Firmness in global petroleum coke prices has bolstered industrial demand for seaborne coal in Asia-Pacific, and the trend could expand to other regions should coal continue to hold competitiveness.

The two fuels typically compete for industrial users, mainly cement makers, but also in other sectors such as iron and steel.

But the fundamentals of each commodity have moved in opposite directions, working to coal's advantage. Coal supplies remain abundant amid high stocks, and as supply could not adjust to the weaker demand environment in the second quarter because of the Covid-19 slowdown.

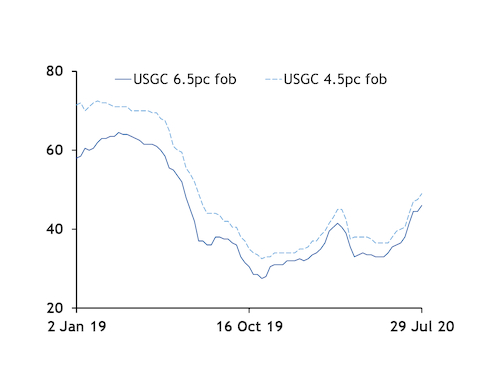

Conversely, coke availability has tightened significantly over the same period because of lower runs at refineries. Refineries in the US — the world's largest producer and exporter of coke — have been running at 70-75pc utilisation rates even after demand for crude and products started to gradually recover in the second quarter, and are expected to remain at similar levels for at least a few more months. This has significantly reduced spot coke availability in the market, lifting the US Gulf coast 6.5pc fob coke price to one-year highs.

One refiner estimates that there is 300,000-350,000t of coker feed out of the US market at current utilisation rates, which translates to a 15,000t/d decrease in coke production, or 450,000t less output per month — equivalent to nine or 10 standard cargoes. And as spot coke availability remains tight, refiners report buying interest at least four to five times higher than cargo availability. This is primarily demand from users with less flexibility to switch fuels.

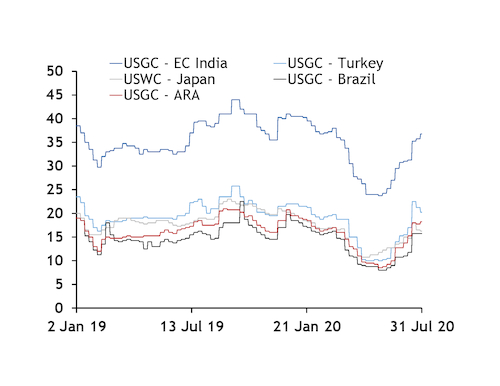

Further on the upside, a sharp rise in freight rates has supported delivered coke prices to key consuming regions, namely Asia-Pacific, the Mediterranean and Latin America.

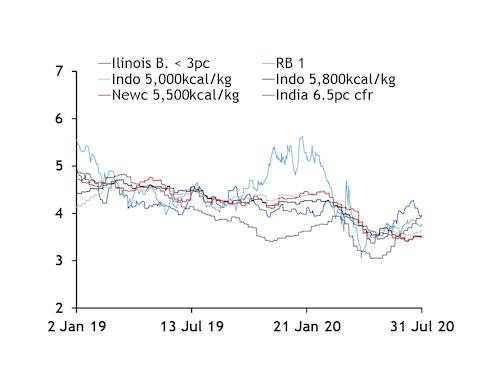

The delivered price for fuel-grade coke with 6.5pc sulphur content to India — the largest consumer of US coke — has switched to a premium to most coal origins, after adjusting for heat content, taxes and inland transportation costs (see chart). This has resulted in many cement makers switching to coal, as cement plants typically ask for a 10-20pc discount for coke to the coal price to be sufficiently attractive to bring in coke.

Cement sector coal imports into India took a hard blow in the first half of 2020, mostly as firms increased their use of coke, which held a wide discount to coal for most of November 2019-April 2020, when the cargoes would have been booked. India's cement sector coal imports fell by 53pc on the year in January-June, according to shipping data from GAC, a much larger drop than the 17pc slide in the power sector's coal intake. By comparison, cement sector coke imports dropped by just 14pc over the same period.

Coal set to gain market share

But coal is likely to gain some market share from coke in the remainder of this year in India and elsewhere in the Asia-Pacific region as the latter has lost competitiveness.

Key Indian cement firms have already ordered cargoes of Indonesian, South African, Australian and US coal to burn in kilns in the coming months, with some expecting coal's share in the fuel mix to reach 50pc or higher by the end of this month, from around 30pc at the beginning of July.

Industrial users elsewhere in the region, particularly in China, South Korea and Japan, could follow a similar trend as buyers have withdrawn from the seaborne coke market because of the spike in prices. Elsewhere, firmness in the Turkey 4.5pc cfr market has already encouraged cement makers to look for alternatives to seaborne coke, with some having secured some domestically produced coke and coke and coal from local distributors in recent weeks. The Turkey-delivered coke price has significantly narrowed its discount to the Turkey supra plus coal price, and stood at just 4pc last week, after adjusting for heat content.

Power and cement sector buyers in Latin America have also withdrawn from coke tenders over the past weeks and sought seaborne coal instead.

And this status quo may not change for a while. Global coal prices are unlikely to firm in the near term, as power sector demand has weakened because of the coronavirus curbs. In India, power demand is expected to drop by 5-6pc during the 2020-21 financial year, which ends in March 2021. Power consumption dropped by around 10pc in January-June as the country fought to limit the spread of the pandemic. And domestic coal stocks have also reached record highs, contributing to the weak outlook. That said, global coal markets could see some balancing into 2021, as major producers are cutting production as a response to weaker demand.

By contrast, coke fundamentals appear likely to hold unchanged in the near term, and many refiners and coke trading firms now believe tightness in the coke market could last until the year end, with demand for oil products expected to remain subdued despite efforts by countries to relax lockdown measures and encourage more travelling.

Although both commodities' trading performance will heavily depend on how fast economies recover from the pandemic slowdown in the second half of the year, coal may remain ahead of coke as long as prices for the latter do not drop to a steep discount to coal.