Traders in Germany are offering B7 diesel for January at a €10-17/100l ($11.70-19.92/100l) premium to December prices, a record high for the period, as a result of an increase in Germany's CO2 levy and greenhouse gas (GHG) quota.

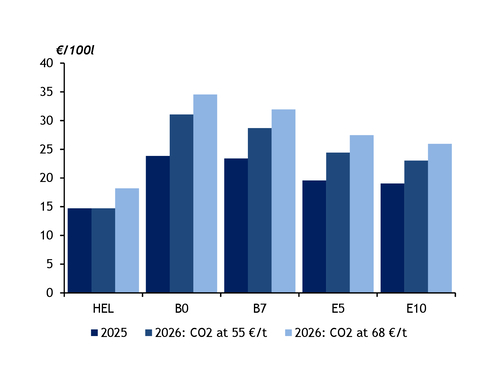

The offered premium is significantly higher than Argus' estimates of €8.50/100l for B7 diesel (see chart) for the period, likely because traders have priced in some market uncertainty as they were waiting for the transposition of the EU's Renewable Energy Directive (RED III) into national law. The vote by the German federal cabinet yesterday to implement RED III should provide some clarity on the legal framework for 2026, although some grey areas remain.

The GHG quota will rise to 12pc in 2026 from 10.6pc currently, requiring companies to submit more GHG certificates when selling fossil fuels. The vote confirmed market participants' expectation that advanced fuels can no longer be double-counted towards fulfilling the GHG quota. The removal of this double-counting provision could make blending biofuels more attractive and raise prices for both biofuels and GHG certificate transfers.

Market participants also expect a decline in biofuel imports from Asia-Pacific, as some imports from the region are unlikely to meet the criteria to generate European GHG certificates. This is because of the planned cancellation of the 'legitimate-expectations' rule, which currently protects buyers of illegitimate GHG certificates from having them revoked. Lower Asia-Pacific volumes will affect biofuels' availability in Europe and likely support prices.

Some uncertainty about the specific design of the sub-quota for renewable fuels of non-biological origin (RFNBOs), such as e-fuels and green hydrogen has also been lifted. A November draft included a penalty of around €120/GJ for non-compliance with the RFNBO sub-quota, instead of the previously proposed €70/GJ. The cabinet meeting on 10 December confirmed this higher penalty.

But some traders remain uncertain on which price to use for the CO2 levy next year, with some using a CO2 price of €68/t of CO2e for their calculations — the price set for companies unsuccessful in a new CO2 auction system for the levy.

The CO2 levy will transition next year from a fixed-price model, currently at €55/t of CO2e, to an auction system where the price of an emission allowance can fluctuate between €55/t and €65/t. One emission allowance corresponds to one tonne of CO2 equivalent. Companies that are unsuccessful in auctions can subsequently buy emission allowances at a fixed price of €68/t. The price could also be even higher in the secondary market for companies that do not participate in auctions.

But there is some uncertainty about the auction process. The auctions will not start until next summer and the specific CO2 costs will not be fully clear until then. Some traders are so planning additional cash reserves to cover any increases in payments.

This is also why some fuel suppliers are still holding back on announcing January prices because of these regulatory uncertainties, further increasing market uncertainty. But the cabinet decision yesterday could push traders to finalise their pricing for January.

Reported premiums for heating oil are between €2.50/100l and €4.50/100l, which is roughly in line with Argus' calculations.

| CO2 levy per 100l | € | |||

| Kosten pro t CO2 | B0/HE | B7 | E5 | E10 |

| 45 € | 12,04 | 11,21 | 10,43 | 10,07 |

| 55 € | 14,72 | 13,70 | 12,75 | 12,31 |

| 65 € | 17,40 | 16,19 | 15,07 | 14,55 |

| 68 € | 18,20 | 16,93 | 15,76 | 15,22 |

| B7 with 6.8l FAME; E5 with 4.8l ethanol and E10 with 9.66l ethanol | ||||

| GHG compliance costs per 100l | € | |||

| B0 | B7 | E5 | E10 | |

| 2025 | 9,13 | 9,70 | 6,83 | 6,74 |

| 2026 | 16,33 | 14,99 | 11,68 | 10,72 |

| Compliance with the GHG quota through blending and purchasing certificates, compliance with the RFNBO mandate through penalty | ||||