UK front winter clean spark spreads have recorded sharp gains in recent weeks amid high day-ahead deliveries this winter, continuing uncertainty around plant availability and reduced hedging from generators owing to carbon price risk.

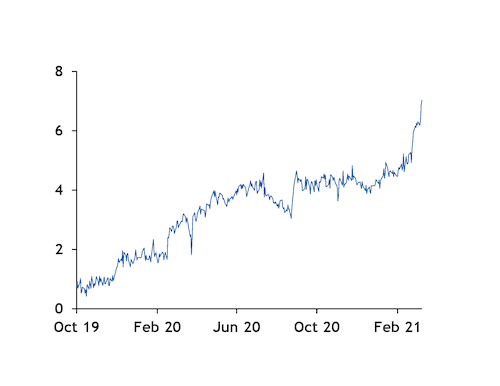

The winter 2021-22 clean spark spread for 49.13pc efficiency was at £7.03/MWh yesterday, up by more than £1/MWh from the end of February and £2.50/MWh from the end of January (see chart).

Clean spark spreads tend to rise closer to delivery as more suppliers begin to hedge their exposure to price spikes. This is being amplified by generators, such as SSE, holding off from hedging because of carbon price risk. There will be no clarity on the UK emissions trading system (ETS) price until the first auctions are held in May. For now the EU ETS price is still being used in clean spark spread calculations.

And suppliers will be particularly incentivised to hedge after the strong price spikes seen this winter.

So far this winter working day-ahead clean spark spreads have averaged £11.14/MWh, up from £3.42/MWh in the previous winter. This has been driven by price spikes, particularly in January, owing to low conventional plant availability and low wind output. And it has been higher than expected — the front winter clean spark spread was £8/MWh at the end of September 2020.

Some of the factors contributing to price spikes this winter could continue into next winter. Calon Energy's 2.3GW of CCGT assets remain mothballed and due to return in September 2021. But the 2021-22 capacity market contracts for two of the three plants have already been terminated, while the third is seen as a non-delivery risk.

There will also be significant doubts over nuclear availability next winter. The 1.1GW Dungeness B station is expected to return in May, but it has been off line since 2018 and has seen its return to the grid repeatedly delayed. The 1GW Hinkley B is due to return later this month, but it has been off line for more than a year and has similarly suffered repeated extensions to its outage.

And the 1GW Hunterston B plant is due to permanently shut in the fourth quarter of 2021.

Against this, the UK should be able to import from Norway during some of the winter. The 1.4GW North Sea Link is targeting commercial operations in 4Q21. And the 1GW IFA2 link with France will be operational for the full winter period, having begun commercial operations on 22 January.