Overseas demand for ethane is rising, as the cost-effective feedstock is trickling into US terminals' plans, writes Abby Downing-Beaver

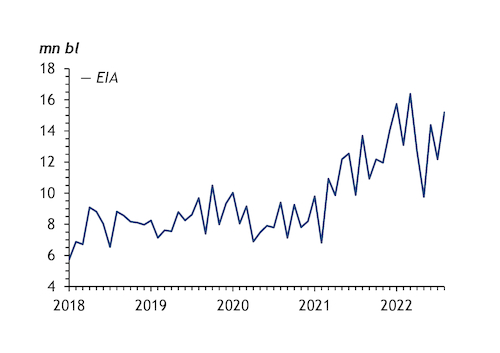

US midstream companies have announced plans to expand ethane exports as overseas interest in the cheaper petrochemical feedstock grows. And firming upstream production in the Permian basin is also driving further investment in gas processing and natural gas liquids (NGL) transportation infrastructure.

Houston-based Enterprise Products Partners, which plans to open a new ethane export terminal in 2025, says it is in talks with potential petrochemical customers in Asia-Pacific for supplies from the facility. The company estimates it exported 5mn-7mn bl/month (282,000-395,000 t/month) of ethane from its 200,000 b/d Morgan's Point terminal in Texas in the third quarter. Its overall seaborne exports of ethane and LPG increased to 747,000 b/d in July-September from 664,000 b/d a year earlier.

Dallas-based peer Energy Transfer reported record exports of ethane from its 700,000 b/d Nederland and 260,000 b/d Marcus Hook terminals on the US Gulf and east coasts, respectively. The company shipped 29mn bl (1.6mn t) of ethane from Nederland in January-September, which it expects to reach 40mn bl by the end of this year compared with about 26mn bl in 2021. Energy Transfer plans to raise this to 60mn bl from the terminal in 2023 on expanding demand for US exports, and is also considering adding ethane export capacity at one of the terminals.

Ethane is the most cost-effective feedstock for US ethylene plants compared with propane, butane and naphtha, which are more closely correlated to global crude prices, while ethane tracks domestic natural gas levels. Ethane cracker margins averaged a narrow $17.66/t in the third quarter, but the other feedstocks' margins were negative, Argus data show. Its relatively low cost has made ethane the most commonly used ethylene feedstock in the US, with domestic demand at about 1.9mn b/d, Enterprise says. But its attraction to overseas crackers is rising as they struggle with weaker margins this year utilising naphtha and LPG.

In addition to rising demand for ethane from petrochemical producers in Asia-Pacific, some US supply is also being used by the region's importers as a replacement for more costly LNG, Enterprise chief executive Jim Teague says.

Houston-based Targa Resources plans to continue expanding its gas processing and takeaway capacities in the Permian basin after it posted record NGL fractionated output and pipeline shipments in the third quarter. The company's processed NGL yields rose to 742,100 b/d from 662,000 b/d a year earlier, while its deliveries climbed to nearly 500,000 b/d from 416,500 b/d.

Cat power

Targa has announced it will build a new 275mn ft³/d (2.8bn m³/yr) gas processing plant in the Delaware basin, part of the wider Permian, called Wildcat II, which is scheduled to come on line in the first quarter of 2024. And it will develop the 400,000 b/d Daytona NGL pipeline to take supplies from the Permian to its existing 550,000 b/d Grand Prix line in north Texas, where NGLs are sent to the firm's complex at Mont Belvieu on the Gulf coast. The Daytona pipeline, which will be part of the existing 75:25 Grand Prix joint venture with Blackstone Energy Partners, is expected to be operational by the end of 2024.

Energy Transfer and Enterprise also raised their fractionated NGL yields in the third quarter because of rising Permian upstream output, but neither are moving ahead with further expansions at this time. Energy Transfer has filed permits for a new petrochemical plant near Nederland, Texas, but it is far from making a final investment decision. Enterprise has postponed its 275,000 b/d expansion of the 250,000 b/d Shin Oak pipeline, which carries raw NGLs from the Permian to Mont Belvieu, until the first half of 2025 from the first half of 2024 on less immediate demand for capacity.

| US midstream operators' 3Q results | ||

| 3Q | ±% 3Q21 | |

| Energy Transfer | ||

| Profit $bn | 1.01 | 58 |

| NGL operating margin $bn | 1.03 | 13 |

| Fractionated NGL output mn b/d | 0.94 | 6 |

| NGL pipeline shipments mn b/d | 1.89 | 5 |

| NGL exports mn b/d | 1.29 | 4 |

| Enterprise | ||

| Profit $bn | 1.39 | 18 |

| NGL operating margin $bn | 1.30 | 27 |

| Fractionated NGL output mn b/d | 1.37 | 10 |

| NGL pipeline shipments mn b/d | 3.70 | 6 |

| NGL exports mn b/d | 0.75 | 12 |

| Targa | ||

| Profit $bn | 0.19 | 6 |

| NGL operating margin $bn | 0.34 | 21 |

| Fractionated NGL output mn b/d | 0.74 | 12 |

| NGL pipeline shipments mn b/d | 0.50 | 20 |

| NGL exports mn b/d | 0.28 | -6 |