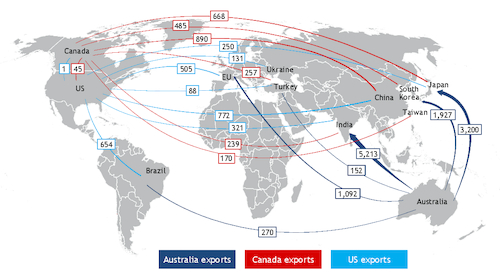

Corrects Canada's coking coal exports from 7.86mn t to 6.97mn t in paragraph 2, and corrects annual reduction from 30.7pc to 35pc. Also corrects numbers on trade flows map.

US and Canadian coking coal exports to China and Europe rose in the first quarter of 2021 but lost ground to Australian material in other markets amid further deterioration in Chinese-Australian relations.

US first-quarter coking coal exports fell by 11.3pc to 9.39mn t, while Canada's fell by 35pc to 6.97mn t. US exports to China rose by more than fivefold to 2.11mn t, while Canada's rose by by 51pc to 2.3mn t as Chinese buyers tried to fill the gap left by Australian premium low-volatile coals. US shipments to the EU rose by 8.6pc to 3.94mn t as restocking supported record-high steel prices. But US exports to all major markets outside of China and the EU fell.

The quarterly total of 201,334t shipped from the US to Korea was the lowest in 12 years and 80pc lower than a year earlier. US shipments to Brazil fell by 23.2pc to 1.45mn t, although March shipments made a partial recovery on a positive outlook for the country's steel industry, to 653,740t, up from 323,733t in February but still 17.8pc lower than a year earlier. US shipments to India and Japan fell by 38.4pc and 33pc to 714,576t and 716,786t, respectively, as buyers took advantage of the increased availability of Australian coals. Australian shipments to India rose by 45pc to a record quarterly total of 15.18mn t. Australian exports to the EU rose by 23.7pc to 3.17mn t, driven largely by a 579,792t annual increase in Poland, as merchant coke producers took advantage of spot opportunities. The Australian premium low-volatile coal price averaged $127.28/t fob Australia in the first quarter, compared with $155.36/t fob Australia in the same period last year.

US, Canada output rises to meet demand

US exports were largely restricted by tight supply in the first quarter, and several requests for spot cargoes from European, Chinese and Brazilian mills were turned down, US mining companies said.

Argus' daily fob Hampton Roads assessment for low-volatile coking coal rose by $6/t over the first quarter of 2021 to $152.50/t, buoyed by strong Chinese buying, and has moved up further since then to $172.50/t fob Hampton Roads yesterday.

But output at most of the largest coking coal mines in the US in the first quarter of this year increased compared with the previous quarter, in response to stronger demand. The 1.22mn st (short ton) (1.11mn t) of low-volatile coking coal produced at Virginia's Buchanan mine in the first quarter was 4.27pc higher than the previous quarter but 7.58pc lower than a year earlier, data from the US Mine Safety and Health Administration (MSHA) show. Low-volatile production at Arch Resources' Beckley mine in West Virginia rose by 34.6pc to 272,851st in the first quarter, but this was 5.37pc lower than a year earlier. Alpha Metallurgical Resources' production of high-volatile and mid-volatile coking coal rose by 2.17pc to 1.79mn st in the same quarter, but fell by 31.3pc from the previous year. Warrior produced 1.55mn st of premium low-volatile coking coal at Blue Creek 7 in Alabama, a quarterly increase of 24.6pc and a rise of 3.33pc on the year.

Most US producers are trying to raise production in the second quarter, a mining firm said, in response to strong demand from domestic mills and China.

The continued deterioration of relations between China and Australia, when China suspended economic talks with Australia yesterday may provide US mining firms with short-term certainty that Chinese demand will remain strong. But the sudden nature of the announcement of tighter restrictions in October is a reminder of how rapidly the market can shift for mining companies.

North American mining firms are still broadly optimistic. Canadian producer Teck plans to continue prioritising spot sales to China this year and has maintained efforts to reach its target of 7.5mn t in coking coal sales to China in 2021, which it is on track to reach, having already sold 2mn t to China in the first quarter. Teck expects to mine 25.5mn-26.5mn t of coking coal this year, compared with 21.1mn t in 2020, and to sell 6.0mn-6.4mn t in the second quarter, compared with 6.2mn t in the first quarter. US low-volatile producer Corsa, which sells largely into the domestic market, said domestic coking coal consumption is steady and expected to rise by 5.5pc to 15.3mn st in 2021. Warrior, whose workers have been on strike since 1 April, expects its 1.2mn st stockpile of coal and reduced production at Blue Creek 7 to enable it to meet commitments of 4.9mn-5.5mn st for 2021. The company sold a June-loading spot cargo of Blue Creek 7 to a Chinese buyer this week at $235/t cfr China.

| US coking coal production | '000 st | |||

| Mine | Coal grade | 1Q-21 output | ±% q-o-q | ±y-o-y |

| Blue Creek 7 | Premium low-vol | 1,457 | 25 | 3 |

| Oak Grove | Premium low-vol | 509 | 11 | 99 |

| Beckley | Low-vol | 273 | 35 | -5 |

| Buchanan | Low-vol | 1,222 | 4 | -8 |

| Affinity | Low-vol | 206 | 18 | -1 |

| Blue Creek 4 | Premium low-vol | 625 | 21 | 5 |

| RES complex | Mid-vol | 134 | 14 | -6 |

| Greenbrier | Mid-vol | 356 | 24 | -5 |

| Leer | High-vol A | 1,222 | 11 | 30 |

| Leer South | High-vol A | 192 | 21 | -9 |

| Morgan Camp | High-vol A | 159 | 53 | 1 |

| Rockwell | High-vol A | 502 | 1 | -8 |

| Mountain Laurel | High-vol B | 289 | 92 | 26 |

| Kanawha Eagle | High-vol B | 522 | 46 | 23 |

| Panther Creek | High-vol B | 413 | 59 | -8 |

| — MSHA | ||||