Fuel benchmarks for the Sunshine State

Florida fuel traders finally have transparent postings for settling contracts, marking books and setting the rack. Argus has wanted to launch these for a long time, but 2024 was the year we finally got it done. Here’s how it happened!

Argus has been publishing prices for Tampa and Port Everglades for several years, but always as a “netback calculation”. We took the price at the US Gulf, added the cost of freight from Houston to Tampa or Port Ev, and then published. For a long time, this was a sensible way to value fuel in Florida – after all, almost all the fuel landing there had come from the US Gulf anyway. Occasionally, Florida prices would decouple from the US Gulf as fuel came in from Europe and elsewhere. But this decoupling was so rare that the netback approach was generally accepted as the best way of pricing these markets.

In 2023-24, things began to change. After years of stable pricing, companies selling fuel in Florida started to see prices dislocating more and more severely from the Gulf coast. They were purchasing fuel at a Gulf coast price, but saw their sales prices moving wildly higher or lower than the Gulf, depending on the state of other global markets. Part of that was a consequence of the shifts that took place in global trade flows amid sanctions on Russian fuel imports. But there was another, larger, factor at play: Jones Act freight. The US Jones Act stops companies from using regular vessels to move goods from one US port to another. Only a small fleet of vessels is legally permitted to make those voyages, so when demand for domestic shipping is high, the cost of chartering one of these vessels can grow sharply. That’s exactly what happened during the shale oil build-out of 2010-15, and it’s what has happened over the past year during the surge in biofuel production. Vessels that could be used to carry US Gulf fuel to Florida are instead carrying renewable diesel and SAF from the US Gulf to California, so the link between prices in the US Gulf and Florida is being broken more and more often.

So Florida fuel sellers were seeing a stark mismatch between their purchase price and their sales price, and feeling the pain of unmanaged price risk. That in turn raised demand for objective Florida price assessments, and market information that was previously ‘under wraps’ started to become more available to Argus reporters. We began to record bids, deals and offers for fuel “delivered at place” in Tampa and Port Everglades, and we started developing a methodology for assessing the price of these spot markets. As with all Argus prices, this meant an intensive period of consultation with market participants. Where was the bulk of the spot market liquidity? What constituted a ‘representative’ transaction? How could we be precise about the market we were assessing? Once we had these details confirmed, we took our planned methodology back to market participants for a final viewing. Stakeholders told us we were taking “the right approach” and that they were “very excited” – we knew we were on the right track!

So, what’s the methodology? The first question we had to answer was what types of transaction we were assessing. How far forward would they deliver? What size? And what quality? Florida fuel markets typically trade 10-20 days out. That means if you’re looking for some extra gasoline, diesel or jet for your tanks, you’re typically going to make a deal 10-20 days before you need it. And if you want a lot of fuel – perhaps a full medium-range tanker’s worth – you might even add a few days to that number. Our outreach determined that within a certain range, volume has relatively little impact on price. If you’re looking for less than 10,000 bl, you probably have to pay a bit extra on a per-gallon basis. And if you can take a full MR, you will probably pay a bit less. But between the two of those sizes, prices are pretty stable. Private docks, we discovered, also carry a premium, so the consensus was that a representative assessment should be for fuel delivering into ‘common docks’. Finally, quality was determined to be in line with other US markets, with the proviso that we should exclude ‘marine flash’ diesel and follow the Central Florida pipeline schedule for gasoline RVP shifts.

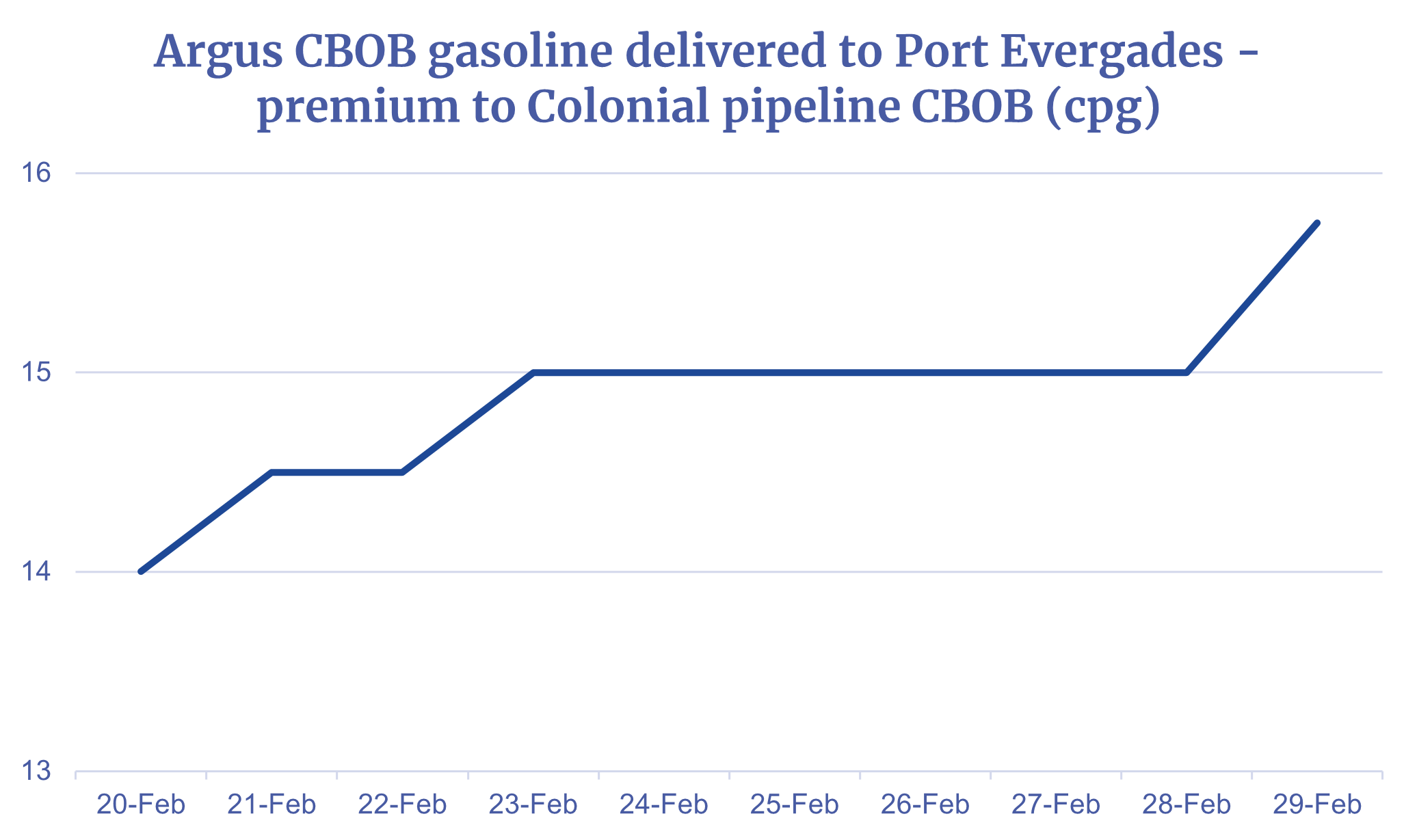

Finally, we had an outstanding question over how to calculate the ‘flat price’ for these markets. All the bids, offers and deals we were processing were concluded at a premium to our Colonial pipeline assessment (e.g. “Colonial cbob +15cpg”), so we needed a way of going from that to an outright price. After a great deal of consultation, we decided to establish a forward strip of Colonial pricing – a weighted average of forward Colonial cycles – since anything trading at a differential to “prompt Colonial” would ultimately price against the cycle that was trading prompt in 10-20 days, not today. We created a forward strip for the Colonial markets in cbob gasoline, ULSD and jet, and started adding our differential assessment to the relevant strip each day.

Effective today, 4 March, Argus is finally providing robust, responsive pricing for the key Florida markets of Tampa and Port Everglades. We hope these will save market participants a great deal of pain for a great many years to come!

Author Argus