The approach of maximum recovery in the Permian and a rising focus on less liquids-rich acreage will limit ethane growth prospects, writes Joseph Barbour

US ethane production growth may slow this year because the largest gas processors are operating at near-maximum recovery rates, limiting scope to increase supply.

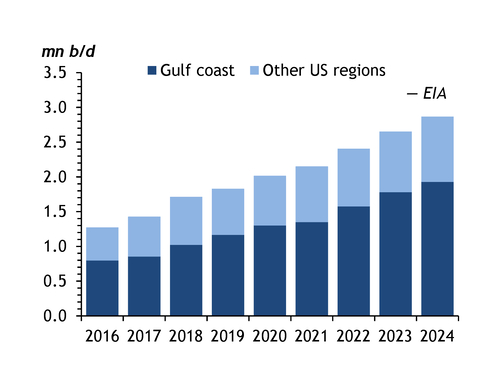

US ethane production, or "recovery", from gas processing surged to 2.87mn b/d (59mn t/yr) in 2024 from 1.27mn b/d in 2016, when the US began waterborne exports of ethane, data from government agency the EIA show, with ethane output growing by 20pc/yr in 2018 alone. But the pace of growth may be slowing.

The EIA forecasts ethane recovery to have averaged 3.06mn b/d last year and to rise to 3.15mn b/d in 2026, in its latest Short-Term Energy Outlook (STEO), annual gains of 6.6pc and 2.9pc, respectively. This means production growth has slowed consistently since 2022, when it stood at 12pc, dropping to 8.1pc in 2024. This is partly attributable to an easing in the expansion of natural gas production, with marketed output — excluding volumes from Alaska and the Gulf of Mexico — rising by only 0.5pc in 2024 from 2023, the slowest since the pandemic hit in 2020.

Gains in US ethane production have far outpaced those of natural gas over the past 10 years. Onshore gas output rose by 50pc from 2016 to 2024, while ethane yields more than doubled. But this trend may stall as the US gets closer to recovering near-maximum levels of ethane from the gas stream, giving less headroom for far higher growth. The robust increase in overall yields of natural gas liquids (NGLs) may also further slow relative to natural gas this year as a result of US producers targeting "drier" gas acreage — reservoirs with lower NGL content. "A lot of the growth we expect to see for crude and gas output is coming from the Haynesville formation [in Texas and Louisiana]… where it's a lot less liquids-rich," STEO contributor Joshua Eiermann told Argus.

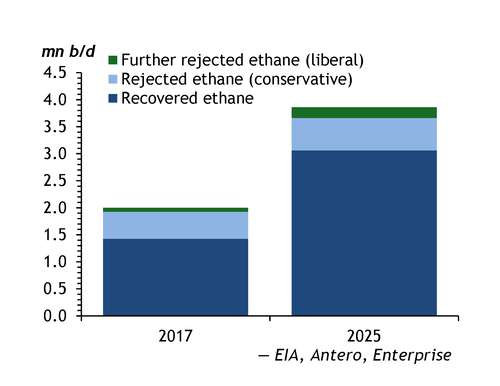

Ethane, which is a by-product of "wet" natural gas, is left in the gas stream — or "rejected" — if it is not economical to separate it for use as a petrochemical feedstock in ethylene steam crackers. The US is rejecting less ethane than it did in the past. It rejected 500,000-575,000 b/d in 2017, or at least a quarter of the total, while such volumes stood at 600,000-800,000 b/d in 2025 based on industry estimates, which equates to about 16-21pc of the total, based on EIA estimates.

Much of the US' NGL production growth in recent years has been driven by the Permian basin in Texas and New Mexico, which is close to full ethane recovery rates. Ethane export infrastructure expansions on the Gulf coast and growing NGL pipeline and storage capacities have encouraged higher Permian recovery. This means that midstream firms that operate from "well-to-water" for NGLs in the Gulf coast region, such as Enterprise Products and Energy Transfer, already recover nearly all the ethane they produce, market participants say.

Handling rejection

The US Gulf coast accounted for about 67pc of ethane recovery in 2024, whereas the east coast, where smaller volumes are exported, accounted for 13pc. Gas processors in the Marcellus and Utica shales in northeast US lack the ability to recover more ethane because of limited takeaway capacity. Marcellus-focused upstream producer Antero Resources in March 2025 estimated that 45pc of potentially recoverable ethane in the east coast's Appalachian production region, or approximately 273,000 b/d, is rejected into the gas stream.

In contrast, higher recovery from the Permian basin means ethane production growth in the region is set to more closely equate to that of natural gas. Overall, US NGL production is expected to continue outpacing natural gas growth this year. Enterprise forecasts NGL output to rise by 17pc between 2024 and 2030 compared with 14pc for all natural gas, although Permian production growth of both will be an equal 32pc. If the Permian continues to constitute an increasing share of US oil and gas output, growth in ethane production is likely to slow alongside natural gas.