Carbon capture will be key to achieving the goals of the Paris climate agreement but it needs government support, BP says

The world's carbon emissions — which grew by 2pc last year, the fastest since 2011 — are unlikely to start falling in the coming years unless governments step up policy incentives, BP warns.

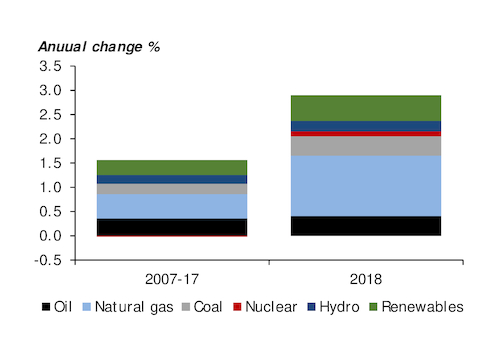

Global energy demand increased by 2.9pc last year, the highest growth since 2010, despite modest GDP growth and rising energy prices,BP says in its latest Statistical Review of World Energy. The rise was supported by an unusually high number of hot and cold days last year, it says. Around two-thirds of the growth came from China, the US and India. US energy consumption rose by 3.5pc, reversing a recent downward trend to record its fastest growth in 30 years.

"There is a growing mismatch between societal demands for action on climate change and the actual pace of progress, with energy demand and carbon emissions growing at their fastest rate for years," BP chief economist Spencer Dale says. "The world is on an unsustainable path." Last year's increase in CO2 emissions is "roughly equivalent to the carbon emissions associated with increasing the number of passenger cars on the planet by a third", he says.

Renewables remain the world's fastest-growing energy source, with generation rising by 15pc last year. Gas demand grew by over 5pc, its fastest in over 30 years, accounting for almost 45pc of the world's energy consumption growth and gaining share relative to coal and oil. In total, oil, gas and coal accounted for three-quarters of 2018 growth in energy demand, the highest share in five years.

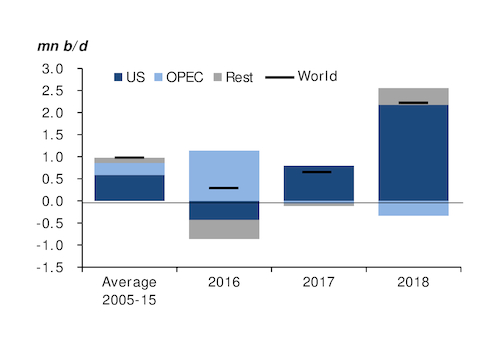

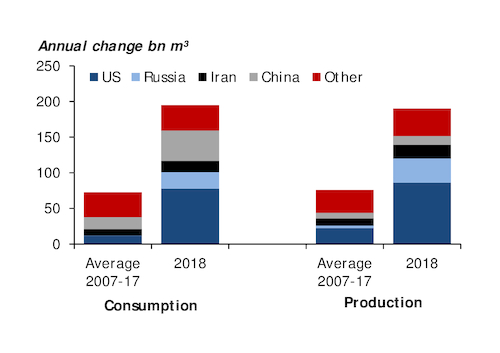

The US shale boom continues to reinforce the country's vaunted role as the world's new energy superpower. US oil production rose by 2.2mn b/d last year — the largest-ever annual increase by any country. And gas output in the country jumped by a record 86bn m³ in 2018.

"Year-to-year growth in non-fossil fuels, especially renewable energy, is largely determined by policy and technological factors, and so is typically less responsive to cyclical movements in energy growth than are oil, gas and coal," Dale says. "Strong growth in overall energy demand tends to be associated with a greater-than-normal contribution from hydrocarbons, as they expand to balance the system," he says.

BP warns that relying on renewables is unlikely to be sufficient to decarbonise the power sector. Global electricity demand grew by 3.7pc last year, accounting for about half of the increase in primary energy. China accounted for 45pc of the global growth in renewable power generation. But CO2 emissions from the power sector rose by 2.7pc last year, accounting for around half of the increase in the global total.

With greater power comes greater responsibility

"Electrification without decarbonising power is of little use," Dale says. "Renewable generation over the past three years would need to have grown more than twice as quickly than it actually did" for growth in power output to have been carbon neutral, he says. "Alternatively, the same outcome for carbon emissions could have been achieved by replacing around 10pc of coal in the power sector with natural gas," he says.

There has been "extraordinary growth" in the global renewable energy sector, as costs have fallen sharply and investments have increased, with "even greater investments" needed, Dale says. But he reiterates that most industry analyses expect to see a significant role for carbon capture, use and storage (CCUS) in meeting the goals of the 2015 Paris climate deal. Yet "we are seeing very little investment in CCUS… because we do not have the policy incentives to support it," Dale says.