Canadian crude producers are fresh off a profitable year and upstream growth plans are in full swing as regulatory wins have kept the 590,000 b/d Trans Mountain Expansion (TMX) pipeline on track for commissioning later this quarter.

Profits for Canada's big four oil sands companies — Canadian Natural Resources (CNRL), Cenovus, Suncor and Imperial Oil — have fallen from the highs of 2022 when global commodity prices surged amid the Ukraine-Russia war, but producers are expected to close out another robust year as results are unveiled in the coming weeks, with even greater optimism for 2024.

The four firms made a combined C$18bn ($13bn) in profit over January-September 2023, a 33pc drop from the same period in 2022 but still historically high. This was up by 20pc from pre-pandemic 2019, and a further boost will be provided this year by the opening of TMX, which will help crude flow more freely and, importantly, to Canada's Pacific coast.

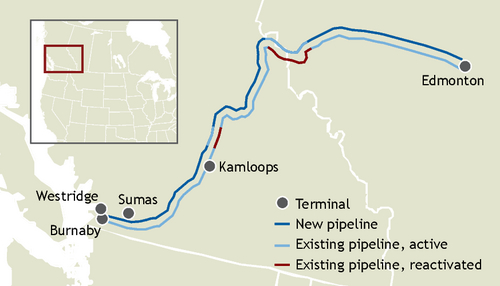

TMX will nearly triple the capacity of the existing 300,000 b/d Trans Mountain system, which links Edmonton, Alberta, with Burnaby, British Columbia. It will be the first Canadian pipeline in decades to offer meaningful access to international markets without crossing the US. It is now more certain that the line will be completed this year, possibly as early as the end of March, after the regulator on 12 January granted Trans Mountain permission to use a smaller diameter pipe in a short section along the route. Difficult terrain had threatened to delay the C$30.9bn project by up to 30 months, which would have been a major setback for Albertan crude producers as they push output beyond 4mn b/d for the first time.

Canada's oil sector saw an additional 370,000 b/d of pipeline egress coming into service in late 2021 in the form of midstream operator Enbridge's Line 3 project, which provided some relief. But crude shippers have in less than two years chewed through that capacity and find themselves short on pipeline export options yet again, and are turning to rail.

That pipeline scarcity is most evident in Enbridge rejecting nominations for its 3mn b/d Mainline system at an increasing rate in recent months, and in the price of key heavy sour crude benchmark Western Canadian Select (WCS), which serves as a bellwether for pipeline congestion out of Alberta. WCS at Hardisty, Alberta, sold at an average $22/bl below US benchmark WTI in the fourth quarter, wider than the $17.50/bl averaged during the first nine months. But producers' results for the quarter will still be positive, and the 2024 outlook appears rosier thanks to TMX.

Growth spurt

Suncor says TMX will help bring the WCS discount back to the mid-teens and boost its cash flow. For Cenovus, every dollar the WCS differential narrows stands to bring in C$80mn of extra cash. The company is investing in plans to grow its upstream production by 10pc by 2026. Suncor is also targeting more growth, after hitting 808,000 b/d of output in the fourth quarter — its second-highest quarterly output ever. Suncor's production is set to rise by 7pc this year, partly thanks to acquiring sole ownership of Alberta's 194,000 b/d Fort Hills mining project last year, and because of a full year's production from its Atlantic offshore Terra Nova project.

In typical oil sands fashion, rising investment by Suncor — up by C$1.1bn on last year to C$6.5bn— will go to initiatives with many years of growth in mind. Mining fleet upgrades at Fort Hills and the Base Mine, new coke drums at Base Plant's Upgrader 1, along with advancing the Syncrude Mildred Lake Extension project are among the firm's plans for significant cash. Imperial Oil meanwhile expects a combined 25,000 b/d more crude from its linchpin Kearl mining project and Cold Lake steam projects in 2024.