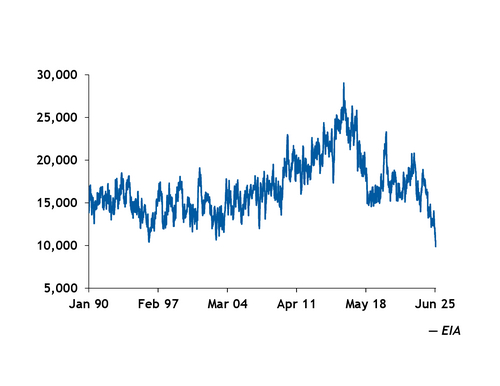

Residual fuel oil inventories in the US Gulf coast have fallen to their lowest level since January 1990 (see chart), with little sign of recovery in the second half of 2025 due to lower domestic output, limited by access to heavy feedstocks and a drop in imports.

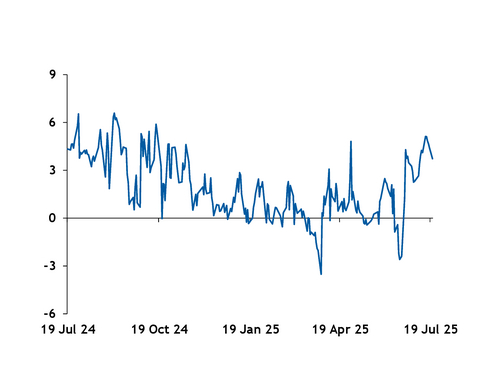

US Gulf coast stocks declined to just 9.7mn bl in the week ending 18 July, according to the US Energy Information Administration (EIA). A backwardation in the US Gulf coast high-sulphur fuel oil (HSFO) market has discouraged storage. On 14–15 July, prompt US Gulf coast HSFO futures traded at a $5.10/bl premium to second-month contracts, the widest spread since mid-October 2024 (see chart).

Feedstocks required to produce residual fuel oil have become difficult to source. The expiration of a US sanctions waiver in late May halted Chevron's imports of Venezuelan heavy crude, which had served as a component in resid-heavy blends. At the same time, more Canadian heavy crude, such as Western Canadian Select (WCS), is being diverted west to the Pacific via the 590,000 b/d Trans Mountain Expansion pipeline, reducing flows to US Gulf coast refiners.

US Gulf coast fuel oil production has recovered slightly, reaching 126,000 b/d in June, up 5pc year-on-year, according to EIA data. But that rebound remains limited. Average output over the first half of 2025 was 134,230 b/d, down 23pc from the same period in 2024, leaving inventories under pressure.

Imports have also declined. Mexico, the US Gulf coast's largest supplier of residual fuel oil, has cut shipments as Pemex's new 340,000 b/d Olmeca refinery upgrades more residual into middle distillates. Mexican fuel oil exports to the US Gulf coast fell to 2.2mn t (67,100 b/d) in the first seven months of 2025, down from 4.5mn t (136,400 b/d) over the same period last year, according to Vortexa. Total US Gulf coast fuel oil imports dropped to 7.8mn t (238,200 b/d), from 10.7mn t (326,800 b/d) a year earlier.

Meanwhile, Asia is seeing the opposite trend. Prompt Singapore HSFO futures flipped into rare contango in mid-July, trading $6.25/t below August contracts, the steepest prompt discount in five years, after a surge in supply from India, Iraq, and Bahrain. But Middle Eastern demand has been soft, as Egypt canceled fuel oil tenders following the resumption of Israeli gas exports and Saudi Arabia switched to burning crude. These surplus barrels are staying in Asia or heading to Europe, not to the US Gulf coast.