An influx of Venezuelan oil could weigh on Canadian prices as the country sits on ample stocks of butane, writes Dennis Kovtun

The uncertain outlook for western Canadian butane prices at the Edmonton hub this year after a weak 2025 is being further clouded by recent events in Venezuela that could result in more of its heavy crude hitting the global market.

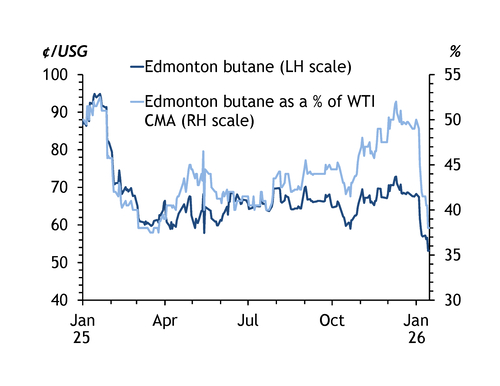

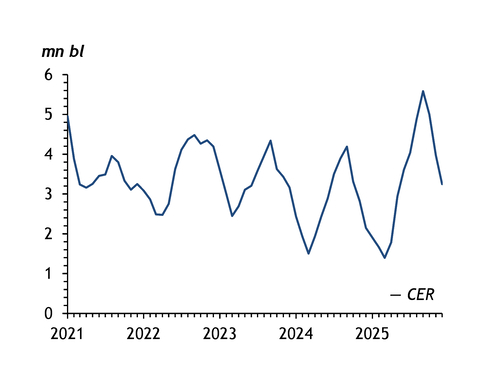

Edmonton butane prices averaged 67.60¢/USG last year, down from 82.26¢/USG in 2024 and compared with a five-year average of 88.25¢/USG. The outright drop came as the price declined as a percentage of the calendar month average of Nymex WTI crude (CMA WTI) to 43.7pc from 46.1pc in 2024. Growing supplies pressured values, with Canadian butane production rising to 216,200 b/d (7.3mn t/yr) in January-October compared with 203,400 b/d over the whole of 2024, data from Statistics Canadashow. Winter gasoline demand during the fourth quarter was also weaker. This meant butane inventories at Edmonton climbed above levels a year earlier in every month from May 2025, averaging 3.3mn bl (306,000t) in 2025 compared with 2.7mn bl in 2024, data from energy regulator the CER show.

Scant indications have emerged on the market this year to suggest Edmonton butane prices are about to recover. The price averaged 61.16¢/USG, or 44.6pc of CMA WTI, over 2-12 January, but prices have fallen to 57.19¢/USG from 68.25¢/USG, and to 41.5pc from 50pc, over the first two weeks of the month.

Butane exports are likely to have increased in 2025. Canada shipped an average 59,400 b/d by pipeline, rail and truck to the US over January-October, up from 56,100 b/d for the whole of 2024 and also higher than the five-year average of 52,300 b/d, the latest CER data show — the country currently exports predominantly propane from its seaborne terminals on the Pacific coast. But rising butane exports could not provide enough of a relief valve to offset climbing stocks.

The usual seasonal winter increase in butane prices has also not materialised, with the Edmonton value averaging 66.53¢/USG, or 46.8pc of CMA WTI, in the fourth quarter, down from 91.75¢/USG, or 54.5pc, a year earlier. And as the market enters 2026, it is being confronted by geopolitical volatility that is having complex effects on prices. This especially applies to one type of butane consumption in western Canada — as a diluent for heavy crude produced from the country's oil sands.

It is reasonable to expect Canadian oil takeaway capacity to rise by 270,000 b/d by 2030, but the potential of more Venezuelan oil hitting the world markets after the US captured President Nicolas Maduro makes more optimistic scenarios of it rising by as much as 820,000 b/d less likely, bank TD Securities analyst Menno Hulshof says. "When you think about consumption of diluent or condensate or butane — maybe that mutes things a little bit there as well," he says.

Heavy toll

At the same time, more Venezuelan crude production could theoretically provide tailwinds for the butane price should the US begin to export more condensate to Venezuela to be used as diluent for its heavy crude. This would make US condensate more expensive for Canadian importers using it as diluent. Butane could become more attractive, leading to modest growth in buying interest, Hulshof says — provided producers are able to swap condensate with butane. But the outlook on the heavy crude market has become more bearish owing to the possibility of Venezuelan crude playing a larger role and the still-limited egress for Canadian bitumen.

Canadian crude and condensate output is forecast to rise to a record 4.85mn b/d in 2026, according to Argus Consulting, but this is only an increase of 1.7pc. Predicting diluent trends, including use of butane, is currently very difficult, Hulshof says.

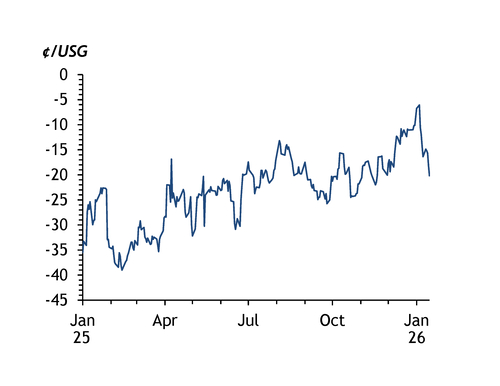

Edmonton price trends will also be significantly influenced by Mont Belvieu EPC butane assessments on the US Gulf coast. Edmonton values typically track Mont Belvieu levels, which have traded lower than in previous years so far this winter as a result of weaker gasoline blending demand and depressed gasoline futures.