Dutch quality conversion of high-calorie gas into low-calorie supply has slipped in recent days as hot weather cut injection capacity at the Norg storage site and low-calorie demand fell.

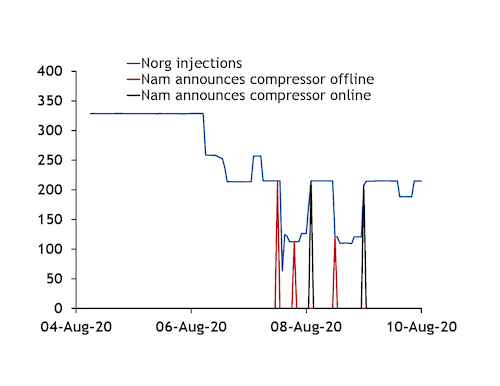

Injection capacity at Norg was cut late last week because the temperature of the site's cooling water climbed too high for operator Nam to run all three of the storage facility's compressors. As a result, Nam said it took one of the compressors off line on 7 August, which it said restricted available injection capacity to 218 GWh/d from technical capacity of 316 GWh/d.

That said, injections to the site from system operator GTS' network already fell from the afternoon on 6 August, dropping to under 214 GWh/d at about 15:00 local time from 259 GWh/d earlier in the day and a steady 329 GWh/d in the previous two gas days.

The hot weather brought a second compressor off line later on 7 August, leaving injection capacity at just under 134 GWh/d, Nam said.

Nam was able to bring one of the compressors on line again early on Saturday morning, as temperatures fell overnight. But the second compressor went off line again later that day, only returning to service early on Sunday morning (see graph). Nam said that the second compressor was off line again as of 15:00 this afternoon.

Daytime temperatures in Amsterdam reached 33.4°C on 7 August and 33.7°C on 8 August, well above the long-term averages of 22.6°C and 22.5°C, respectively. Temperatures fell to 30.6°C yesterday, but were forecast to rise again to over 33°C today, over 34°C on 11-12 August and above 32°C on 13 August, before falling more sharply in the following days. This suggests that the outage could continue in the coming days.

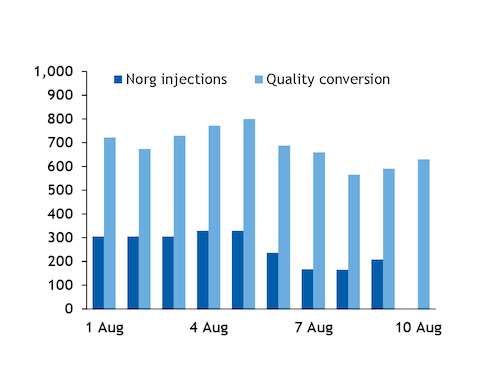

Weaker Norg injections may have resulted in less Dutch use of high-calorie gas for quality conversion, reducing the scope to absorb high-calorie supply. Norg can be filled with converted gas for the first time this summer, while injections could previously only be made directly from Groningen. The site can be filled with converted gas or Groningen supply, but not both simultaneously.

Converted high-calorie supply fell to 687GWh on 6 August from 786 GWh/d on 4-5 August, with injections to Norg slipping to 236GWh from 329 GWh/d. And only 659GWh was converted on 7 August, after injections dropped under 167GWh because of the outage at two of Norg's compressors (see graph).

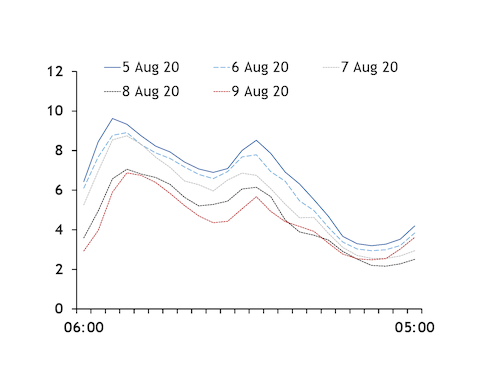

That said, the drop in quality conversion lagged the reduction in Norg injection capacity by several hours, and may have been more responsive on an hourly level to within-day changes in low-calorie gas demand. Dutch low-calorie demand and quality conversion typically rises in the morning and declines in the evening (see graph).

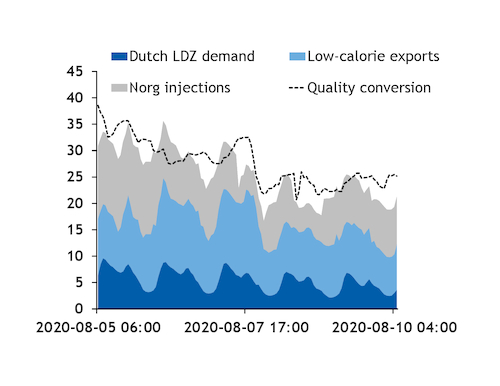

And conversion continued to slide on 7-9 August even as Norg injections held at 180 GWh/d, amid a further slide in low-calorie demand.

Combined demand from Dutch households and small businesses — which is predominantly for low-calorie gas — and low-calorie exports to Germany and Belgium fell to 365 GWh/d on 7-9 August from 447 GWh/d on 4-6 August and 404 GWh/d earlier in the month (see graph). The fall over the past two days was at least partly driven by a dip in demand over the weekend, similar to 1-2 August.

And unplanned restrictions to nitrogen availability at GTS' base-load conversion sites over the weekend may have also contributed to a reduction in quality conversion. But nitrogen use had already largely held below available capacity so far this month, as muted low-calorie consumption may have limited the market's scope to absorb converted gas. GTS expects the unplanned capacity restrictions to end on 14 August.