Australian beef exports rose by 22pc on the year to 139,012t in September because of a strong national cattle herd and robust international demand, taking total exports in January-September up to 1.13mn t.

Exports in January-September are up by 17pc compared with the same period in 2024 and 45pc higher than volumes recorded in January-September 2023, data from the Department of Agriculture, Fisheries and Forestry (DAFF) show. The uptrend will likely continue because drought conditions in the US will sustain demand for Australian lean beef and reduce American export volumes to key markets such as China, Japan and South Korea.

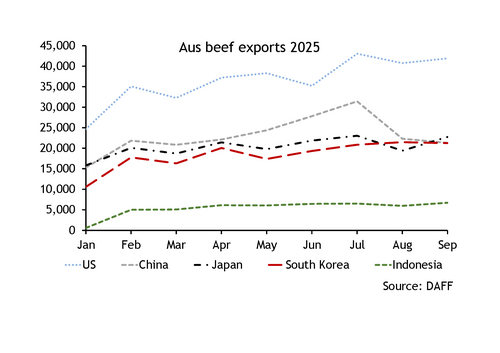

The US remained Australia's largest export destination for chilled and frozen beef in September at 41,918t, marking the third consecutive month of shipments above 40,000t. Continued drought conditions are amplifying strong US demand for lean beef, while tariffs on Brazilian beef of more than 76pc have made the product uneconomical and bolstered Australia's competitive position.

Exports to Japan rose by 17pc on the month in September and exceeded the 17,104t shipped in September 2024. In contrast, shipments to South Korea dipped slightly to 21,247t. The South Korean safeguard mechanism is likely to be triggered this month, potentially eroding competitiveness because of the higher tariff on Australian beef.

Exports to China fell to 21,320t in September, down by 32pc from the July peak. The decline came on the back of the triggering of the safeguard mechanism under the Australia-China Free Trade Agreement in late July, which replaced the zero-tariff rate with a 12pc tariff. Most of the reduction was in frozen grass-fed beef, while chilled volumes edged up slightly to 5,520t in September, independent firm Meat and Livestock Australia said.

Australian beef imports also grew consistently in other markets, including Canada, Dubai, Thailand, New Zealand, Malaysia and the UK, reflecting the broad-based strength of Australia's export performance.