Low LPG refinery output and a restriction on imports have seen railcar demand decline, leading to port congestion and long wait times, writes Waldemar Jaszczyk

Demand for LPG railcars from the Amsterdam-Rotterdam-Antwerp (ARA) hub spiked in 2022 as refinery supply shortages and the war in Ukraine upended railway logistics.

Europe's LPG import bottleneck and declining refinery output, together with a heavy German railway maintenance schedule, significantly reduced the number of railcar roundtrips last year. Record-high natural gas prices last year forced refineries to consume the LPG they produce in place of gas, reducing regional availability by about 20-30pc. This deepened Europe's dependency on seaborne imports into a limited number of terminals at the ARA hub, making railcar journeys longer. The resulting congestion at ports significantly strained transport infrastructure, with railcars often waiting several days to pick up product.

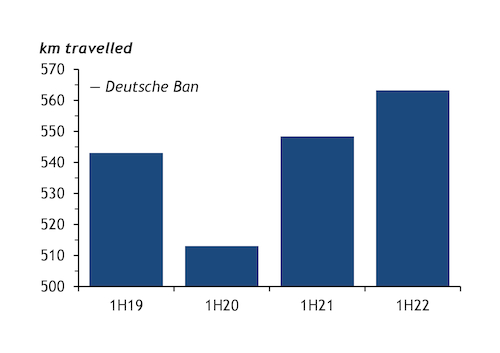

The problem was exacerbated by European logistics, after state-owned railway operators including Germany's Deutsche Bahn undertook substantial maintenance that pared network availability. The works cut the number of roundtrips a railcar typically makes in the country from 2-3 to one, which further strengthened demand, according to German logistics provider VTG's LPG manager, Clemens Rauhaus.

The war in Ukraine also spurred higher demand for railcars from importers in central eastern Europe, as the region sought to redirect supply routes away from Russia, adding pressure to northwest European logistics. No direct EU sanctions have been introduced on Russian LPG exports, but the flow of eastern product into countries such as Poland has been disrupted since the conflict began. Many firms have self-sanctioned by refusing to buy Russian LPG. This motivated importers to look to alternative supply routes, the only real option being the ARA hub, compounding congestion there. The invasion also brought an abrupt halt to LPG arrivals from Ukraine's main suppliers — Russia, Kazakhstan and Belarus — forcing the country's importers to secure a significant number of 1,435mm standard-gauge railcars in order to import product from its European neighbours to the northwest.

Railway transport firms struggled to meet the surge in demand, leading to longer waiting times for LPG railcars and higher rates. The sector mobilised railcars from all over Europe at short notice, but it could not easily hasten the construction of new units as this requires long-term planning and investment, Rahaus says.

The industry also faced mounting construction and maintenance costs, as the price of components, labour and energy increased last year. As a result, the waiting time to develop a new LPG railcar rose to 12 months and the purchase price by 20-30pc, railcar leasing company GATX Rail Europe says.

Railcar companies were knocking at LPG suppliers' doors only a year ago, but in the past several months the situation has reversed, Polish distributor Gaspol chief executive Ewa Gawrys-Osinska says. The company received new railcars from GATX in November, eight months after it decided to boycott Russian LPG.

Back on track

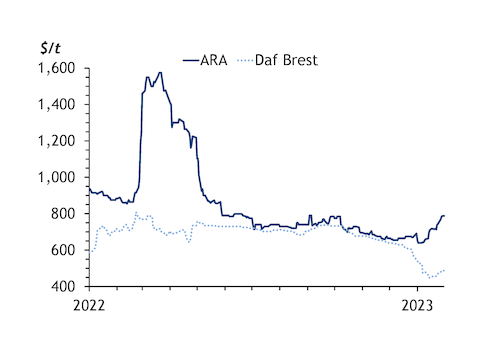

But the surge in demand for railcars last year may have been short-lived, as mild weather in the heating season this winter and abundant downstream inventories have lessened the need for ARA shipments. Railcar prices had hovered below $700/t fca ARA since 1 November before surging to $788/t in the second half of last month. Pricing has edged up, but this has been fuelled by large cargo price gains, and values still remain more than $100/t lower than a year earlier.

Many consumers stocked up on supply ahead of winter, and storage facilities in Germany and Belgium are still full, despite it being peak winter. It would take more than a few weeks of very cold weather for them to be depleted enough to warrant fresh railcar demand, market participants say. And this is without factoring the German government's requirement for consumers to reduce energy consumption.