Russian state-controlled Gazprom today booked no extra gas entry capacity to Ukraine from Russia at Sudzha, having taken up all offered firm capacity last week.

Ukrainian state-owned system operator GTSOU offered 63.7mn m³/d of interruptible capacity, which if bought by Gazprom — the only firm able to export pipeline gas from Russia — would have allowed the firm to largely offset weaker pipeline flows along the 55bn m³/yr Nord Stream and 33bn m³/yr Yamal-Europe routes during next month's annual maintenance.

No additional interruptible capacity exiting Ukraine was offered at today's monthly auctions. Gazprom would likely need to reserve capacity at this side in addition to capacity at Sudzha to lift its deliveries to Europe.

Under EU energy rules, applied at Ukraine's borders, all firm capacity at a point typically has to be bought before interruptible capacity is offered. All 2.03 TWh/d of exit capacity at the Uzhgorod/Velke Kapusany exit point towards Slovakia is firm. Bookings at the point for July are 81.2mn m³/d, following monthly bookings of 14.7mn m³/d last week, of 73mn m³/d offered.

But Gazprom should still be able to book capacity at auctions for firm day-ahead and within-day capacity at Ukraine's EU borders next month, provided GTSOU makes the capacity available. GTSOU was not immediately available for comment. It has not yet made interruptible capacity available at Sudzha on a day-ahead basis.

Day-ahead and within-day Ukrainian transport capacity is more expensive than monthly capacity. GTSOU applies a 1.45 multiplier for day-ahead capacity, compared with a 1.2 multiplier for monthly capacity. Monthly entry capacity at Sudzha costs about €1.80/MWh and exit capacity at Velke Kapusany costs about €1.09/MWh, including value-added tax. Day-ahead capacity costs €2.18/MWh at Sudzha and €1.32/MWh at Velke Kapusany (see data & download).

Alternative options, but unclear

The planned Nord Stream halt on 13-22 July could cut Gazprom's deliverability by a cumulative 1.7bn m³, which could have been mostly offset by an extra 1.4bn m³ sent through Ukraine on 1-22 July had Gazprom taken up available capacity. But the firm may be able to meet nominations in a combination of ways during the period.

Works on Yamal-Europe on 6-10 July could reduce the firm's export capacity by a further 360mn m³, excluding deliveries to Poland.

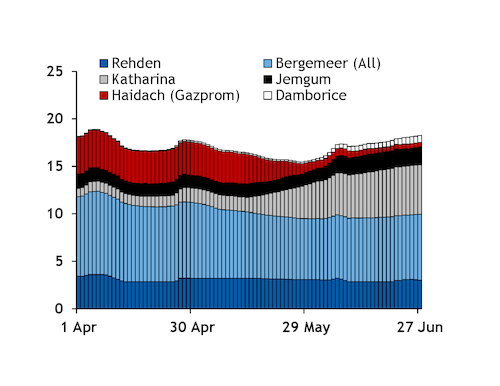

Based on Gazprom's European stocks alone and pace of recent injections, the firm may not be able to fully offset the maintenance by drawing on storage. Stocks at sites where the firm holds all or nearly all capacity — not accounting for small amounts leased to third parties and excluding Serbia — were around 1bn m³ a week ago. Stocks at facilities it shares with others would have been 360mn m³, if apportioned in line with its share of the capacity at each site (see graph). Less than a cumulative 50mn m³ was added on 22-27 June, the latest available data.

Gazprom has at times booked extra storage capacity commercially. Recent corporate filings do not cover decisions taken this year and the firm was unavailable for comment on whether it made any such bookings this year.

Gazprom also buys spot LNG cargoes and has fob term offtake, and made record deliveries to European terminals last year. The firm may have some additional flexibility to meet customer nominations through its trading subsidiaries active in northwest European markets. Some supply that would ordinarily be delivered by pipeline and sold to trading subsidiaries — which also make open market purchases and may sell cargoes procured by LNG subsidiary Gazprom Global — may be able to be turned down.

Gazpromexport also sold 7.6bn m³ on a repurchase basis in 2019 to affiliate Gazprombank. Gazprom was unavailable for comment on the status of the agreements, although it said last week that Gazpromexport "finalised the acquisition" of trading subsidiary Centrex from Gazprombank. This would make Centrex a subsidiary, and mean any gas that it may have is now owned by Gazpromexport.

The firm could also buy spot pipeline gas to help meet customer nominations over the works.

| Gazprom group LNG sales | |||||

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| European markets (trillion Btu) | |||||

| Belgium | - | - | - | - | 3.8 |

| UK | - | - | - | 21.4 | 32.8 |

| The Netherlands | - | - | - | - | 50.7 |

| France | - | - | - | - | 24.8 |

| Spain | - | 6 | 2.9 | 10.9 | 25.5 |

| Greece | - | - | - | - | 3.2 |

| Total Fob | 3.0 | - | 21.4 | 23.5 | 50.8 |

| Total | 3.0 | 6.5 | 24.3 | 55.8 | 191.6 |

| — Gazprom | |||||