Europe's majors are looking to make the switch from gas but are faced with the prospect of logistical and infrastructure challenges, writes Emma Reiss

The yawning gap between natural gas and other energy commodity prices has industrial consumers of gas across Europe hunting for alternatives. And for metals, ceramics, glass and asphalt producers, LPG is an obvious contender.

LPG has many similarities with natural gas but requires different infrastructure and equipment, making fast switches unlikely. Lead times to make the switch have ballooned from about six weeks to six months, partly because of greater demand as well as high steel costs and limited labour. Yet industrial firms are still making the move. German chemical producer Evonik was one of the first to announce it was swapping gas for LPG for power generation at its Marl plant in August. Other large firms, including major metals producers, have increasingly stepped forward to lodge their interest with regional suppliers, industry participants say.

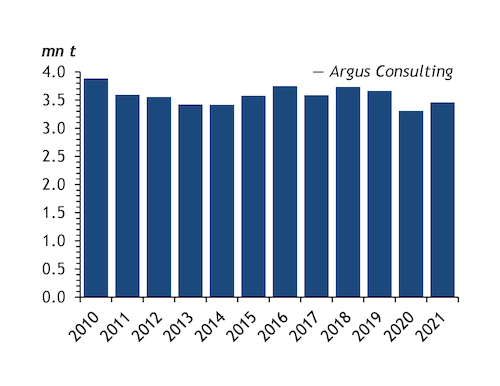

The potential boost to European LPG demand from a widespread industrial switch from gas is substantial. Individual firms in the sector are looking to buy as much as 40,000-50,000 t/yr, according to distributors. Natural gas supply security is also a driving force behind the interest in LPG. Poland has established a legal mechanism to suspend gas supplies to industrial users in emergency circumstances. The country is experiencing "an unprecedented shift towards LPG in the industry sector", domestic LPG association POGP director Bartosz Kwiatkowski says. "We expect that LPG consumption in the industrial sector may even double in 2022."

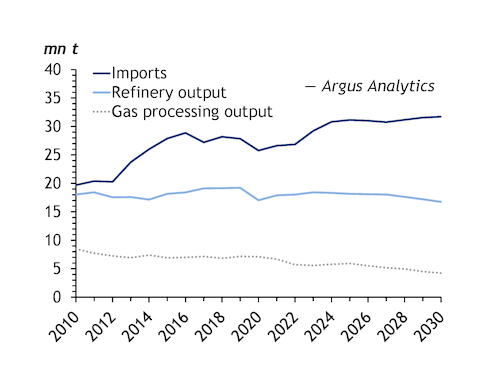

This would represent almost 180,000t of additional demand in Poland. Industrial sector demand in Europe was about 3.4mn t last year. If this was to grow by a fifth, let alone doubling, the problem would shift to LPG supplies rather than natural gas. High gas prices have slashed European LPG output, from the upstream North Sea fields and refineries, by 20-30pc. The region is already dependent on imports and is becoming more so — net imports are due to reach almost 12.5mn t this year and maybe 15mn t in 2023, from 11mn t in 2021 and just 7mn t in 2010.

Global supply is sufficient to meet the increase in demand. US natural gas liquids production continues to break new ground and the country's stocks are well above levels seen a year ago prior to winter. Import demand in Asia-Pacific is also weak as the petrochemical sector struggles in the face of a faltering global economy. But Europe's ability to get US LPG imports to inland customers is already strained.

Europe traditionally got most of its LPG from refineries scattered across the region, casting a wide net of distribution. Most of its imports now arrive on very large gas carriers (VLGC) from the US, and these mostly feed into a few terminals at the Amsterdam-Rotterdam-Antwerp hub — the larger Antwerp Gas Terminal (AGT) and Flushing terminals, and the smaller Antwerp Terminal and Processing (ATPC) facility. There are other major storage units but these are operated by petrochemical companies with no distribution facilities.

Terminal velocity

Flushing and AGT can accept VLGCs and distribute LPG downstream on smaller barges, railcars and trucks, while ATPC can take smaller vessels and send volumes inland by rail. The terminals took in 2.21mn t last year, up from 1.85mn t in 2020, Vortexa data show. But the capacity to bring in more imports and distribute these is limited. Other terminals can absorb more, including distributor SHV's Karlshamn terminal in Sweden, which can take VLGCs. Brunsbuttel in Germany can take midsized gas carriers. But the tonnes still need to move inland through a logistics network strained by Covid-19, low Rhine river levels and sanctions on Russia. Transport infrastructure is limited by capacity that cannot be expanded quickly.

These challenges mean some LPG distributors are uncomfortable taking on more large customers, despite the lure of sales. The focus is on ensuring their customers are supplied in winter, particularly in the event of a lengthy cold snap.