Brazilian farmers are delaying 2023-24 soybean crop sales amid concerns over unfavorable weather conditions and a month-long downward trend for oilseed prices.

Forward sales reached a little over 31pc of an estimated production of 149.4mn metric tonnes

(t) by the end of January, according to market participants' estimates.

That is an approximately one percentage point advancement for the month, or less than 500,000t/week. Market participants consider an ideal pace for this time of year to be 2mn-2.5mn t/week, as the five-year average of volumes sold by end-January is 48pc of expected output.

The El Nino weather phenomenon caused many problems for soybean crops, especially in Brazil's center-west — its main producing region — which suffered from a severe drought and extremely high temperatures in September-December.

Besides reducing total output from initial estimates, the adverse weather kept farmers occupied dealing with all its impacts and discouraged them from reaching more deals with potential buyers amid uncertain outlook.

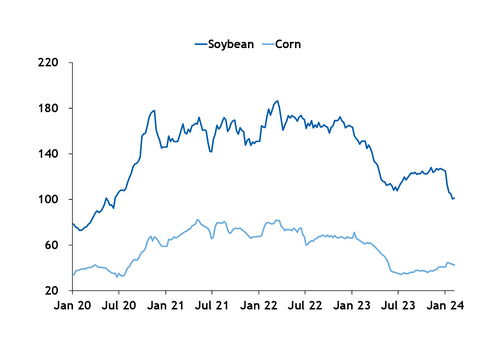

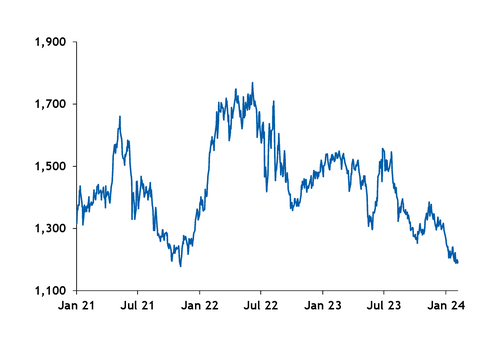

Producers were also further discouraged by fallin

g soybean prices this past month. The front-month contract of the Chicago Board of Trade (CBOT) fell

below 1,200¢/bu by 29 January

for the first time since November 2021, based on the current lack of demand for the oilseed and expectations of it remaining this way in the short term.

The average price of a 60kg bag of the oilseed in Rondonopolis and Sorriso cities, in central-western Mato Grosso state — Brazil's largest grain and oilseed producer — began February at R100.50/bag ($20.13/bag), down from R124.85/bag on 4 January. That is the lowest level since June 2020.

The 2022-23 soybean crop was around 28pc sold a year ago, with sales barely progressing throughout January 2023. Sales for the cycle — which produced a record 154.6mn t — were postponed during the first half of 2023 because producers expected prices to maintain an upward trend in January-May, when harvesting takes place.

But prices dropped throughout 2023 amid a global oversupply of soybeans. The front-month CBOT soybean contract ended the year at 1,293.50¢/bu from 1,487.25¢/bu on 3 January 2023. The decrease caused the remaining sales for the already-harvested 2022-23 crop and forward sales for the 2023-24 season to follow a sluggish pace.

Farmers seized occasional surges in prices, spikes in demand and periods when the US dollar appreciated against the Brazilian real to advance sales. But market participants note that producers are currently receiving payment from previously sold cargoes and are not in an immediate hurry to sell.

Market participants expect 2023-24 soybean crop sales to remain slow until the harvest surpasses its halfway mark, which usually happens between the last week of February and before March ends. That would also be when average yields should reach a consolidated level, eliminating the uncertainty that currently worries farmers.

The persistence of the drought at the Panama Canal may also help boost Brazilian soybean sales when harvesting is more advanced, according to market participant. US freight rates and the longer wait for the country's soybean shipments to be delivered may encourage China — a key importer — to prefer the Brazilian product instead when the Asian country eventually returns to the market to supply its needs, following a long period of absence.

But farmers will initially focus on negotiations for the domestic market, with the biodiesel blending mandate rising to 14pc from 12pc in March — increasing national demand for soybean oil — and the animal feed sector also expecting a boost this year.

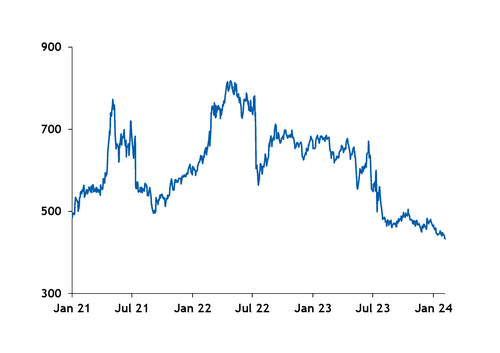

Winter corn sales also halted

Brazilian farmers sold approximately 15pc of the 88.1mn t expected for the 2023-24 winter corn crop by the end of last month, estimate market participants.

Forwards sales for the current season advanced only one percentage point from the progress registered by the end of December, maintaining a yearly advantage of two percentage points over 2022-23 sales at this time in 2023. That is behind a historical average of over 30pc by the end of January.

Sales occur sporadically, according to farmers' financial needs, daily gains posted by CBOT futures and exchange rate fluctuations between the US dollar and the Brazilian real.

The trend of slow-paced negotiations began in late 2022, when producers expected prices to maintain an upward trend and decided to wait for them to reach more economically favorable levels. But the opposite happened, as an oversupplied market in 2023 lowered prices throughout the year.

The front-month CBOT ended 2022 and began 2023 consistently above 600¢/bu, but reached only 448.21¢/bu on 31 January. The average price of a 60kg bag of the grain in Rondonopolis and Sorriso cities in Mato Grosso — which is also Brazil's biggest corn producer — fell to R40.70/bag in the beginning of last month from R66.16/bag in early January 2023.

Alongside low prices discouraging producers from selling, the lack of international demand for the Brazilian grain also explains the sluggish sales progress. Importers maintain an interest in attending their short-term needs and acquire cargoes scheduled for shipment between April and May.

The few corn sales taking place in the Brazilian market are for the 2023-24 summer corn crop and account for the domestic market, to supply the corn ethanol and animal feed sectors, according to market participants.