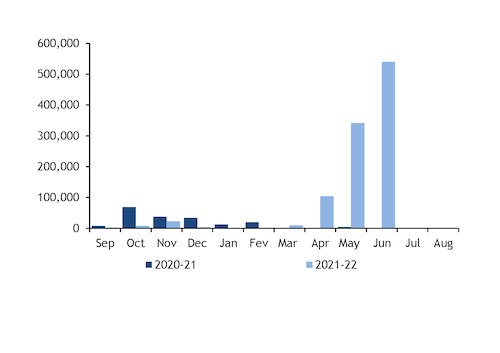

Ukraine has exported more than 1mn t of SFS since the start of the 2021-22 marketing season in September 2021, compared with only 190,000t over the same period last year, with exports in March-June — amid the blockade of Ukraine's Black Sea ports — accounting for 90pc of the volume, according to customs data (see chart). This was almost in line with 1996-97, when Ukraine's SFS exports reached a record 1.1mn t, according to the US Department of Agriculture (USDA).

The sharp rise was driven by higher export profitability of SFS relative to other crops owing to high prices, as well as strong import demand. Prices for Ukrainian SFS stood at above $900/t on a dap Constanta and cif Marmara basis in late March, compared with just $250-260/t heard for corn on a dap Izov basis, which made SFS more attractive for exports, given rising transportation costs and complicated logistics.

SFS exports were also supported by falling domestic demand and a simultaneous increase in import demand, as SFO supplies from Ukraine — the world's largest SFO exporter — were cut off from the global market because of the seaport blockade. As a result, Romania and Bulgaria — the EU's largest SFS exporters — as well as Turkey ramped up SFS imports from Ukraine, with most EU countries also increasing their purchases but to a lesser extent.

This came despite Ukraine's export tax on SFS shipments — which the country introduced in 1999 to support the domestic crushing industry and is still in place. Ukrainian SFS shipments are currently subject to a 10pc export tax when supplied globally, and a 3.6pc tax when exported to the EU within a 100,000t quota, with a maximum additional tax rate of 6.4pc for volumes exceeding the quota.

Clouded demand and price prospects for upcoming months

But Ukrainian SFS prices were not able to resist large supply availability domestically because of disrupted inland crushing, as well as weakening demand from major buyers, with prices on a dap Bulgaria basis decreasing to $580/t in early July from $795/t on 1 April.

After supply shocks in March-April, SFO availability in the EU has increased, following market adjustments. EU downstream operators reformulated their product recipes to replace SFO with rapeseed oil where possible, with some operators importing Ukrainian SFS to crush them locally. In addition, Ukraine increased its SFO exports to the block by rail and truck.

And EU crushers switching to new-crop rapeseed processing in July leaves less space for SFS, resulting in a significant drop of import demand for Ukrainian product and driving down prices further. The Bulgarian market is overloaded with SFS and many cancellations of previous purchases of Ukrainian SFS are heard from Bulgarian, as well as Romanian buyers, traders said.

Meanwhile, logistics costs in Ukraine continue to increase, jumping by two and a half times since March. Rail tariffs doubled in June, while delivery by trucks now cost a minimum of €3/km, compared with €1.20-1.30/km a few months ago. Coupled with lower prices, this has reduced the profitability of SFS shipments in favour of rapeseed, for which prices are higher.

Given that Ukrainian farmers sitting on large old-crop SFS stocks — about 3.5mn t on 1 July, according to approximate calculations — and new-crop SFS arrival in September-October in both Ukraine and the EU, prospects for middle-term demand, as well as prices for Ukrainian SFS look gloomy, if inland crushing and sea exports do not resume at full capacity.

Ukraine's SFS production is projected at about 10mn t by the agriculture ministry, meaning that overall 2022-23 SFS supply could reach up to 11mn-13mn t. Meanwhile, EU SFS production may hit a record high in the new season at 11.14mn t, compared with 10.33mn t in 2021-22, owing to higher acreages, under European Commission estimates.

In light of the bumper SFS supply at the start of the 2022-23 marketing season and the possibility of a prolonged crushing season for rapeseed in Ukraine amid blocked sea exports, traders expect prices for Ukrainian new-crop SFS may drop further, with October-delivery cargo heard to have already been traded at $460/t dap Bulgaria.