Ukrainian corn is struggling to compete against rival supplies from the US, Argentina and Brazil, as Ukraine's producers continue to hold back volumes in anticipation of higher prices in October-September.

Ukraine's share in the global corn market is likely to shrink, in part because its production and exports are forecast to drop in 2024-25. In contrast, the world's top three corn exporters — Argentina, Brazil and the US — are each projected to increase exports.

Since December, Ukraine's corn export pace has slowed, both because of lower volumes available, and because Ukraine's corn prices have struggled to compete against prices in Argentina, Brazil and the US.

Ukrainian exporters have at times struggled to take advantage of periods of rising prices among Ukraine's competitors. Ukrainian producers have typically reacted to any global price increases by raising their own price expectations, eroding sales.

When global prices decline, Ukraine's corn producers also opt to hold back their volumes, anticipating a rebound in prices at a later date. This often has resulted in farmers expecting higher prices during the northern hemisphere's spring or summer, when they anticipate potential support from risks to production in Argentina or Brazil.

That said, the global corn supply-demand balance in 2024-25 is forecast to be somewhat resilient to supply shortfalls. Global corn supply is forecast 7mn t above projections for global imports, according to the US Department of Agriculture (USDA), leaving some room for uncertainty around production in South America.

Ukraine exports to fall with output

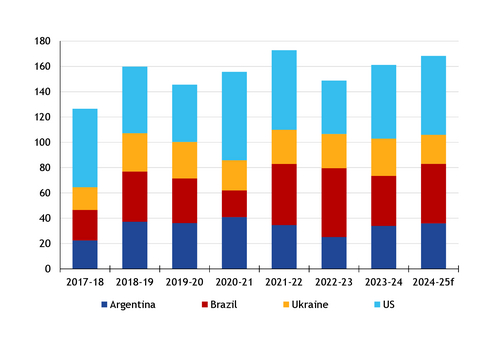

While global corn exports are forecast slightly lower on the year in 2024-25 at 191.4mn t, Argentina, Brazil and the US are projected to increase their combined corn exports to 145.2mn t in 2024-25, up from 131.7mn t a year earlier, according to the USDA.

US 2024-25 corn exports are forecast to rise by 4mn t to 62.2mn t, Argentina's corn exports are projected to increase by 2mn t to 36mn t and Brazil's exports are forecast to rise by 7.5mn t to 47mn t.

In contrast, Ukraine's exports are forecast to fall by 6.5mn t on the year to 23mn t as production falls by 6mn t to 26.5mn t, according to the USDA.

Losing ground in China

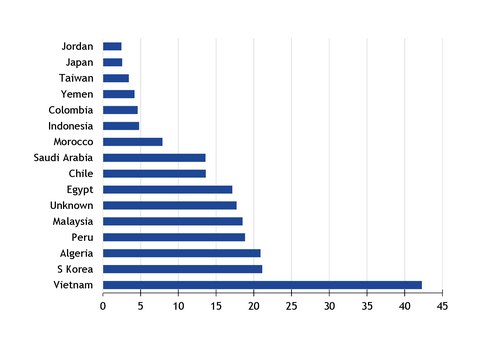

Both Brazil and the US could pose competition to Ukrainian corn for shipments to China this year. But China's overall demand is forecast sharply lower in 2024-25, leaving Ukraine to seek other outlets for its corn exports.

The US has steadily increased its share of Spain's corn import market in 2024-25. Total commitments of US corn to Spain since the start of the exporter's marketing year in September reached 942,600t as of 16 January — already higher than the total 2023-24 exports of around 711,000t, according to USDA and customs data.

Competing with Argentina

The main destination where Ukrainian corn competes with Argentinian product is Egypt.

While Argentina's 2024-25 crop has come under threat from unfavourable weather conditions, Egyptian buyers have also been booking corn from Brazil and the US. As a result, any further declines in Argentinian corn output, or less competitive prices, could still leave Egypt with multiple options to choose from.

And Ukrainian corn producers could raise their price expectations more, even if Argentina's corn output falls so short of forecasts as to boost global corn prices for an extended period of time.

Brazil crop coming in May

Brazil's new-crop corn is set to hit the global market in May, and the origin traditionally ships volumes to many of Ukraine's corn export destinations, including Egypt, China, Spain and Portugal. Provided Brazil's 2024-25 corn output is close to forecasts, Ukrainian exports could struggle to compete against the ample volumes leaving Brazilian ports.