Stronger domestic supplies and weaker demand are contributing to a shift in focus as consumers make the move to piped natural gas

China's wholesale LPG prices have started to ease from six-month highs this month as supplies from refineries and import terminals grew on healthy wholesale margins. Domestic demand has also waned following the recent price rally as consumers switch to piped natural gas and because of restrictions on LPG truck deliveries in the run up to the Asian Games.

The Pearl River Delta index, covering import terminals in south China that serve the wholesale market, increased by nearly two-thirds to 5,826 yuan/t ($798.51/t) between 7 July and 8 September, partly supported by rising crude and bolstered by short supply. Prices then fell by 5.5pc to Yn5,508/t on 12 September, as sentiment shifted on stronger domestic supplies and weakening demand.

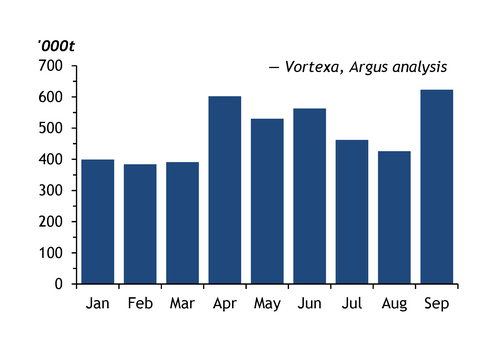

Imports to wholesale market terminals in south China are on course to increase by 46pc from August to 623,000t in September, according to oil analytics firm Vortexa. This is mainly because margins have improved for suppliers, many of whom have benefited from securing term supplies on a Saudi Aramco contract price basis at low prices at the same time as international and domestic prices have increased.

Some Chinese refineries' LPG output has risen this month as they switched to consuming natural gas as a fuel and naphtha as a feedstock at their integrated ethylene steam crackers. A refinery in Huizhou raised LPG supplies by about 20,000t this month, another in Fujian resumed sales of about 10,000 t/month after several months away from the market, and another in Shanghai raised its offering by about 10,000 t/month. A propane dehydrogenation (PDH) plant in Fujian has also increased supplies to the wholesale market after shutting down in mid-August owing to weak production margins, while a new PDH facility in Maoming, Guangdong, expected to start up soon also planned to sell LPG by truck this month.

Domestic demand has simultaneously dropped as more consumers turned back to natural gas as it became more competitive than LPG. In south China, LPG wholesale prices rose above Yn5,000/t from mid-August, while trucked LNG prices in the region fell below Yn4,500/t. This led to some industrial users turning back to LNG, and commercial and residential customers choosing piped natural gas if available, a south China-based LPG trader says. About 418,000 cylinder users in Shenzen city switched to natural gas in the first half of this year, according to Shenzhen Gas.

Waiting game

The forthcoming Asian Games in Hangzhou, Zhejiang province, from 23 September to 8 October, has also weighed on demand as the transportation of dangerous goods on highways, including LPG trucks, has been suspended since 16 September until 9 October. The games will coincide with China's National Day holiday over 29 September-6 October. Two PDH plants in Zhejiang — the 450,000 t/yr Sanyuan and Huahua 2 units in Shaoxing — were shut down this month because of disruption to truck deliveries, and are set to return once the suspension is lifted. And some refineries in the province have also limited their domestic sales during the event, redirecting LPG to export terminals to be loaded on to pressurised vessels to avoid inventory pressures, a Ningbo-based refiner says. Refineries in Ningbo include Sinopec Zhenhai's 460,000 b/d refinery and CNOOC Daxie's 280,000 b/d refinery.

The recent price rises surprised many local market participants given they took place over the summer off-season. This raised concern among some that prices could slide during winter, especially as many downstream residential and commercial users have switched to piped natural gas this year, an east China-based LPG trader says.