The drop in gas demand from local distribution networks following the UK's lockdown has varied widely depending on the type of connection, and has at times resulted in scaled-back entry capacity from the LNG terminals at Milford Haven, National Grid has said.

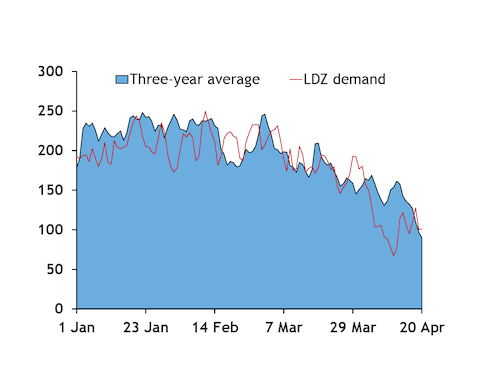

Overall UK weather-adjusted consumption has dropped following the implementation of stricter social distancing measures from mid-March to contain the spread of Covid-19 (see graph). Demand reductions have varied significantly between different distribution networks based on the type of connection, while there have also been considerable day-on-day fluctuations depending on the weather, National Grid said.

Weather-adjusted demand by local distribution networks has fallen by an average of 8-9pc compared with pre-lockdown expectations using the long-term correlation between LDZ demand and the weather, physical operations manager at National Grid Craig James said. National Grid uses a composite weather variable (CWV), which accounts for temperature, wind speed and effective temperatures, to calculate its demand forecasts.

The discrepancy between actual and weather-adjusted LDZ demand has varied widely post-lockdown, between plus 3.8pc and minus 18.1pc, James said.

LDZ demand has stayed much closer to weather-adjusted averages when the weather has been colder, reflecting a small uptick in CWV-adjusted domestic heating demand with domestic residences occupied for longer. And demand over the Easter bank holiday was also little changed from previous years as industrial activity is typically already low.

The effect of industrial shutdowns has been felt most on weekdays when the weather has been warm, James said.

Demand has reacted differently to the social distancing measures depending on the type of connection, National Grid said. There has been a small increase in consumption by non-daily metered (NDM) users — which includes households as well as smaller industries and commercial connections — relative to the CWV following the start of the restrictions, with more people staying at home, James said.

This has been more than offset by a "sudden and relatively large drop" in demand from daily metered (DM) users, which includes larger industrial and power station connections, he said.

DM demand does not tend to vary as much seasonally as NDM consumption, although embedded power demand is affected by some seasonal factors, such as overall power demand and solar generation, James said.

Demand reductions have also shown large regional variations. LDZ demand in East Anglia — which has a much greater concentration of larger industrial facilities subject to coronavirus controls than the national average — has fallen significantly since the lockdown, James said. In contrast, demand in southern England has stayed at similar levels.

Capacity restrictions at Milford Haven

Weak demand across the network has resulted in National Grid having to scale back firm and interruptible entry capacity from the Milford Haven LNG facilities on some days this month.

National Grid has scaled back interruptible entry capacity, withheld firm capacity and taken locational sell actions on a number of days this month.

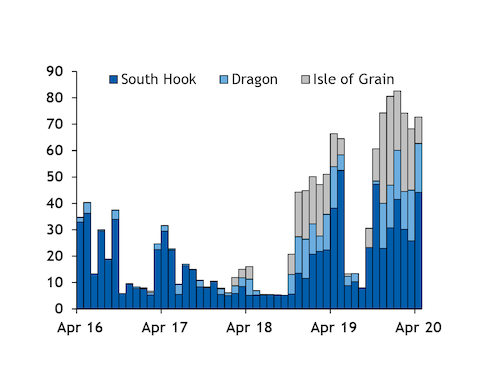

Weak LDZ demand in recent weeks has coincided with strong LNG sendout from the 15.6mn t/yr South Hook and 4mn t/yr Dragon terminals, located in Wales' Milford Haven port (see graph). This has resulted in up to around 40pc of demand being met by Milford Haven supplies on some days, National Grid said.

And this has been coupled with "short-term asset availability issues", the system operator said.

National Grid took sell-side balancing actions at Milford Haven on 14, 18 and 20 April.

Combined regasification from South Hook and Dragon was 63mn m³/d on 1-21 April, up from 53.9mn m³/d in all of April 2019, which had already been well above most previous years. Entries into the grid from Milford Haven were as high as 72.9mn m³ on 18 April, not far off technical entry capacity of 89.7mn m³. National Grid made two locational sell-side actions that day.

Brisk Qatari deliveries to the UK have bolstered regasification this month, particularly from South Hook. And sendout could stay strong in the coming days, with South Hook having booked a 10th April delivery.

There is potential for continued use of locational tools in the coming weeks, with flows at Milford Haven having stayed close to obligated capacity at the point, National Grid said. But all the asset issues earlier in the month have been resolved, it said.