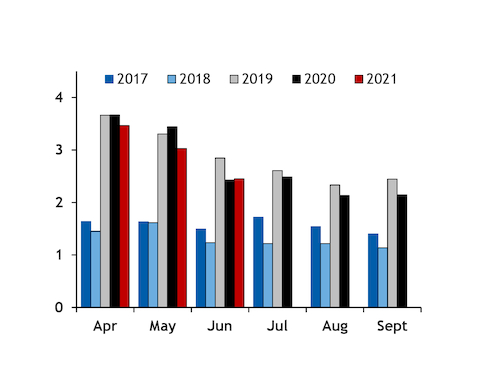

European regasification has slipped this month from recent years, holding closer to 2018 levels than in the second quarter.

Sendout was 1.89 TWh/d on 1-5 July, on track to be about 660 GWh/d lower than in July 2019-20 although still about 670 GWh/d higher than over the full month in 2018.

Regasification last month was similar to 2019-20 and as much as 1.2 TWh/d higher than in June 2018 — although it still slipped from earlier in the second quarter.

Europe's LNG sendout tends to fall around midsummer as northeast Asian demand ramps up with hotter weather. And unseasonably hot weather in June-July in southern China, Taiwan and much of southeast Asia may have driven an earlier slowdown than usual, reducing surplus LNG to send to Europe.

The global market was most recently tightly supplied in summer 2018, driven by high demand in Mexico and Egypt as well as strong Chinese demand growth.

Argus northeast Asian (ANEA) des LNG prices last month held above European hubs by enough to encourage firms to ship Atlantic basin cargoes to northeast Asia ahead of Europe, even if sent around the Cape of Good Hope given congestion through the Panama Canal.

The wide arbitrage has sparked the continuation of European LNG slot cancellations.

Northeast Asian import needs are set to strengthen in the coming weeks as cooling demand ramps up. Recent long-term forecasts project above-average temperatures at times during July in Beijing, Tokyo and Seoul.

And northeast Asian demand could hold firm throughout the third quarter if more buyers from the region — particularly Japan — step into the market to restock LNG inventories ahead of winter.

Latin American demand could also increase in the coming months. Brazil's state-controlled Petrobras was last month authorised to increase LNG imports to the country by 50pc in August to make up for an expected drop in domestic gas flows when the Rota 1 pipeline shuts for maintenance from mid-August.

Severe drought already curbed Brazilian hydropower output last month, prompting the government to authorise higher LNG purchases to boost thermal generation, while deliveries to Argentina also rose as the country continued to struggle to lift domestic output.

The reopening of the Northern Sea Route has also supported higher exports from Novatek's 17.4mn t/yr Yamal facility to northeast Asia since mid-June.

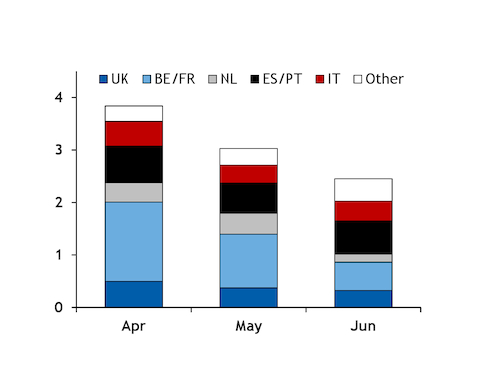

France drives June increase

A jump in France's June regasification from a year earlier offset decreases elsewhere in Europe, driving aggregate regasification higher.

French sendout rose to 419 GWh/d in June from 289 GWh/d a year earlier.

This was despite heavy maintenance at times last month.

Dutch regasification also rose from a year earlier, despite scheduled works in the second half of the month driving sendout down to just above minimum boil-off.

But sendout slowed substantially on the year in the UK, Spain and Italy (see table, European LNG sendout data & download).

Spanish PVB hub prices extending their premium to the cost of crude-linked supply last month made Algerian gas particularly competitive relative to LNG, reducing the need for Spanish firms to compete with Asian buyers for cargoes.

| European LNG sendout | GWh/d | ||

| Jun-21 | May-21 | Jun-20 | |

| Total | 2,451 | 3,028 | 2,427 |

| UK | 323 | 373 | 422 |

| Belgium | 122 | 211 | 117 |

| Netherlands | 154 | 403 | 71 |

| France | 419 | 810 | 289 |

| Italy | 379 | 339 | 440 |

| Spain | 447 | 404 | 635 |

| Portugal | 183 | 169 | 147 |

| Poland | 140 | 150 | 131 |

| Lithuania | 130 | 71 | 70 |

| Greece | 98 | 55 | 105 |

| Croatia | 56 | 54 | − |

| — System operators, Entso-G | |||