The EU and UK's June regasification stepped down to its lowest since October, but was still the highest for any June on record, as consumption and storage injection demand ticked down on the month, but Russian pipeline receipts remained much slower than a year earlier.

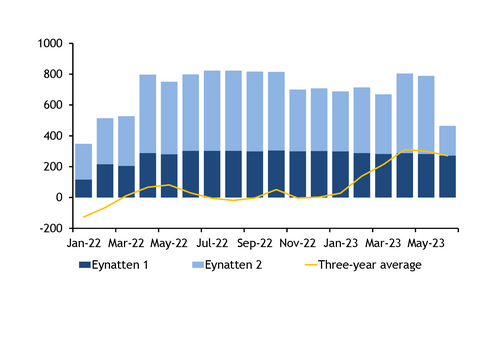

Sendout averaged 4.3 TWh/d in June, the lowest since October but up from 4 TWh/d a year earlier. Regasification was boosted by record monthly sendout in the Netherlands and Croatia, while regasification was slow in the UK and Belgium.

UK sendout was the slowest for any month since September 2021 as domestic production and imports from Norway were ample to cover much reduced demand with high temperatures for much of the month. And Belgian sendout was the slowest since September. The country's demand also held below the three-year average during the month, while flows to Germany collapsed and fell to their lowest for any month since January 2022 (see pipeline graph).

Slow injections, demand drive weaker sendout

Regasification slowed from recent months as consumption and injections both held below average, but weaker pipeline receipts from Russia led to higher sendout on the year.

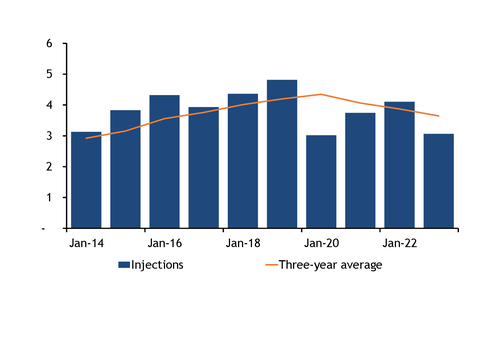

Injections were at their lowest for any June since 2020 at 3 TWh/d, below the three-year average of 3.7 TWh/d (see injection graph). The slow stockbuild is likely to continue in the coming months with inventories already well above historical averages. EU and UK stocks were at 890TWh or 79pc of capacity on Sunday, above the three-year average of 706TWh for the date.

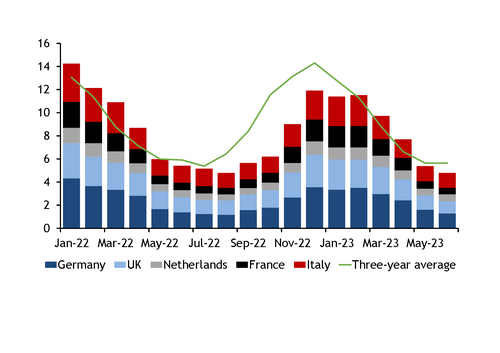

And consumption from the continent's five largest gas consumers — Germany, the UK, France, Italy and the Netherlands — slipped to its lowest for any month since August at 4.8 TWh/d, also below the three-year average for the month of 5.6 TWh/d (see consumption graph). Industrial consumption has yet to fully recover from high prices in recent years, while hot weather led to a sharp fall in demand from households and small businesses, more than offsetting increased power-sector gas demand. And daytime temperatures were forecast today to rise well above averages for Amsterdam, Essen, Milan and Paris on 7-17 July — after a short cooler spell on 3-6 July — which could continue to limit consumption in the coming weeks.

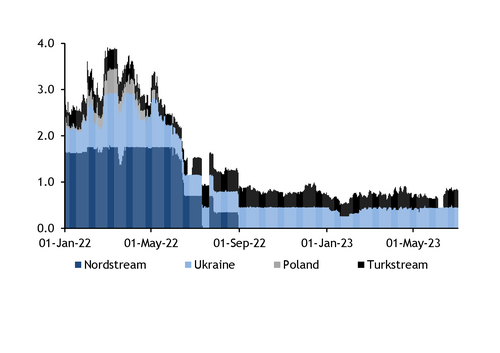

But sendout could nevertheless continue to be boosted from a year earlier by weaker Russian pipeline receipts. European imports from Russia were just 722 GWh/d in June, down from 1.8 TWh/d for the month a year earlier (see Russian graph).