Oil and gas workers are key to the president's re-election, but energy policy setbacks and Covid-19 may have undermined their support, writes Chris Knight

President Donald Trump's pitch to voters for his first term was to bring the country back to a simpler era, with the idea to "Make America Great Again". That manifested itself as an energy policy that tried to recreate something akin to the 1960s, when vehicles were unburdened by fuel-economy targets, the US was the world's top oil producer and climate change was not a concern of federal government.

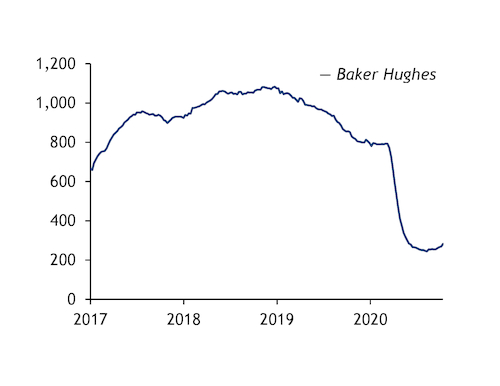

Trump has achieved those goals, more or less. But his administration's struggle for basic competency on everything from pipeline permitting to response to the Covid-19 pandemic has arguably left many in the oil sector worse off than when he took office nearly four years ago. The severe economic hit from Covid-19 has forced US oil and gas producers to lay off workers and sent the domestic rig count to its lowest in a decade. Keystone XL and other major oil and gas pipelines have been beset by delays caused by flawed federal decisions, while a planned expansion of offshore oil leasing is dead in the water. The administration's regulatory rollbacks have reinforced Democratic support for a "Green New Deal" that would put the oil sector on the path to irrelevance in a couple of decades.

Trump believes perceived slights against him justify additional time in office. "We should get a redo of four years," he says. That thinking seems to extend to getting another shot at achieving his energy vision, or as his campaign puts it, succinctly, "Continue Deregulatory Agenda for Energy Independence". That could mean expedited permitting of energy infrastructure, the beginning of oil exploration in the Arctic National Wildlife Refuge, new obstacles against renewable energy development and ever-deepening regulatory rollbacks.

Land rush

Trump's push since 2017 to open vast areas of federal land to oil and gas development has always come with a caveat. Producers have known that leases could face an entirely different regulatory environment before they have time to begin drilling, particularly when Democratic presidential candidate Joe Biden promised to ban new permitting on federal land. But a Trump win would offer assurances that leases will retain their value at least through to the end of 2024, bringing in a surge of investment while the land remains available.

A win would make the greatest difference in an upcoming lease sale that will offer up to 1.6mn acres (6,475km²) of the coastal plain of the Arctic National Wildlife Refuge, an area expected to support production of up to 560,000-880,000 b/d in two decades. The administration is also preparing to sell leases on 7mn acres of newly open tracts in the National Petroleum Reserve in Alaska, where US independent ConocoPhillips is considering making a final investment decision on its 160,000 b/d Willow project. Other likely lease sales would re-offer over 1mn acres in western states that a court scrapped this year because of procedural problems.

Trump made an uncharacteristic decision for his "energy dominance" agenda last month, when he signed orders prohibiting offshore leasing from 2022-32 in the eastern Gulf of Mexico, Florida, Georgia, the Carolinas and Virginia. That effectively torpedoed his own offshore energy plan and the industry's hopes for expansion, since there is scant interest in drilling outside those areas. It is no secret that political considerations drove Trump to sign the leasing moratorium. And it is unclear if he might reverse course in 2021, something he already suggests is a possibility. "If you want to have oil rigs out there, just let me know," Trump told supporters in Virginia last month. "I can change things very easily."

Building gas pipelines and approving oil leases on federal land requires the government to prepare exhaustive reviews under the 50-year-old National Environmental Policy Act. The law requires the government to take a "hard look" at the environmental effects of projects before issuing permits. Navigating those reviews has proved challenging to his administration, which has prized expediency over legally secure decisions, leading to repeated losses in court.

Trump earlier this year essentially declared a reset on how those reviews should proceed, attempting to limit their scope and to remove the need to consider if building pipelines or expanding oil leasing will exacerbate climate change or cause other "remote" effects. If re-elected, the administration will have to defend those changes in court, while also figuring out how to put pen to paper on environmental reviews under an entirely different regulatory regime.

Another top priority for Trump will be reissuing permits to build the long-delayed 830,000 b/d Keystone XL crude pipeline, which is not due to enter service until 2023, and continue operating the 530,000 b/d Dakota Access crude pipeline. The administration is also defending permits needed to finish construction of the $5.4bn Mountain Valley pipeline that would transport shale gas from West Virginia to Virginia, with a planned expansion to North Carolina.

Courting success

Trump in his first term focused on dismantling nearly every environmental rule issued under former US president Barack Obama, including fuel-economy targets, methane restrictions, power plant emission standards and offshore drilling safety rules. A second term would offer a chance at the true "deconstruction of the administrative state", as termed by former Trump adviser Steve Bannon. The government would be likely to continue shedding career staff, prodded on by recent hostile moves such as non-voluntary relocations. Environmental agency EPA is trying to impose long-lasting hurdles, under the veneer of "transparency" and cost-benefit analysis, to hinder the ability of a subsequent Democratic administration to issue tougher rules.

A second-term Trump would have an easier chance at success on his deregulatory agenda with the imminent rightward shift this month of the US Supreme Court to a 6-3 conservative majority, which is already likely to weigh in on issues such as the ability of states and cities to try to recover climate damages they attribute to oil majors. Trump would be further helped by more than 200 federal judges he appointed during his first term. They will be tasked with reviewing the legality of regulatory rollbacks, oil and gas leases, and pipeline permits.

State rights resistance

California, New York and other states have not given up on ambitious environmental goals, just because Trump believes climate change is a "hoax" or that global temperatures might start cooling. California and New Jersey are pursuing measures to require automakers within their borders to sell only zero-emission passenger vehicles by 2035. Nearly 30 states have approved laws requiring their local utilities to source a percentage of electricity supply from renewable energy, in the form of renewable portfolio standards. New York and New Jersey have successfully blocked major natural gas pipelines. The administration is fighting to undermine those initiatives or overrule state "vetoes" of infrastructure, but faces challenges because of US constitutional protection of states' rights.

Trump is relying heavily on oil and gas workers in the battleground states of Pennsylvania and Ohio, and even in an unexpectedly close contest in Republican stronghold Texas, to re-elect him out of economic self-interest. He has warned them, inaccurately, that Biden plans to ban hydraulic fracturing and bring an end to fossil fuels. That could garner support for Trump, but the attack loses potency if his mismanagement of Covid-19 has already cost some of those workers their jobs.