Gas price volatility in Europe has soared to its highest in nearly eight months, as a combination of factors has tightened the market just as firms were starting to move to avert a late summer supply surplus.

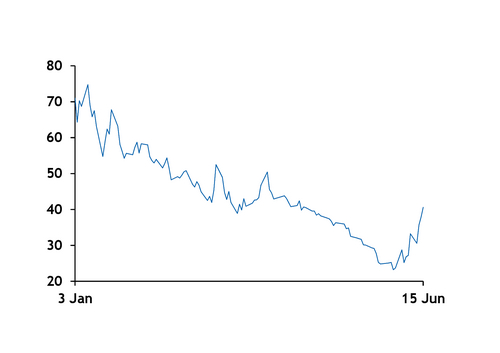

The Dutch TTF front-month contract closed above €40/MWh on Thursday for the first time in nearly two months, having touched €50/MWh in late morning. It then lost over 15pc of its value by Friday's market close.

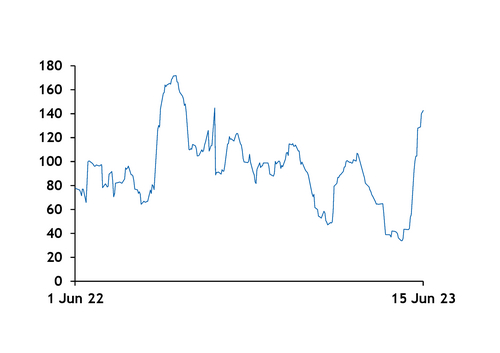

The Argus TTF front-month volatility index — an annualised historic measure of the variation of the price series over time — has climbed to its highest for any sustained period since September 2022, when Russian state-controlled Gazprom announced the indefinite closure of the Nord Stream pipeline (see volatility graph). And higher volatility has filtered through to longer-dated contracts, including the front winter.

The rally began at the start of last week, after the arbitrage between the Atlantic and Pacific basins for LNG cargoes loaded in the US and west Africa had been open for a couple of weeks. This had followed a steady fall in European gas prices for several months, as firms priced in the increasing likelihood of storage sites filling before the end of summer unless LNG and pipeline imports could fall sufficiently.

The open arbitrage had incentivised firms to unwind hedges at the TTF and send cargoes to Asia instead, supporting prices. At the same time, the market for spot LNG cargoes tightened last week thanks to the confirmed start of maintenance at two liquefaction trains at the US' Sabine Pass.

European hub prices increased enough to close the arbitrage, and then Shell's announcement earlier this week of a lengthy shutdown at its Nyhamna gas processing plant in Norway triggered an even steeper price rise.

Nyhamna is to be off line for an extra 24 days, according to offshore system operator Gassco's schedule. This could remove roughly 1.2bn m³ of supply, judging by combined average production over the past year from Ormen Lange and Aasta Hansteen, the two fields that deliver to the processing plant. And Shell has said that Nyhamna's restart date is still uncertain, further fuelling forward price volatility.

Market prices then moved dramatically during Thursday's trading session, with the TTF front-month market trading at close to €50/MWh at its peak, before moving lower by the market close. Traders put the price hike down to rumours of the confirmed closure of the Groningen field on 1 October, although the Dutch government had already said in late January that all four conditions set out in 2018 for the field's closure had been met and has opposed GTS' calls for the field stay on line for longer. The government told Argus on Thursday that it will make a final decision later this month.

Meanwhile some of the extra volatility at the TTF has been driven by large day-on-day swings in the power market, with the two markets closely correlated. A heatwave across northwest Europe has boosted cooling demand this week, while French nuclear maintenance has been higher than planned this month after it was stable for much of May. In addition, rising solar capacity has increased short-term power price volatility and driven significant negative power prices around the solar peak on several lower-demand days in recent months.

In any event, while the European gas price rally has been dramatic in the context of several months of price falls, the TTF curve has retained its contango shape, with prompt markets trading well below forward markets and the winter 2023-24 market still at a discount to the winter 2024-25 price. And Asian LNG prices have not chased European hub prices up, reflecting weak spot LNG demand in the Pacific basin and the fact that European import demand remains the key driver of the global market this summer.