One of the most persistent factors impacting the markets for bulk liquid petrochemicals since the Covid-19 pandemic has been elevated costs for moving product across the oceans.

Many commodities have seen a reversal of fortunes since the heady days of the post-pandemic rush to move and consume, but “easy chemicals” ocean freight rates have remained stubbornly high. The actual and potential implications of this are far reaching for an industry acutely reliant on deep-sea trade to clear and balance many of its regional markets. In this brief paper, we will examine the reasons why and the potential for continued strength in spot charter rates for aromatic petrochemical products, like benzene and paraxylene.

In the bulk shipping world, aromatic hydrocarbons such as BTX are included in a basket of products known as “easy chemicals.” They are chemicals that can be carried in so-called coated tanks, without the extreme temperature requirements of carrying petrochemical gas products such as ethylene, or the specialized conditions required by many specialty chemical products. Coated tanks are made of steel, and the inside is layered (coated) by a coating such as zinc silicate or epoxy. These tanks typically are offered in different sizes and configurations on specialized ocean-going chemical parcel tankers, which range from 5,000t to 50,000t deadweight. This category of liquid petrochemicals, therefore, occupies a special place in the shipping world, often providing opportunistic cargoes for less complex Medium Range (MR) clean petroleum product (CPP) vessels, or even some petrochemical gas carriers, as well as its staple position as cargo for chemical parcel tankers across the full spectrum of sizes. The fact that aromatic petrochemical products such as BTX are also some of the most widely traded commodity chemicals, with large volumes moving structurally and opportunistically, also adds to the appeal to shipowners and operators alike.

In the petrochemical markets themselves, ocean shipping is often a lifeline for product markets which have evolved large regional surpluses and deficits based on strategies, or more often circumstances. The emergence of lower-cost steam cracker feeds based on natural gas has robbed the Atlantic Basin benzene markets, for example, of millions of tons of byproduct output, leaving the derivative industry with an uncomfortable reliance on deep-sea benzene imports. Conversely, the international petrochemical market is a ready target for refiners looking to upgrade some of their surplus fuel products streams and build a value-added chemical business to underpin their growth ambitions in developing fuel markets. This task of balancing the world through trade has been made somewhat more difficult since the Covid-19 pandemic, which saw the cost of moving these chemical products more than double from its traditional levels.

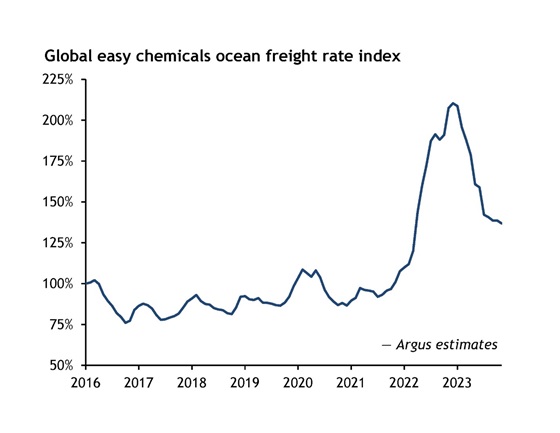

We are all well-acquainted with the disruption caused to many supply chains of the Covid-19 pandemic, which put many millions of families into lockdown and shut down large numbers of manufacturing businesses for a period. Fortunately, much of the supply chain trauma of that period has passed, but there are some markets where pre-pandemic conditions remain elusive. As the chart below illustrates, the global petrochemical industry had become accustomed to relatively stable, and barely appreciating freight rates in the years leading up to the pandemic. Larger and more sophisticated vessels, and greater all-around shipping efficiency had seen average global shipping rates for typical BTX parcel sizes remain remarkably flat in nominal terms. The global easy chemicals freight rate index shown below is a composite of nine separate trade lane combinations used to assess trends in global liquids ocean freight rates.

As is all too clear from the graphic, the cost of moving product more than doubled when compared to a representative baseline selected in January 2016, and more so when compared to the levels seen during the lockdown periods in 2020. As with many averages and indexes however, there were some regions of the world which saw a more subdued increase, while others saw their rates increase much more. As we will see later, this variance of fortunes has also been rather persistent.

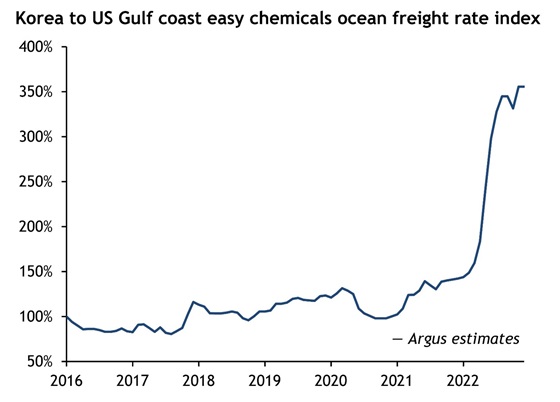

So, why did freight rates for arguably some of the most flexible of petrochemical products rise so dramatically during 2022? In many ways, the flexibility which arguably helped hold freight costs flat for so long was perhaps part of the reason behind the spike in rates. That flexibility comes in a variety of forms, both in how these products are made and priced, as well as how these products can be moved. Aromatic petrochemical products such as BTX have traditionally been produced as by-products or co-products of other petroleum and chemical products. As by-products, they can often have inelastic supply, which historically has meant that they have often been chosen as feedstocks for value-based products. As co-products, they have historically been able to provide a modest value upgrade over fuel products, but especially so during the period when many people were not commuting to their place of work, or taking international trips. In 2022, however, things dramatically changed, as many embarked on a phase of “revenge mobility” following the pandemic lockdowns, and the alternative value for these petrochemicals in the fuels pool shifted dramatically higher. This meant that regional shortfalls got exaggerated, and the need to import supplemental supply was therefore heightened. At the same time, the availability of tonnage to move these products was being diluted by greater call on crude and product carriers as European Union bans on Russian crude imports meant more ocean voyages and pending bans on product imports saw CPP vessels tied up on longer rotations. East of Suez saw the most vicious increases, with the routes which typically see MR type vessels vying for cargoes feeling the most immediate impacts. A typical Korea to the US Gulf coast rate as below, jumped to over 350pc of its baseline rate by the end of 2022.

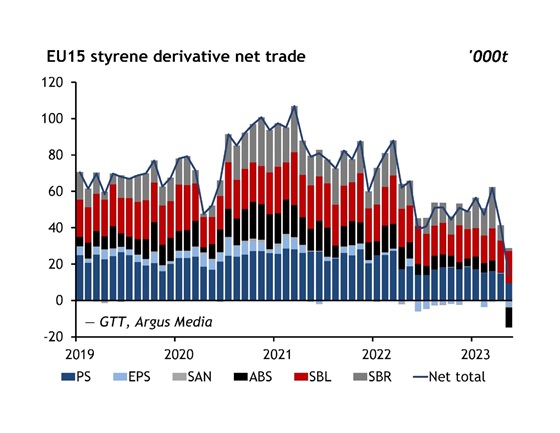

Given that both product market and freight market factors helped precipitate the spike in easy chemicals ocean freight rates, how have things developed since the pandemic, and what does the future hold? Markets react, and routinely the cure for high prices is high prices. Incentives built, and products started to move along routes, which were not as impacted by high rates. Precipitous falls in container freight rates meant that chemical intermediates and polymer products could move preferentially versus the petrochemical feeds and basic chemicals which would ordinarily make the trip. This cut into the need to make the monomers in the destination regions, which helped mitigate some of the need to move the liquid products. The cost pressures however remained, with US gasoline prices reaching all-time records and driving aromatic products and octane components on a quest to reach the US Gulf and US east coasts. This ironically meant that BTX combination shipments could compete for full MR charters and opened an opportunity for opportunistic benzene parcels to hitch a ride. Otherwise, traditional smaller parcel charters were simply still too expensive, even as prices in the receiving markets rose to try and catalyze some flow. As seen in the example below, this helped accelerate the demise of the export business for many Atlantic Basin chemical producers, as containerized products from east of Suez became sufficiently tempting and started to make some serious and likely irreversible headway.

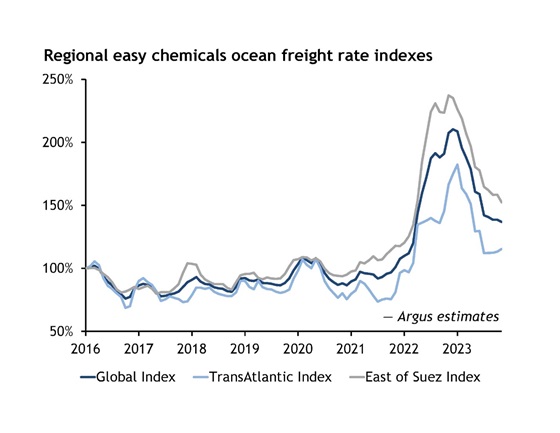

So, what has happened to rates in the meantime? The answer is a window into the future, as the easy chemicals market struggles to adapt primarily in the rapidly developing markets in Asia. The global market has become somewhat bifurcated as shown in the following chart, with rates east of the Suez Canal showing significant reluctance to fully correct. The Atlantic Basin has in contrast fared much better from an industry perspective, although as we have discussed, this perhaps masks far more structural damage to the derivative industries that the feedstocks support. The ocean freight market in the east is however still feeling the effects, as long-range vessels (LR2) are being retained solely in crude service, pulling more LR1 tonnage away from product shipments. This means that more MR tonnage continues to be tied up moving products, particularly those displaced by the European Union bans on Russian imports. This ripples into the market for large chemical parcel tankers and keeps a lid on the amount of spot tonnage prepared to go on-berth. Owners can still be somewhat picky on where they place their vessels, and the opportunistic nature of many of the BTX movements out of Asia is arguably working against it.

So then, what does the future hold? For the moment, shipowners in the bulk liquid arena are still the winners from an operating perspective as margins in the liquid chemicals sector are offsetting difficult conditions elsewhere in their portfolio, and rewarding capital invested in state-of-the-art vessels during the latest investment round. The real issue now revolves around what “state of the art” chemical parcel tankers might mean in the newest age of decarbonization. With much uncertainty around legislation and fuel selection, the investment rate in new tonnage is being held back, delaying and mitigating the potential market impacts of this period of higher-than-normal returns. Even with some clearer direction on what fuels and propulsion systems will meet tomorrow’s legislative framework, the cost of delivering and operating vessels will undoubtedly be increased. The petrochemical industry, at least for easy chemicals, has traditionally been able to bank on competitive ocean freight rates, which had increased little in real terms over decades of the industry’s evolution. Larger and more sophisticated vessels had been delivered at a pace sufficient to keep underlying rate inflation at relatively low levels. This has meant that the global balancing of many of these product markets using deep-sea trade has been somewhat encouraged, and now the price is being paid for this reliance as freight costs remain stubbornly above trend. With the lead time on new vessel construction projects being multiple years, even given some clearer direction around fuel choice, vessel supply is unlikely to be able to make a step change before 2027. In the meantime, other challenges conspire to further tighten market conditions. Europe needs to import large quantities of diesel on an ongoing basis to replace the barrels formerly imported from Russia. This is starting to make itself felt in the transatlantic CPP market, with knock-on implications for chemical tanker availability. Constraints on the passage of vessels of all kinds through the Panama Canal are reaching the point where owners are redirecting their ships, which further increases cost and voyage durations. Safe passage of vessels through the Gulf of Aden and the Red Sea approach to the Suez Canal is also under threat at a critical time for the shipping industry. The efficiency of the chemical tanker fleet is really being tested, and this will impact the cost to serve. Thus, the outlook for freight costs is going to continue to challenge the ability of these markets to balance themselves globally in a cost-effective manner. It also introduces additional supply risk for consuming operations being held to strict working capital targets, which appear to tighten year-on-year while the supply chain becomes laden with more risk. In light of all this, it is unlikely that freight rates will again see the absolute levels and consistency experienced prior to the Covid-19 pandemic. For modelling purposes, we are using an Easy Chemicals Global Freight Index value of around 130 to 150 percent (of January 2016 rates) for at least the next three years, and from 2027 on rates are still unlikely to go much below an Index value of around 120 percent. For the aromatics and derivatives industry, in particular known for enjoying a high rate of molecular tourism, this is likely to continue to have profound implications throughout the supply chain.

This article is created by Argus’ aromatics experts using data and insight taken from Argus’ benzene and toluene and xylenes services.

Author Simon Palmer