China's deepening health crisis is weighing on iron ore and base metal prices. Travel bans and an extension of the lunar new year holiday to contain the coronavirus virus are delaying the resumption of construction projects and manufacturing in China amid growing concerns over the impact on global economic growth.

At the same time, delays to the re-start of metal production after the holiday period because of logistical bottlenecks and travel restrictions on workers returning from their hometowns are expected to tighten supply and lift prices for some alloy and specialty metals.

China, the world's largest producer and consumer of most metals, has extended its holidays by three days to 2 February and expanded lock-down measures to contain the spread of the virus. The epicentre of the outbreak is Wuhan city in Hubei province.

Commodity and equity markets globally responded to the potential economic and logistical impact of an extended holiday period and the wider impact of the crisis on global growth.

Some analysts have drawn parallels with the Sars outbreak in 2003, arguing the impact of the coronavirus could even be greater given the relative size of the Chinese economy compared to when Sars broke out.

Bellwether copper, base metals fall

Prices for copper, the bellwether metal most sensitive to macroeconomic changes, extended losses today and have fallen more than 3pc since last Friday. The London Metal Exchange three-month copper price slumped by more than 8pc in the past seven days to $5,809/t on 27 January, down from $6,330/t on 16 January.

Elsewhere, aluminium alloy prices in Europe could come under pressure if demand from the Chinese manufacturing sector falls because of delayed post-holiday restarts.

"Without China, Europe nosedives," an executive at a European alloy producer said.

While the crisis is centred on Hubei province, most of the copper semi-fabricator and aluminium downstream factories are based in Guangdong province, so markets will keep a close watch on this region to see if manufacturing activities return.

Port closures, construction delays hit iron ore

The iron ore market is bracing itself for the impact of some port closures and potential delays to the restart of construction projects.

Chinese iron ore prices declined on expectations that the outbreak could delay the restart of construction projects in the spring.

The effect on immediate steel demand and output will be muted because most construction projects in China are idled. But Chinese steelmakers maintain operations over the holiday to keep crude steel output from dropping significantly. This sends steel inventories soaring to annual peaks in late February and early March each year.

And prolonged delays to construction projects would cause an even bigger build up in inventories in the first quarter, potentially weighing heavily on prices. Demand will be weaker for rebar and coil, and downstream will also be reduced, pushing back demand for finished steel products.

Furthermore, Jingtang port and Caofeidian port in Tangshan city are temporarily closed from 28 January, market participants said, with only vehicles carrying medical supplies allowed to enter and leave the ports, which means mills cannot export steel through the ports during the closure.

The ports have not issued official notices, nor said when they will reopen.

Supply shortfall fears lift minor metals

For certain minor metals markets, such as manganese, silicon and cobalt, the news is likely to trigger a price rise as supply could fall from China.

"Logistics is the issue… everyone relies on timely shipments from China," a trader said.

With the already persisting tightness in cobalt supply from China, the extension could reduce access to material further. Most producers in China are not offering material on the spot market until mid-month.

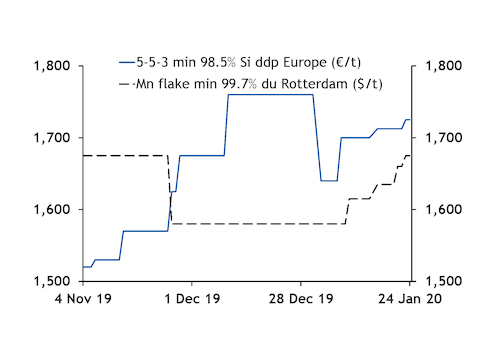

European traders expect tightness in supply of manganese flake, thanks to the delayed end to the holidays. The price reaction was immediate in Europe. A trader sold 75t of 99.7pc manganese flake yesterday on the spot market at $1,725/t in warehouse Rotterdam, around $25/t higher than the top end of Argus' price range of $1,650-1,700/t on 27 January. Prices were already on the rise last week because of delays to shipping ahead of the lunar new year.

Similarly, falling Chinese silicon imports into Europe lifted export prices last week — that allowed European producers typically capped by competition with low-priced Chinese material to increase their prices. This delay could allow room for producers to raise offer prices in Europe.

By Anuradha Ramanathan, Chris Newman, Jethro Wookey, Stuart Penson, Thomas Kavanagh, Yoke Wong and Beijing staff