Thermal and metallurgical coal exports from Australia's 102mn t/yr Gladstone port hit a seven-month high in January, as it resumed shipments to China.

Gladstone shipped 5.68mn t of coal in January, up from 5.22mn t in December and from 5.43mn t in January 2022, according to Gladstone Ports (GPC) data. January was the strongest shipping month since June last year, despite a derailment outside the port on 29 January interrupting coal deliveries. The effects of the derailment will be felt in February, with deliveries disrupted until 9 February and shipping queues outside Gladstone growing to 30 on 6 February from a more-average 23 on 2 February.

China took 134,000t of coal from Gladstone in January, with a further 80,000t shipment marked with Hong Kong as its destination. This is the first time that Gladstone has shipped coal to China since October 2020. The port shipped 10.1mn t of coal to China in 2020, down from 10.93mn t in 2019 and a peak of 15.58mn t in 2014, according to GPC data.

Australian coal producers have had several enquiries from Chinese customers for coal, but many are waiting to see how easily the initial cargoes unload and are processed by Chinese authorities before committing to supply tonnage.

Gladstone shipped coal to Germany for the first time in January since June 2019, as the conflict in Ukraine continues to disrupt trade patterns and coal demand in Europe.

January was drier than average across most Queensland coal fields, according to the Australian Bureau of Meteorology (BoM). Gladstone avoided the flooding that disrupted the other Queensland coal ports of Hay Point, Dalrymple Bay Coal terminal and Abbot Point. February has started wet in parts of the Bowen basin, but the BoM expects the La Nina weather pattern, which often brings above-average rain to Queensland's coal fields, to ease towards neutral over the next few weeks, which could allow mining firms to increase production.

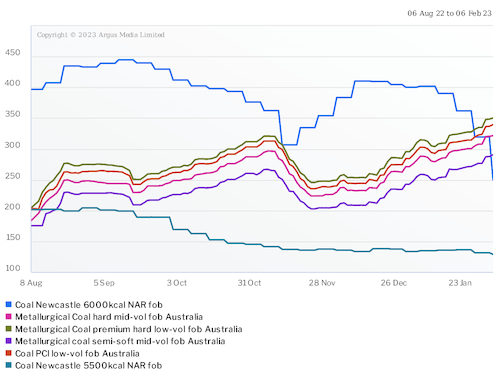

Argus assessed high-grade 6,000 kcal/kg NAR thermal coal at $249.79/t fob Newcastle on 3 February, down from $402.02/t on 6 January and from a peak of $444.59/t on 9 September. It assessed the premium hard low-volatile metallurgical coal price at $350.25/t fob Australia on 3 February, up from $314.75/t on 6 January and from $244.75/t on 24 November.

| Gladstone coal shipments | mn t | |||||

| Month | Japan | India | South Korea | Taiwan | Vietnam | Total |

| Jan '23 | 2.06 | 1.12 | 1.41 | 0.26 | 0.25 | 5.68 |

| Dec '22 | 1.87 | 1.08 | 1.43 | 0.13 | 0.00 | 5.22 |

| Jan '22 | 1.88 | 1.07 | 1.23 | 0.13 | 0.20 | 5.31 |

| 2022 | 20.99 | 12.16 | 14.14 | 4.62 | 2.89 | 62.01 |

| 2021 | 21.29 | 18.96 | 14.14 | 3.74 | 2.75 | 68.98 |

| Source: GPC | ||||||

| Total includes all destinations, not just those listed | ||||||